Question: please include work i would like to understand! thank you Mr. Z, a calendar year taxpayer, opened a new car wash. Prior to the car

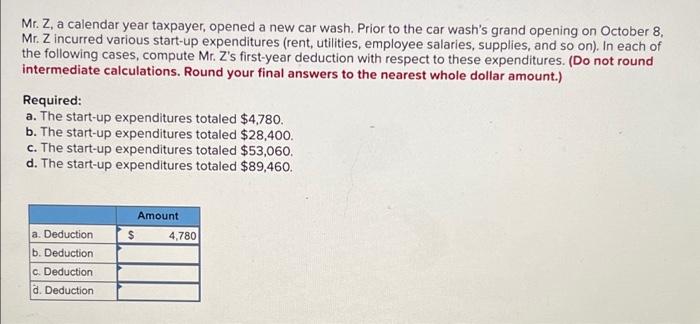

Mr. Z, a calendar year taxpayer, opened a new car wash. Prior to the car wash's grand opening on October 8, Mr. Z incurred various start-up expenditures (rent, utilities, employee salaries, supplies, and so on). In each of the following cases, compute Mr. Z's first-year deduction with respect to these expenditures. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Required: a. The start-up expenditures totaled $4780. b. The start-up expenditures totaled $28.400. c. The start-up expenditures totaled $53,060. d. The start-up expenditures totaled $89,460. Amount $ 4.780 a. Deduction b. Deduction c. Deduction a. Deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts