Question: please include work, i would like to understand! thank you :) During 2020, Pronghorn Co's first year of operations, the company reports pretax financial income

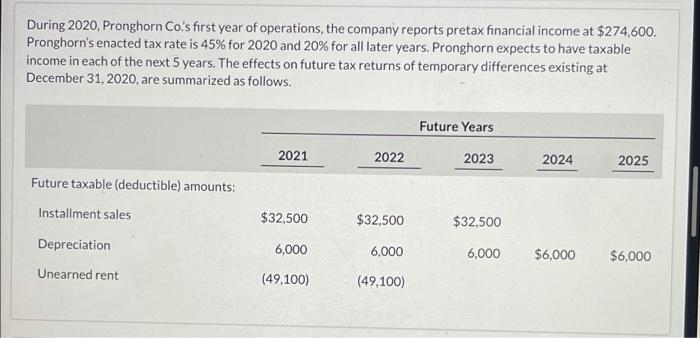

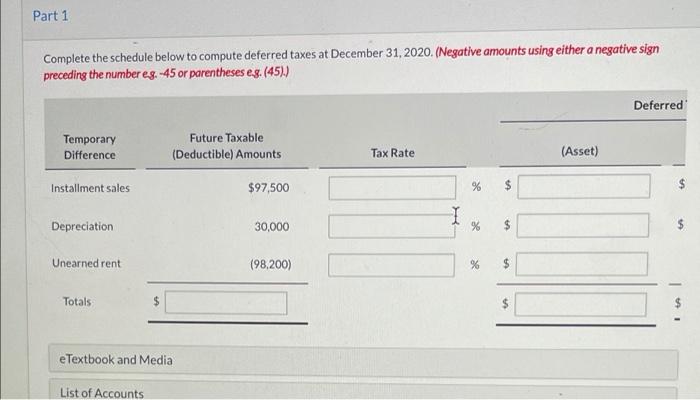

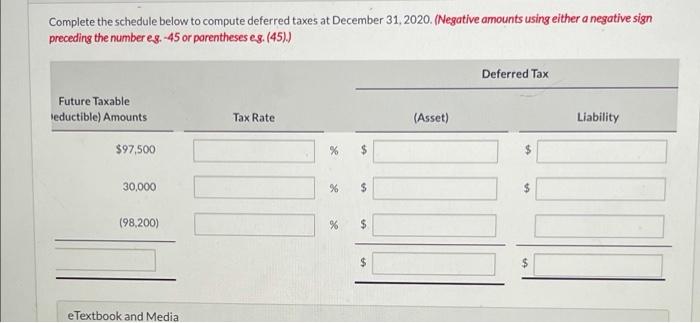

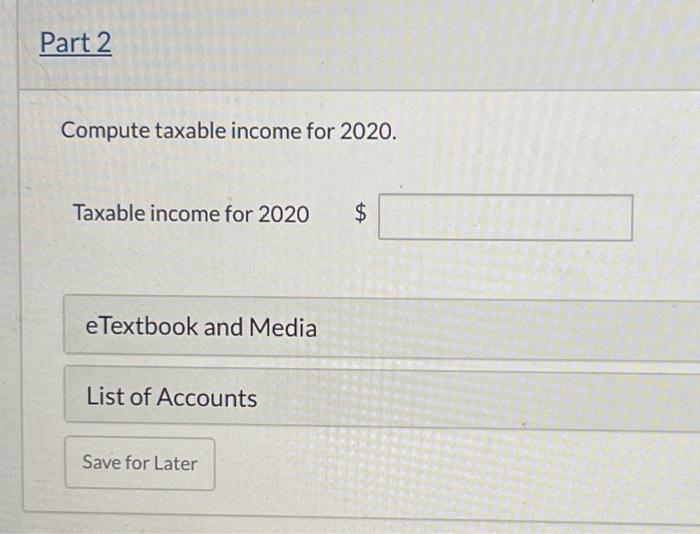

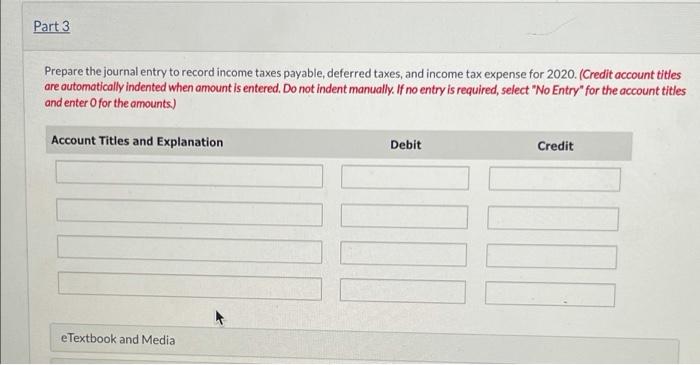

During 2020, Pronghorn Co's first year of operations, the company reports pretax financial income at $274,600. Pronghorn's enacted tax rate is 45% for 2020 and 20% for all later years. Pronghorn expects to have taxable income in each of the next 5 years. The effects on future tax returns of temporary differences existing at December 31, 2020, are summarized as follows. Future Years 2021 2022 2023 2024 2025 Future taxable (deductible) amounts: Installment sales $32,500 $32,500 $32,500 Depreciation 6,000 6,000 6,000 $6,000 $6,000 Unearned rent (49.100) (49.100) Part 1 Complete the schedule below to compute deferred taxes at December 31, 2020. (Negative amounts using either a negative sign preceding the number eg.-45 or parentheses es.(45) Deferred Temporary Difference Future Taxable (Deductible) Amounts Tax Rate (Asset) Installment sales $97,500 % $ Depreciation 30,000 % $ $ Unearned rent (98,200) % $ $ Totals e Textbook and Media List of Accounts Complete the schedule below to compute deferred taxes at December 31, 2020. (Negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg.(45)) Deferred Tax Future Taxable leductible) Amounts Tax Rate (Asset) Liability $97,500 % $ $ 30,000 % $ (98,200) % $ $ VA e Textbook and Media Part 2 Compute taxable income for 2020. Taxable income for 2020 $ e Textbook and Media List of Accounts Save for Later Part 3 Prepare the journal entry to record income taxes payable, deferred taxes, and income tax expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts