Question: please include work Homework 1 Suppose that in Example 3.4 the company decides to use a hedge ratio of 0.9. That is, it decides to

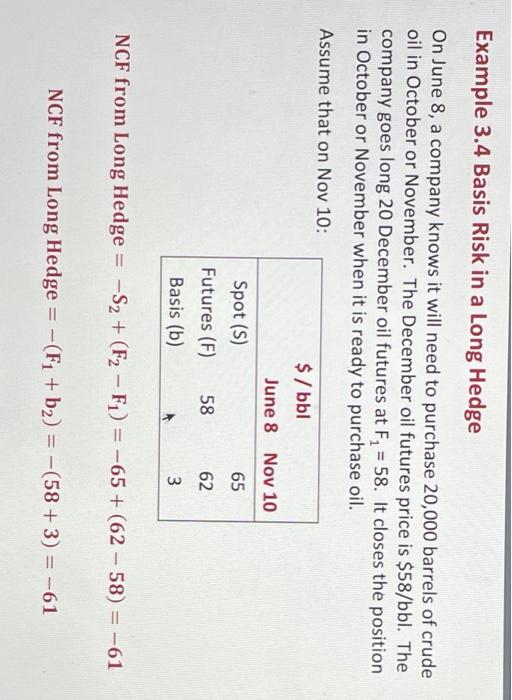

Homework 1 Suppose that in Example 3.4 the company decides to use a hedge ratio of 0.9. That is, it decides to hedge 90% of its total exposure. How does the decision affect the way in which the hedge is implemented? How does it affect the result? Assume the futures and spot prices are as in Example 3.4. Example 3.4 Basis Risk in a Long Hedge On June 8, a company knows it will need to purchase 20,000 barrels of crude oil in October or November. The December oil futures price is $58/bbl. The company goes long 20 December oil futures at F1 = 58. It closes the position in October or November when it is ready to purchase oil. Assume that on Nov 10: $/bbl June 8 Nov 10 Spot (S) 65 Futures (F) 58 62 Basis (b) 3 NCF from Long Hedge = -S2 + (F2-F1) = -65+ (62 - 58) = -61 - NCF from Long Hedge = -(F1 + b2) = -(58+3) = -61 = Homework 1 Suppose that in Example 3.4 the company decides to use a hedge ratio of 0.9. That is, it decides to hedge 90% of its total exposure. How does the decision affect the way in which the hedge is implemented? How does it affect the result? Assume the futures and spot prices are as in Example 3.4. Example 3.4 Basis Risk in a Long Hedge On June 8, a company knows it will need to purchase 20,000 barrels of crude oil in October or November. The December oil futures price is $58/bbl. The company goes long 20 December oil futures at F1 = 58. It closes the position in October or November when it is ready to purchase oil. Assume that on Nov 10: $/bbl June 8 Nov 10 Spot (S) 65 Futures (F) 58 62 Basis (b) 3 NCF from Long Hedge = -S2 + (F2-F1) = -65+ (62 - 58) = -61 - NCF from Long Hedge = -(F1 + b2) = -(58+3) = -61 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts