Question: please include the steps( calculations ) of how you found the answers. The balance sheet of DCC Corp., as of the end of Quarter 2,

please include the steps( calculations ) of how you found the answers.

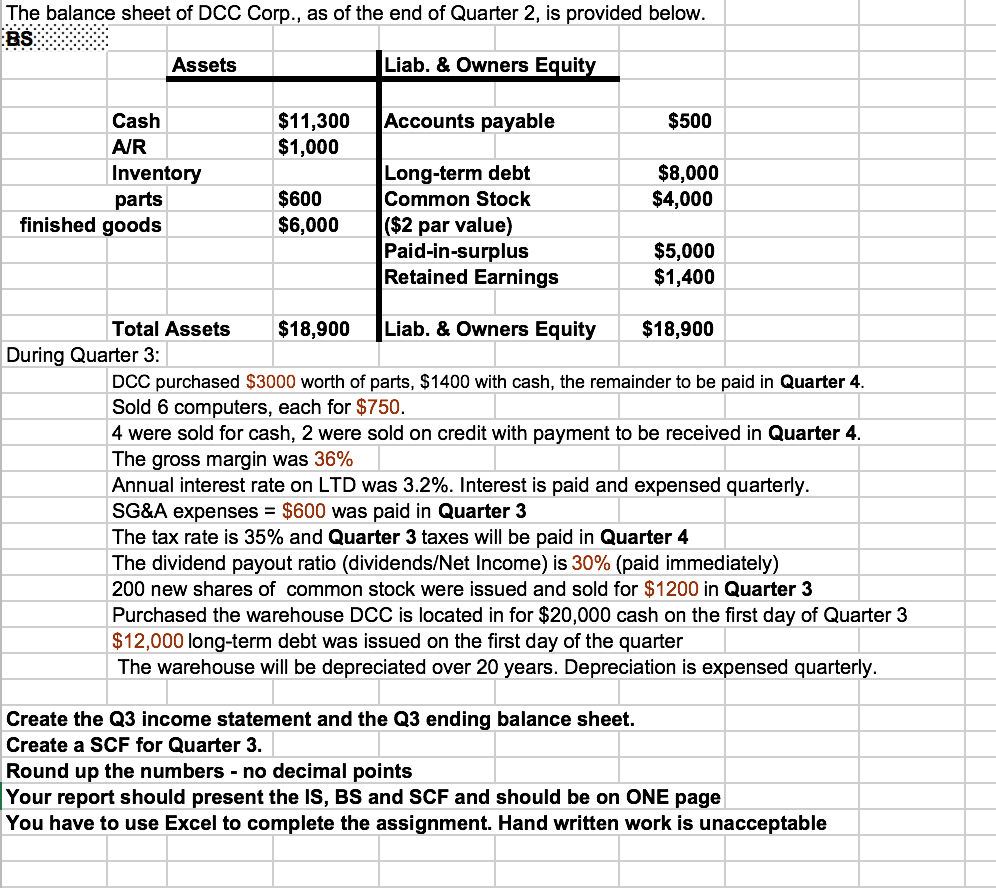

The balance sheet of DCC Corp., as of the end of Quarter 2, is provided below Assets Liab. & Owners Equit Cash A/R Inventory parts $11,300 Accounts payable $1,000 $500 Long-term debt Common Stock $8,000 $4,000 $600 finished goodS 6,000 $2 par value) $5,000 $1,400 Paid-in-surplus Retained Earning:s Total Assets$18,900 Liab. & Owners Equity $18,900 During Quarter 3 DCC purchased $3000 worth of parts, $1400 with cash, the remainder to be paid in Quarter 4 Sold 6 computers, each for $750. 4 were sold for cash, 2 were sold on credit with payment to be received in Quarter 4 The gross margin was 36% Annual interest rate on LTD was 3.2%. Interest is paid and expensed quarterly SG&A expenses = $600 was paid in Quarter 3 The tax rate is 35% and Quarter 3 taxes will be paid in Quarter 4 The dividend payout ratio (dividends/Net Income) is 30% (paid immediately) 200 new shares of common stock were issued and sold for $1200 in Quarter 3 Purchased the warehouse DCC is located in for $20,000 cash on the first day of Quarter 3 $12,000 long-term debt was issued on the first day of the quarter The warehouse will be depreciated over 20 years. Depreciation is expensed quarterly. Create the Q3 income statement and the Q3 ending balance sheet. Create a SCF for Quarter 3. Round up the numbers - no decimal points Your report should present the IS, BS and SCF and should be on ONE page You have to use Excel to complete the assignment. Hand written work is unacceptable The balance sheet of DCC Corp., as of the end of Quarter 2, is provided below Assets Liab. & Owners Equit Cash A/R Inventory parts $11,300 Accounts payable $1,000 $500 Long-term debt Common Stock $8,000 $4,000 $600 finished goodS 6,000 $2 par value) $5,000 $1,400 Paid-in-surplus Retained Earning:s Total Assets$18,900 Liab. & Owners Equity $18,900 During Quarter 3 DCC purchased $3000 worth of parts, $1400 with cash, the remainder to be paid in Quarter 4 Sold 6 computers, each for $750. 4 were sold for cash, 2 were sold on credit with payment to be received in Quarter 4 The gross margin was 36% Annual interest rate on LTD was 3.2%. Interest is paid and expensed quarterly SG&A expenses = $600 was paid in Quarter 3 The tax rate is 35% and Quarter 3 taxes will be paid in Quarter 4 The dividend payout ratio (dividends/Net Income) is 30% (paid immediately) 200 new shares of common stock were issued and sold for $1200 in Quarter 3 Purchased the warehouse DCC is located in for $20,000 cash on the first day of Quarter 3 $12,000 long-term debt was issued on the first day of the quarter The warehouse will be depreciated over 20 years. Depreciation is expensed quarterly. Create the Q3 income statement and the Q3 ending balance sheet. Create a SCF for Quarter 3. Round up the numbers - no decimal points Your report should present the IS, BS and SCF and should be on ONE page You have to use Excel to complete the assignment. Hand written work is unacceptable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts