Question: Please include the calculations and explanation. Thank you so much Marks/23.25 Furniture Co. is a retailer that sells furniture. Alfred Co. has approached the company

Please include the calculations and explanation. Thank you so much

Please include the calculations and explanation. Thank you so much

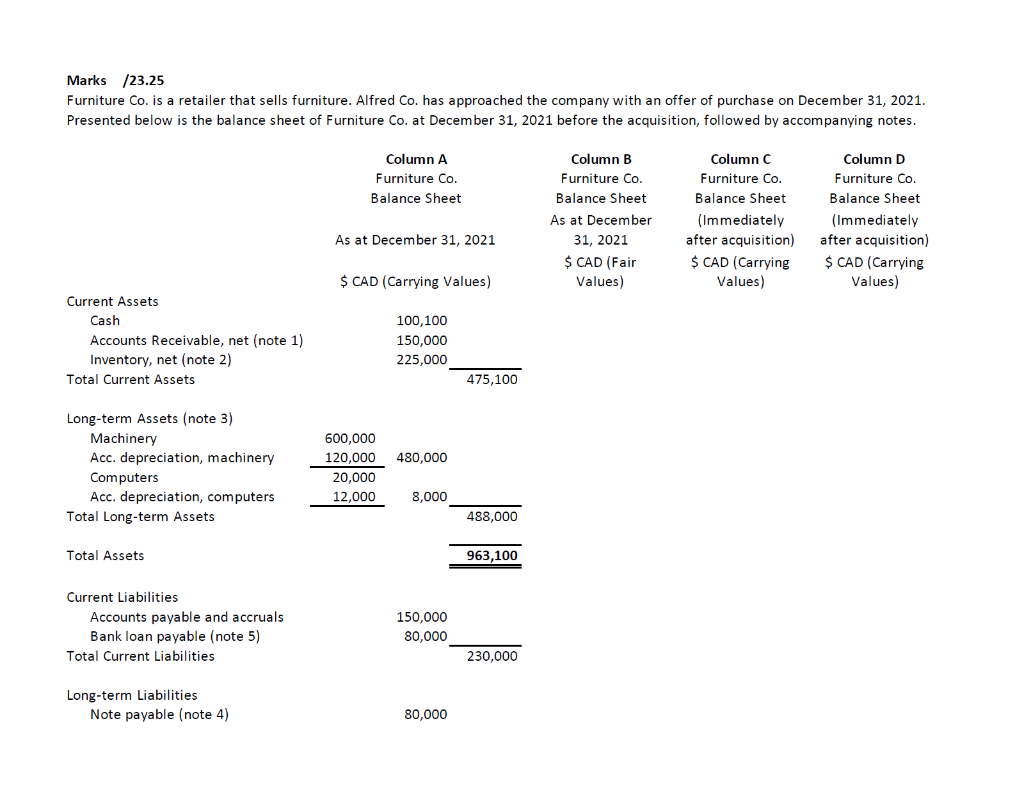

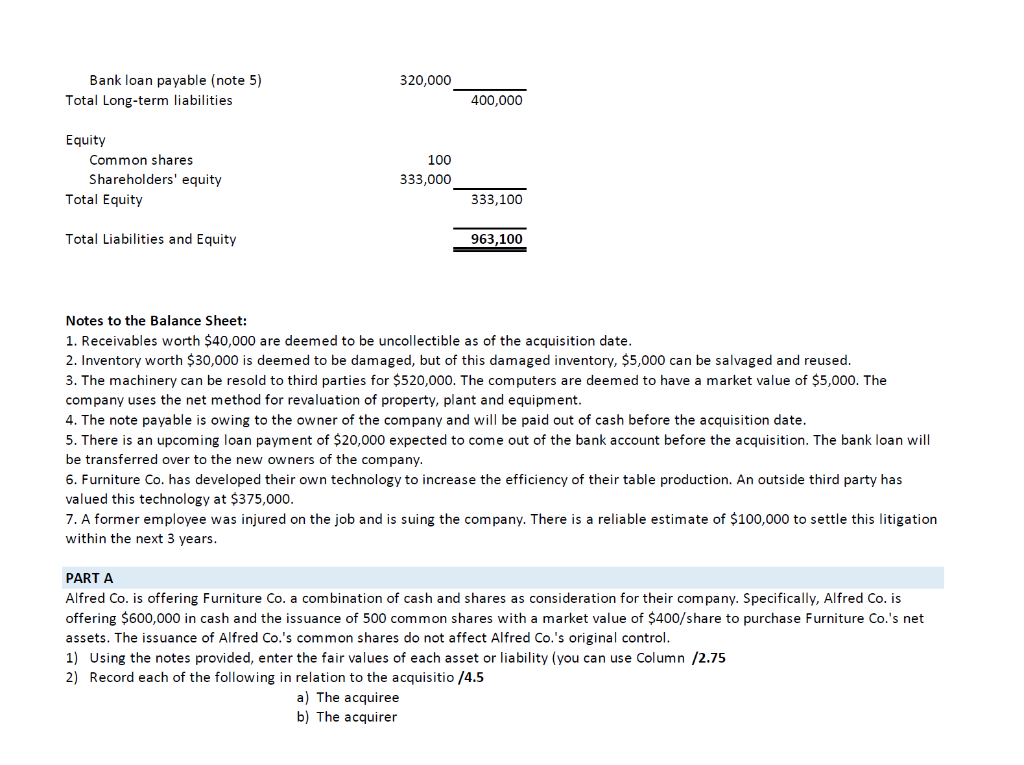

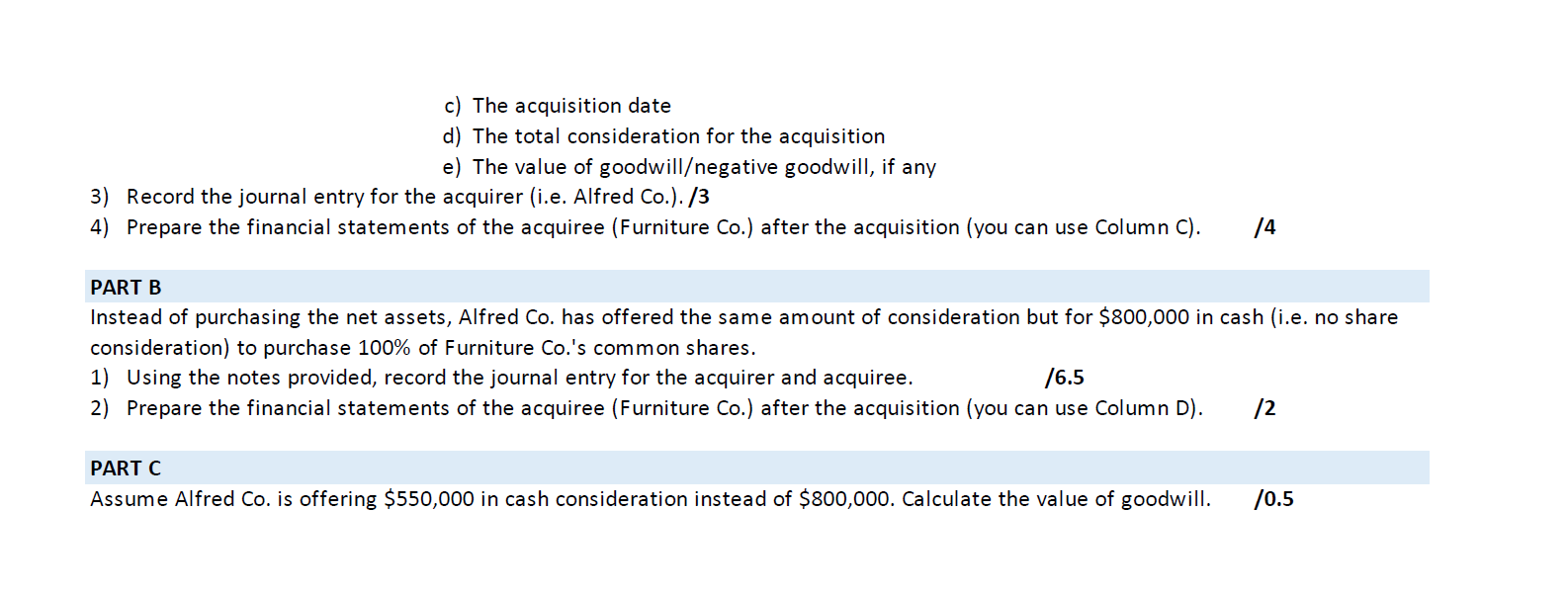

Marks/23.25 Furniture Co. is a retailer that sells furniture. Alfred Co. has approached the company with an offer of purchase on December 31, 2021. Presented below is the balance sheet of Furniture Co. at December 31, 2021 before the acquisition, followed by accompanying notes. Column A Furniture Co. Balance Sheet Column B Furniture Co. Balance Sheet As at December 31, 2021 $ CAD (Fair Values) Column C Furniture Co. Balance Sheet (Immediately after acquisition) $ CAD (Carrying Values) Column D Furniture Co. Balance Sheet (Immediately after acquisition) $ CAD (Carrying Values) As at December 31, 2021 $ CAD (Carrying Values) Current Assets Cash Accounts Receivable, net (note 1) Inventory, net (note 2) Total Current Assets 100,100 150,000 225,000 475,100 480,000 Long-term Assets (note 3) Machinery Acc. depreciation, machinery Computers Acc. depreciation, computers Total Long-term Assets 600,000 120,000 20,000 12,000 8,000 488,000 Total Assets 963,100 Current Liabilities Accounts payable and accruals Bank loan payable (note 5) Total Current Liabilities 150,000 80,000 230,000 Long-term Liabilities Note payable (note 4) 80,000 320,000 Bank loan payable (note 5) Total Long-term liabilities 400,000 Equity Common shares Shareholders' equity Total Equity 100 333,000 333,100 Total Liabilities and Equity 963,100 Notes to the Balance Sheet: 1. Receivables worth $40,000 are deemed to be uncollectible as of the acquisition date. 2. Inventory worth $30,000 is deemed to be damaged, but of this damaged inventory, $5,000 can be salvaged and reused. 3. The machinery can be resold to third parties for $520,000. The computers are deemed to have a market value of $5,000. The company uses the net method for revaluation of property, plant and equipment. 4. The note payable is owing to the owner of the company and will be paid out of cash before the acquisition date. 5. There is an upcoming loan payment of $20,000 expected to come out of the bank account before the acquisition. The bank loan will be transferred over to the new owners of the company. 6. Furniture Co. has developed their own technology to increase the efficiency of their table production. An outside third party has valued this technology at $375,000. 7. A former employee was injured on the job and is suing the company. There is a reliable estimate of $100,000 to settle this litigation within the next 3 years. PARTA Alfred Co. is offering Furniture Co. a combination of cash and shares as consideration for their company. Specifically, Alfred Co. is offering $600,000 in cash and the issuance of 500 common shares with a market value of $400/share to purchase Furniture Co.'s net assets. The issuance of Alfred Co.'s common shares do not affect Alfred Co.'s original control. 1) Using the notes provided, enter the fair values of each asset or liability (you can use Column /2.75 2) Record each of the following in relation to the acquisitio /4.5 a) The acquiree b) The acquirer c) The acquisition date d) The total consideration for the acquisition e) The value of goodwillegative goodwill, if any 3) Record the journal entry for the acquirer (i.e. Alfred Co.). /3 4) Prepare the financial statements of the acquiree (Furniture Co.) after the acquisition (you can use Column C). 14 PART B Instead of purchasing the net assets, Alfred Co. has offered the same amount of consideration but for $800,000 in cash (i.e. no share consideration) to purchase 100% of Furniture Co.'s common shares. 1) Using the notes provided, record the journal entry for the acquirer and acquiree. 76.5 2) Prepare the financial statements of the acquiree (Furniture Co.) after the acquisition (you can use Column D). /2 PART C Assume Alfred Co. is offering $550,000 in cash consideration instead of $800,000. Calculate the value of goodwill. /0.5 Marks/23.25 Furniture Co. is a retailer that sells furniture. Alfred Co. has approached the company with an offer of purchase on December 31, 2021. Presented below is the balance sheet of Furniture Co. at December 31, 2021 before the acquisition, followed by accompanying notes. Column A Furniture Co. Balance Sheet Column B Furniture Co. Balance Sheet As at December 31, 2021 $ CAD (Fair Values) Column C Furniture Co. Balance Sheet (Immediately after acquisition) $ CAD (Carrying Values) Column D Furniture Co. Balance Sheet (Immediately after acquisition) $ CAD (Carrying Values) As at December 31, 2021 $ CAD (Carrying Values) Current Assets Cash Accounts Receivable, net (note 1) Inventory, net (note 2) Total Current Assets 100,100 150,000 225,000 475,100 480,000 Long-term Assets (note 3) Machinery Acc. depreciation, machinery Computers Acc. depreciation, computers Total Long-term Assets 600,000 120,000 20,000 12,000 8,000 488,000 Total Assets 963,100 Current Liabilities Accounts payable and accruals Bank loan payable (note 5) Total Current Liabilities 150,000 80,000 230,000 Long-term Liabilities Note payable (note 4) 80,000 320,000 Bank loan payable (note 5) Total Long-term liabilities 400,000 Equity Common shares Shareholders' equity Total Equity 100 333,000 333,100 Total Liabilities and Equity 963,100 Notes to the Balance Sheet: 1. Receivables worth $40,000 are deemed to be uncollectible as of the acquisition date. 2. Inventory worth $30,000 is deemed to be damaged, but of this damaged inventory, $5,000 can be salvaged and reused. 3. The machinery can be resold to third parties for $520,000. The computers are deemed to have a market value of $5,000. The company uses the net method for revaluation of property, plant and equipment. 4. The note payable is owing to the owner of the company and will be paid out of cash before the acquisition date. 5. There is an upcoming loan payment of $20,000 expected to come out of the bank account before the acquisition. The bank loan will be transferred over to the new owners of the company. 6. Furniture Co. has developed their own technology to increase the efficiency of their table production. An outside third party has valued this technology at $375,000. 7. A former employee was injured on the job and is suing the company. There is a reliable estimate of $100,000 to settle this litigation within the next 3 years. PARTA Alfred Co. is offering Furniture Co. a combination of cash and shares as consideration for their company. Specifically, Alfred Co. is offering $600,000 in cash and the issuance of 500 common shares with a market value of $400/share to purchase Furniture Co.'s net assets. The issuance of Alfred Co.'s common shares do not affect Alfred Co.'s original control. 1) Using the notes provided, enter the fair values of each asset or liability (you can use Column /2.75 2) Record each of the following in relation to the acquisitio /4.5 a) The acquiree b) The acquirer c) The acquisition date d) The total consideration for the acquisition e) The value of goodwillegative goodwill, if any 3) Record the journal entry for the acquirer (i.e. Alfred Co.). /3 4) Prepare the financial statements of the acquiree (Furniture Co.) after the acquisition (you can use Column C). 14 PART B Instead of purchasing the net assets, Alfred Co. has offered the same amount of consideration but for $800,000 in cash (i.e. no share consideration) to purchase 100% of Furniture Co.'s common shares. 1) Using the notes provided, record the journal entry for the acquirer and acquiree. 76.5 2) Prepare the financial statements of the acquiree (Furniture Co.) after the acquisition (you can use Column D). /2 PART C Assume Alfred Co. is offering $550,000 in cash consideration instead of $800,000. Calculate the value of goodwill. /0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts