Question: Please indicate A), B), C), D), E) Q1: BOP, NFA and Fixed exchange rate regime (30 marks) Suppose a small economy is represented by a

Please indicate A), B), C), D), E)

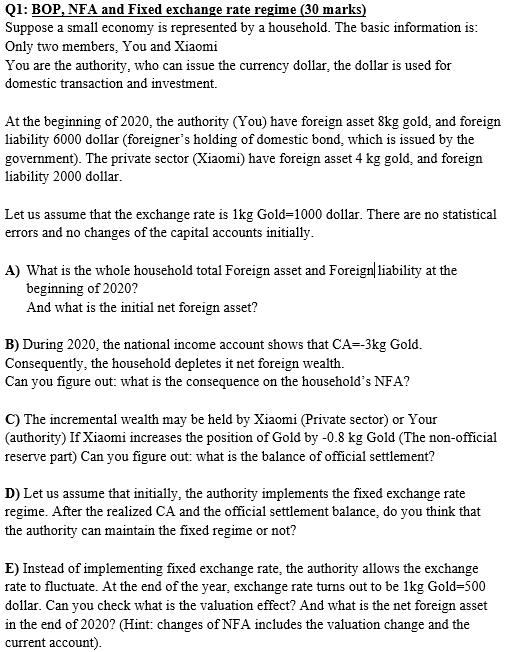

Q1: BOP, NFA and Fixed exchange rate regime (30 marks) Suppose a small economy is represented by a household. The basic information is: Only two members, You and Xiaomi You are the authority, who can issue the currency dollar, the dollar is used for domestic transaction and investment. At the beginning of 2020, the authority (You) have foreign asset 8kg gold, and foreign liability 6000 dollar (foreigner's holding of domestic bond, which is issued by the government). The private sector (Xiaomi) have foreign asset 4 kg gold, and foreign liability 2000 dollar. Let us assume that the exchange rate is 1kg Gold=1000 dollar. There are no statistical errors and no changes of the capital accounts initially. A) What is the whole household total Foreign asset and Foreign liability at the beginning of 2020? And what is the initial net foreign asset? B) During 2020, the national income account shows that CA=-3kg Gold. Consequently, the household depletes it net foreign wealth. Can you figure out what is the consequence on the household's NFA? C) The incremental wealth may be held by Xiaomi (Private sector) or Your (authority) If Xiaomi increases the position of Gold by -0.8 kg Gold (The non-official reserve ve part) Can you figure out what is the balance of official settlement? D) Let us assume that initially, the authority implements the fixed exchange rate regime. After the realized CA and the official settlement balance, do you think that the authority can maintain the fixed regime or not? E) Instead of implementing fixed exchange rate, the authority allows the exchange rate to fluctuate. At the end of the year. exchange rate turns out to be 1kg Gold=500 dollar. Can you check what is the valuation effect? And what is the net foreign asset in the end of 2020? (Hint: changes of NFA includes the valuation change and the current account). Q1: BOP, NFA and Fixed exchange rate regime (30 marks) Suppose a small economy is represented by a household. The basic information is: Only two members, You and Xiaomi You are the authority, who can issue the currency dollar, the dollar is used for domestic transaction and investment. At the beginning of 2020, the authority (You) have foreign asset 8kg gold, and foreign liability 6000 dollar (foreigner's holding of domestic bond, which is issued by the government). The private sector (Xiaomi) have foreign asset 4 kg gold, and foreign liability 2000 dollar. Let us assume that the exchange rate is 1kg Gold=1000 dollar. There are no statistical errors and no changes of the capital accounts initially. A) What is the whole household total Foreign asset and Foreign liability at the beginning of 2020? And what is the initial net foreign asset? B) During 2020, the national income account shows that CA=-3kg Gold. Consequently, the household depletes it net foreign wealth. Can you figure out what is the consequence on the household's NFA? C) The incremental wealth may be held by Xiaomi (Private sector) or Your (authority) If Xiaomi increases the position of Gold by -0.8 kg Gold (The non-official reserve ve part) Can you figure out what is the balance of official settlement? D) Let us assume that initially, the authority implements the fixed exchange rate regime. After the realized CA and the official settlement balance, do you think that the authority can maintain the fixed regime or not? E) Instead of implementing fixed exchange rate, the authority allows the exchange rate to fluctuate. At the end of the year. exchange rate turns out to be 1kg Gold=500 dollar. Can you check what is the valuation effect? And what is the net foreign asset in the end of 2020? (Hint: changes of NFA includes the valuation change and the current account)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts