Question: please include the formula for each step. Thank you :) 3. Exercise Three: Air Jordan has recently acquired a new Airbus A-380 for $365,000,000. They

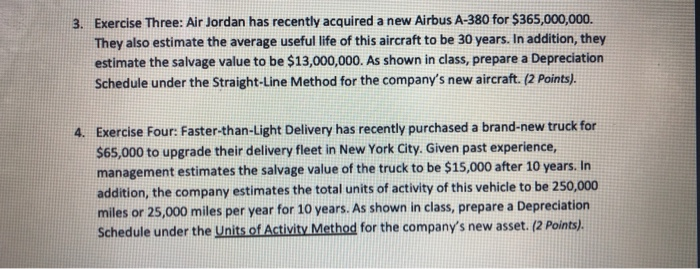

3. Exercise Three: Air Jordan has recently acquired a new Airbus A-380 for $365,000,000. They also estimate the average useful life of this aircraft to be 30 years. In addition, they estimate the salvage value to be $13,000,000. As shown in class, prepare a Depreciation Schedule under the Straight-Line Method for the company's new aircraft. (2 Points). 4. Exercise Four: Faster-than-Light Delivery has recently purchased a brand-new truck for $65,000 to upgrade their delivery fleet in New York City. Given past experience, management estimates the salvage value of the truck to be $15,000 after 10 years. In addition, the company estimates the total units of activity of this vehicle to be 250,000 miles or 25,000 miles per year for 10 years. As shown in class, prepare a Depreciation Schedule under the Units of Activity Method for the company's new asset. (2 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts