Question: please indicate if each amount is a CR or DR. thanks At January 1, 2023, Crane Corporation had plan assets of $252,000 and a defined

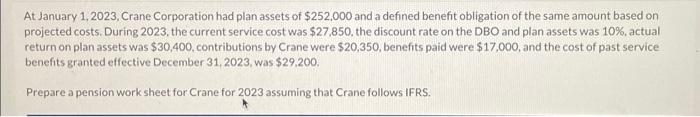

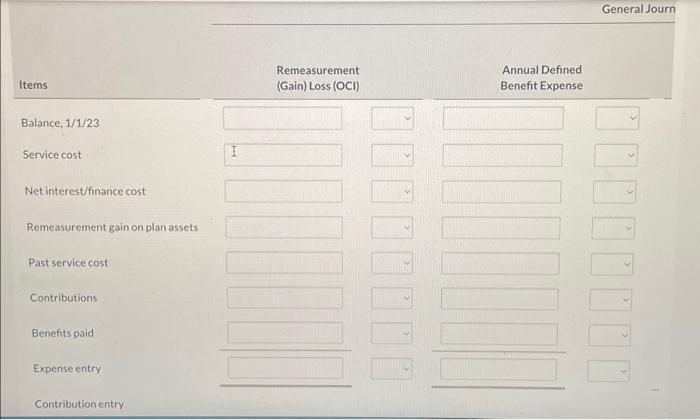

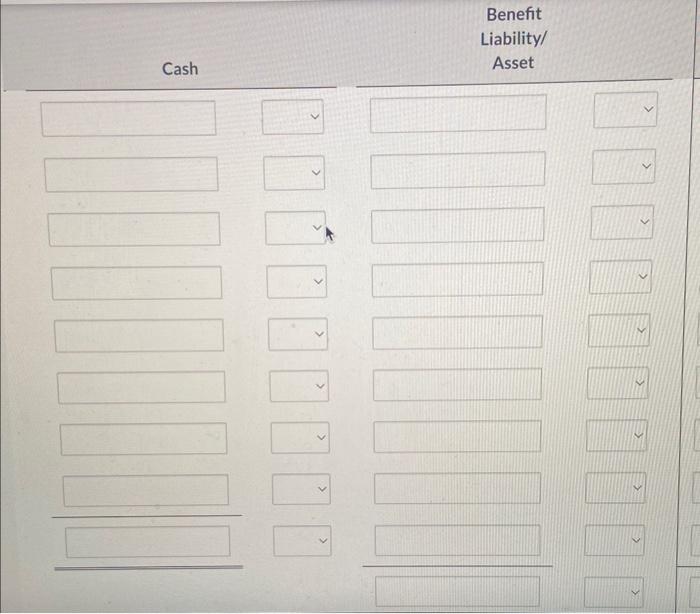

At January 1, 2023, Crane Corporation had plan assets of $252,000 and a defined benefit obligation of the same amount based on projected costs. During 2023, the current service cost was $27,850, the discount rate on the DBO and plan assets was 10%, actual return on plan assets was $30,400, contributions by Crane were $20,350, benefits paid were $17,000, and the cost of past service benefits granted effective December 31,2023 , was $29,200 Prepare a pension work sheet for Crane for 2023 assuming that Crane follows IFRS. General Journ Annual Defined Benefit Expense Remeasurement gain on plan assets Past service cost Contributions Benefits paid Expense entry Contribution entry Benefit Liability/ Asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts