Question: please include work i would like to understand! thank you At the beginning of its 2021 tax year, Hiram owned the following business assets: Date

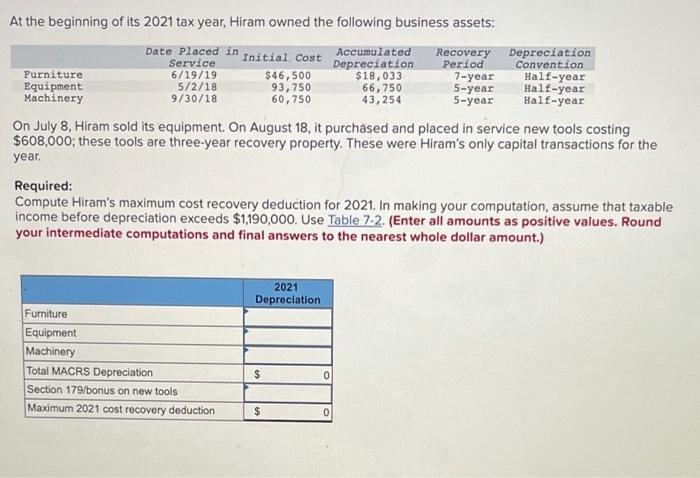

At the beginning of its 2021 tax year, Hiram owned the following business assets: Date Placed in Initial Cost Accumulated Recovery Depreciation Service Depreciation Period Convention Furniture 6/19/19 $46,500 $18,033 7-year Half-year Equipment 5/2/18 93,750 66,750 5-year Half-year Machinery 9/30/18 60,750 43,254 5-year Half-year On July 8, Hiram sold its equipment. On August 18, it purchased and placed in service new tools costing $608,000; these tools are three-year recovery property. These were Hiram's only capital transactions for the year. Required: Compute Hiram's maximum cost recovery deduction for 2021. In making your computation, assume that taxable income before depreciation exceeds $1,190,000. Use Table 7-2. (Enter all amounts as positive values. Round your intermediate computations and final answers to the nearest whole dollar amount.) 2021 Depreciation Furniture Equipment Machinery Total MACRS Depreciation Section 179/bonus on new tools Maximum 2021 cost recovery deduction $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts