Question: Please include the answers highlighted S7-5 (similar to) Question Help On January 1, 2017, ShipEx Transportation Company purchased a used aircraft at a cost of

Please include the answers highlighted

Please include the answers highlighted

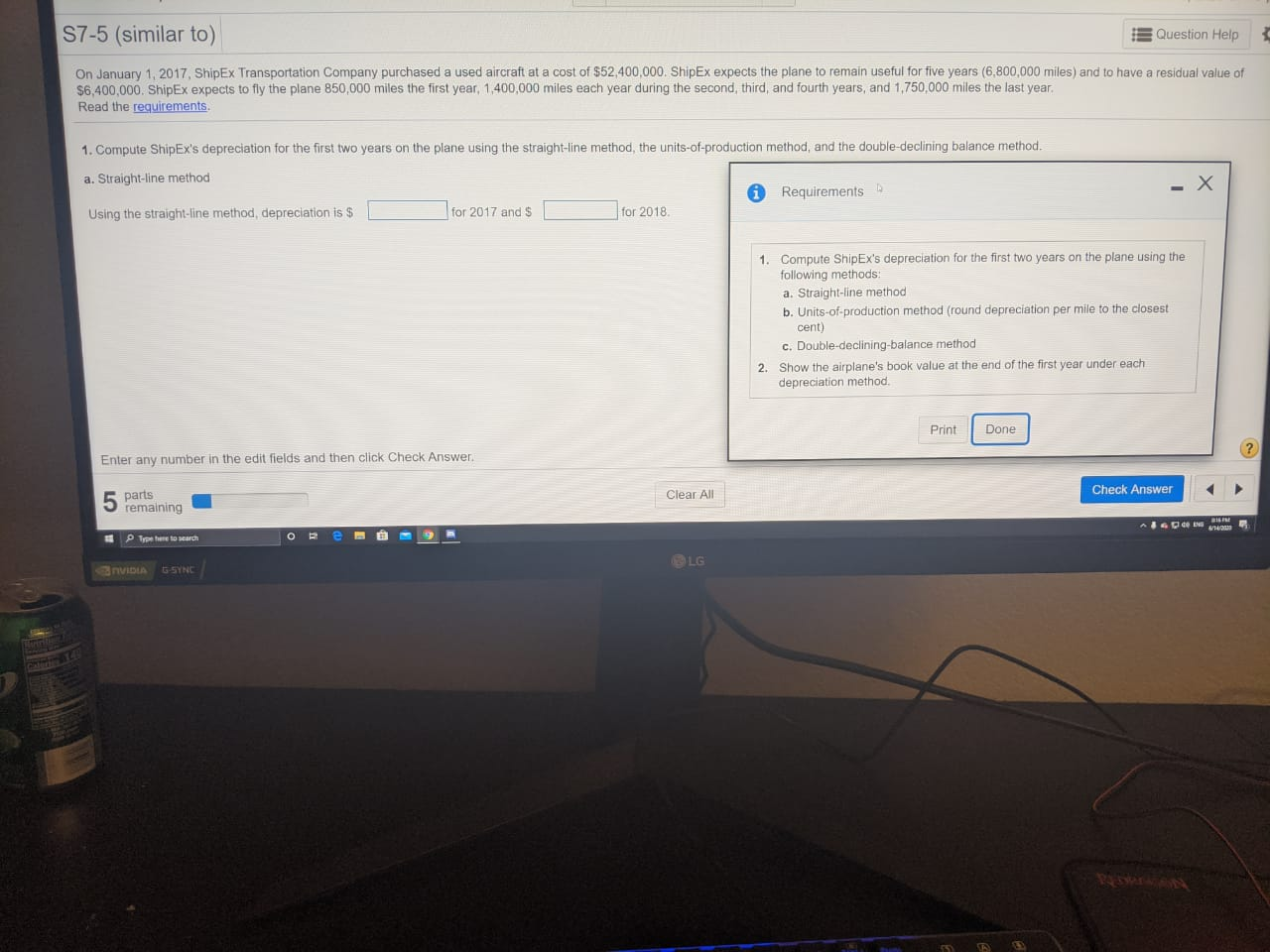

S7-5 (similar to) Question Help On January 1, 2017, ShipEx Transportation Company purchased a used aircraft at a cost of $52,400,000. ShipEx expects the plane to remain useful for five years (6,800,000 miles) and to have a residual value of $6,400,000. ShipEx expects to fly the plane 850,000 miles the first year, 1,400,000 miles each year during the second third, and fourth years, and 1,750,000 miles the last year, Read the requirements. 1. Compute ShipEx's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Requirements Using the straight-line method, depreciation is $ for 2017 and $ for 2018 1. Compute ShipEx's depreciation for the first two years on the plane using the following methods a. Straight-line method b. Units-of-production method (round depreciation per mile to the closest cent) c. Double-declining-balance method 2. Show the airplane's book value at the end of the first year under each depreciation method. Print Done ? Enter any number edit fields and then click Check Answer Clear All Check Answer parts remaining AGEN The to search O e LG NVIDIA t-SYNC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts