Question: Please include steps with explanations and formulas in part A and B, as well as at least 50 data points for the graph. 3) (40

Please include steps with explanations and formulas in part A and B, as well as at least 50 data points for the graph.

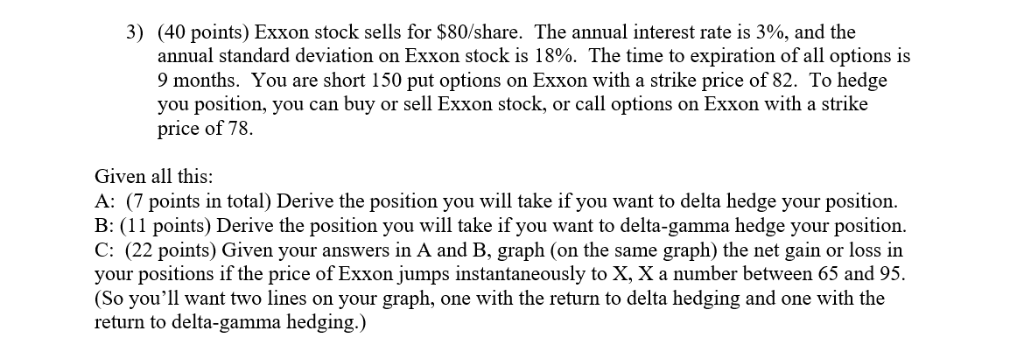

3) (40 points) Exxon stock sells for $80/share. The annual interest rate is 3%, and the annual standard deviation on Exxon stock is 18%. The time to expiration of all options is 9 months. You are short 150 put options on Exxon with a strike price of 82. To hedge you position, you can buy or sell Exxon stock, or call options on Exxon with a strike price of 78. Given all this: A: (7 points in total) Derive the position you will take if you want to delta hedge your position. B: (11 points) Derive the position you will take if you want to delta-gamma hedge your position. C: (22 points) Given your answers in A and B, graph (on the same graph) the net gain or loss in your positions if the price of Exxon jumps instantaneously to X, X a number between 65 and 95. So you'll want two lines on your graph, one with the return to delta hedging and one with the return to delta-gamma hedging.) 3) (40 points) Exxon stock sells for $80/share. The annual interest rate is 3%, and the annual standard deviation on Exxon stock is 18%. The time to expiration of all options is 9 months. You are short 150 put options on Exxon with a strike price of 82. To hedge you position, you can buy or sell Exxon stock, or call options on Exxon with a strike price of 78. Given all this: A: (7 points in total) Derive the position you will take if you want to delta hedge your position. B: (11 points) Derive the position you will take if you want to delta-gamma hedge your position. C: (22 points) Given your answers in A and B, graph (on the same graph) the net gain or loss in your positions if the price of Exxon jumps instantaneously to X, X a number between 65 and 95. So you'll want two lines on your graph, one with the return to delta hedging and one with the return to delta-gamma hedging.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts