Question: please include work i would like to understand! thank you Suber Incorporated, a calendar year taxpayer purchased equipment for $740,000 and placed it in service

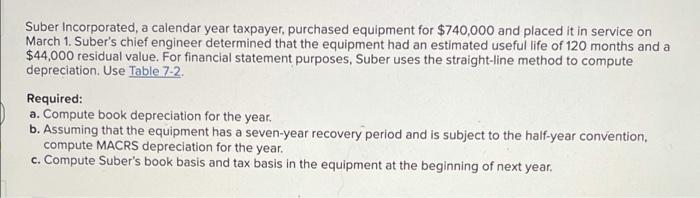

Suber Incorporated, a calendar year taxpayer purchased equipment for $740,000 and placed it in service on March 1. Suber's chief engineer determined that the equipment had an estimated useful life of 120 months and a $44,000 residual value. For financial statement purposes, Suber uses the straight-line method to compute depreciation. Use Table 7-2. Required: a. Compute book depreciation for the year. b. Assuming that the equipment has a seven-year recovery period and is subject to the half-year convention, compute MACRS depreciation for the year. c. Compute Suber's book basis and tax basis in the equipment at the beginning of next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts