Question: Please include the process to get the answers so I can learn thank you Evan Surridge and Nicholas Tahir have each decided to close their

Please include the process to get the answers so I can learn thank you

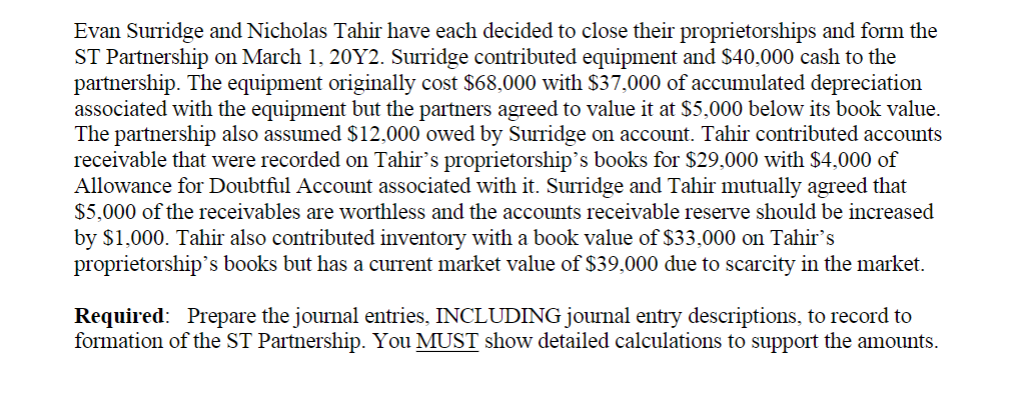

Evan Surridge and Nicholas Tahir have each decided to close their proprietorships and form the ST Partnership on March 1, 20Y2. Surridge contributed equipment and $40,000 cash to the partnership. The equipment originally cost $68,000 with $37,000 of accumulated depreciation associated with the equipment but the partners agreed to value it at $5,000 below its book value. The partnership also assumed $12,000 owed by Surridge on account. Tahir contributed accounts receivable that were recorded on Tahirs proprietorships books for $29,000 with $4,000 of Allowance for Doubtful Account associated with it. Surridge and Tahir mutually agreed that $5,000 of the receivables are worthless and the accounts receivable reserve should be increased by $1,000. Tahir also contributed inventory with a book value of $33,000 on Tahir's proprietorships books but has a current market value of $39,000 due to scarcity in the market. Required: Prepare the journal entries, INCLUDING journal entry descriptions, to record to formation of the ST Partnership. You MUST show detailed calculations to support the amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts