Question: ***Please indicate the Excel =(function) for 3A & 3B Suppose you own a portfolio worth $220,000 at year-end 2021. At the end of each calendar

***Please indicate the Excel =(function) for 3A & 3B

***Please indicate the Excel =(function) for 3A & 3B

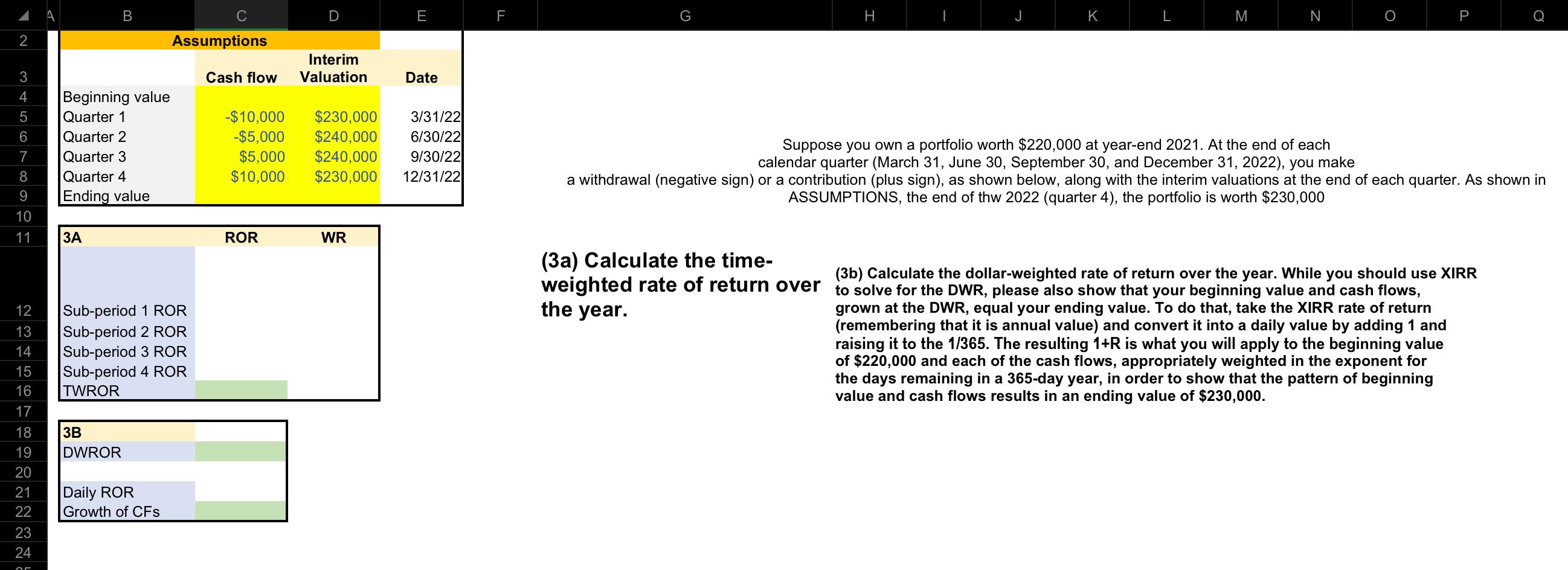

Suppose you own a portfolio worth $220,000 at year-end 2021. At the end of each calendar quarter (March 31, June 30, September 30, and December 31, 2022), you make a withdrawal (negative sign) or a contribution (plus sign), as shown below, along with the interim valuations at the end of each quarter. As shown in ASSUMPTIONS, the end of thw 2022 (quarter 4), the portfolio is worth $230,000 (3a) Calculate the timeweighted rate of return over (3b) Calculate the dollar-weighted rate of return over the year. While you should use XIRR the year. grown at the DWR, equal your ending value. To do that, take the XIRR rate of return (remembering that it is annual value) and convert it into a daily value by adding 1 and raising it to the 1/365. The resulting 1+R is what you will apply to the beginning value of $220,000 and each of the cash flows, appropriately weighted in the exponent for the days remaining in a 365-day year, in order to show that the pattern of beginning value and cash flows results in an ending value of $230,000. Suppose you own a portfolio worth $220,000 at year-end 2021. At the end of each calendar quarter (March 31, June 30, September 30, and December 31, 2022), you make a withdrawal (negative sign) or a contribution (plus sign), as shown below, along with the interim valuations at the end of each quarter. As shown in ASSUMPTIONS, the end of thw 2022 (quarter 4), the portfolio is worth $230,000 (3a) Calculate the timeweighted rate of return over (3b) Calculate the dollar-weighted rate of return over the year. While you should use XIRR the year. grown at the DWR, equal your ending value. To do that, take the XIRR rate of return (remembering that it is annual value) and convert it into a daily value by adding 1 and raising it to the 1/365. The resulting 1+R is what you will apply to the beginning value of $220,000 and each of the cash flows, appropriately weighted in the exponent for the days remaining in a 365-day year, in order to show that the pattern of beginning value and cash flows results in an ending value of $230,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts