Question: Please include your computations for Exercise 4-2 The following information relates to Hudison City for its fiscal yeat encled December 3t. 20x:2. - During the

Please include your computations for Exercise 4-2

Please include your computations for Exercise 4-2

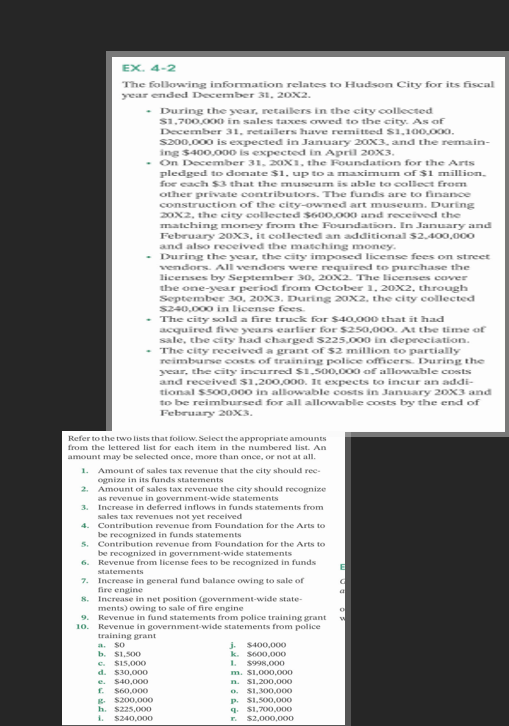

The following information relates to Hudison City for its fiscal yeat encled December 3t. 20x:2. - During the sear, recaikers in the city coolkected S1, 700,000 in sales taxes orwed to the city. Ass of S200,000 is expected in January 200x3, and the remainings $4000000 is expected in Apri]z03. - On racember 31. 2axa , the Foundation for the Arts pledged to doenate $1, up to an maximum of $1 millipon. foe each 53 that the mutacum is able te oollect fremen other private contributors. The fundts are to finance constaruction of the city-owned art museum. During Dax2, the city colleeted \$6tiouacol and received the matehing rmoney from the Foundatiscn. In Jamuary and February: 20X.3, it collected an additional \$2,400,000 and also reoelved the matehing money; - During the year, checity inppased license fees on street verndints. All wendoes were required to purchase the licerses by Septermber 30,202. The livenses edver the ome-ytear petiod from Oetober 1,202, through September 30,203, muring 202, the city collected Sz2tenex0 in license fees. - The city sold a fire truck for $404000 that it had sale, che city had charged $225,000 in depereiation. - The city received a grant of $2 million to partially reimbeamee oxsts of trainimg police officers. During the yestr, the city incurred \$1,500,000 of allowable coects and received $1,200,000. It expects to incur an additianal \$soo,000 in allowalole costs in January 203 and to be reimbursed for all allowable coosts by the end of Febutanzy 203. Refer to the two lists that follow. Select the appropriate amounts from the lettered list for each item in the numbered list. An amount may be selected once, more than once, or not at all. 1. Amount of sales tax revenue that the city should reeegnize in its funds statements 2. Amount of sales tax revenue the city should recognize as revenue in government-wide statements 3. Increase in deferred inflows in funds statements from sales tax revenues not yet received 4. Contribution revenue from Foundation for the Arts to be recognized in funds statements 5. Contribution revenue from Foundation for the Arts to be recognized in government-wide statements 6. Revenue from license fees to be recognized in funds statements 7. Increase in general fund balance owing to sale of fire engine 8. Increase in net position (government-wide statements) owing to sale of fire engine 9. Revenue in fund statements from police training grant 10. Revenue in government-wide statements from police training grant a. $0 b. $1,400 j. $400.000 c. $15,000 1. 5998,000 d. $30,000 m. $1,000,000 e. $40,000 n. $1,200,000 f. $60,000 6. \$1, 900,000 g. $200,000 p. \$1,500,000 h. $2225,000 q. r. $2,000,000 The following information relates to Hudison City for its fiscal yeat encled December 3t. 20x:2. - During the sear, recaikers in the city coolkected S1, 700,000 in sales taxes orwed to the city. Ass of S200,000 is expected in January 200x3, and the remainings $4000000 is expected in Apri]z03. - On racember 31. 2axa , the Foundation for the Arts pledged to doenate $1, up to an maximum of $1 millipon. foe each 53 that the mutacum is able te oollect fremen other private contributors. The fundts are to finance constaruction of the city-owned art museum. During Dax2, the city colleeted \$6tiouacol and received the matehing rmoney from the Foundatiscn. In Jamuary and February: 20X.3, it collected an additional \$2,400,000 and also reoelved the matehing money; - During the year, checity inppased license fees on street verndints. All wendoes were required to purchase the licerses by Septermber 30,202. The livenses edver the ome-ytear petiod from Oetober 1,202, through September 30,203, muring 202, the city collected Sz2tenex0 in license fees. - The city sold a fire truck for $404000 that it had sale, che city had charged $225,000 in depereiation. - The city received a grant of $2 million to partially reimbeamee oxsts of trainimg police officers. During the yestr, the city incurred \$1,500,000 of allowable coects and received $1,200,000. It expects to incur an additianal \$soo,000 in allowalole costs in January 203 and to be reimbursed for all allowable coosts by the end of Febutanzy 203. Refer to the two lists that follow. Select the appropriate amounts from the lettered list for each item in the numbered list. An amount may be selected once, more than once, or not at all. 1. Amount of sales tax revenue that the city should reeegnize in its funds statements 2. Amount of sales tax revenue the city should recognize as revenue in government-wide statements 3. Increase in deferred inflows in funds statements from sales tax revenues not yet received 4. Contribution revenue from Foundation for the Arts to be recognized in funds statements 5. Contribution revenue from Foundation for the Arts to be recognized in government-wide statements 6. Revenue from license fees to be recognized in funds statements 7. Increase in general fund balance owing to sale of fire engine 8. Increase in net position (government-wide statements) owing to sale of fire engine 9. Revenue in fund statements from police training grant 10. Revenue in government-wide statements from police training grant a. $0 b. $1,400 j. $400.000 c. $15,000 1. 5998,000 d. $30,000 m. $1,000,000 e. $40,000 n. $1,200,000 f. $60,000 6. \$1, 900,000 g. $200,000 p. \$1,500,000 h. $2225,000 q. r. $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts