Question: please its continuoes question need the answer urgently Christ decides to invest in HP Co. stock which price is forecasted to decrease during the next

please its continuoes question need the answer urgently

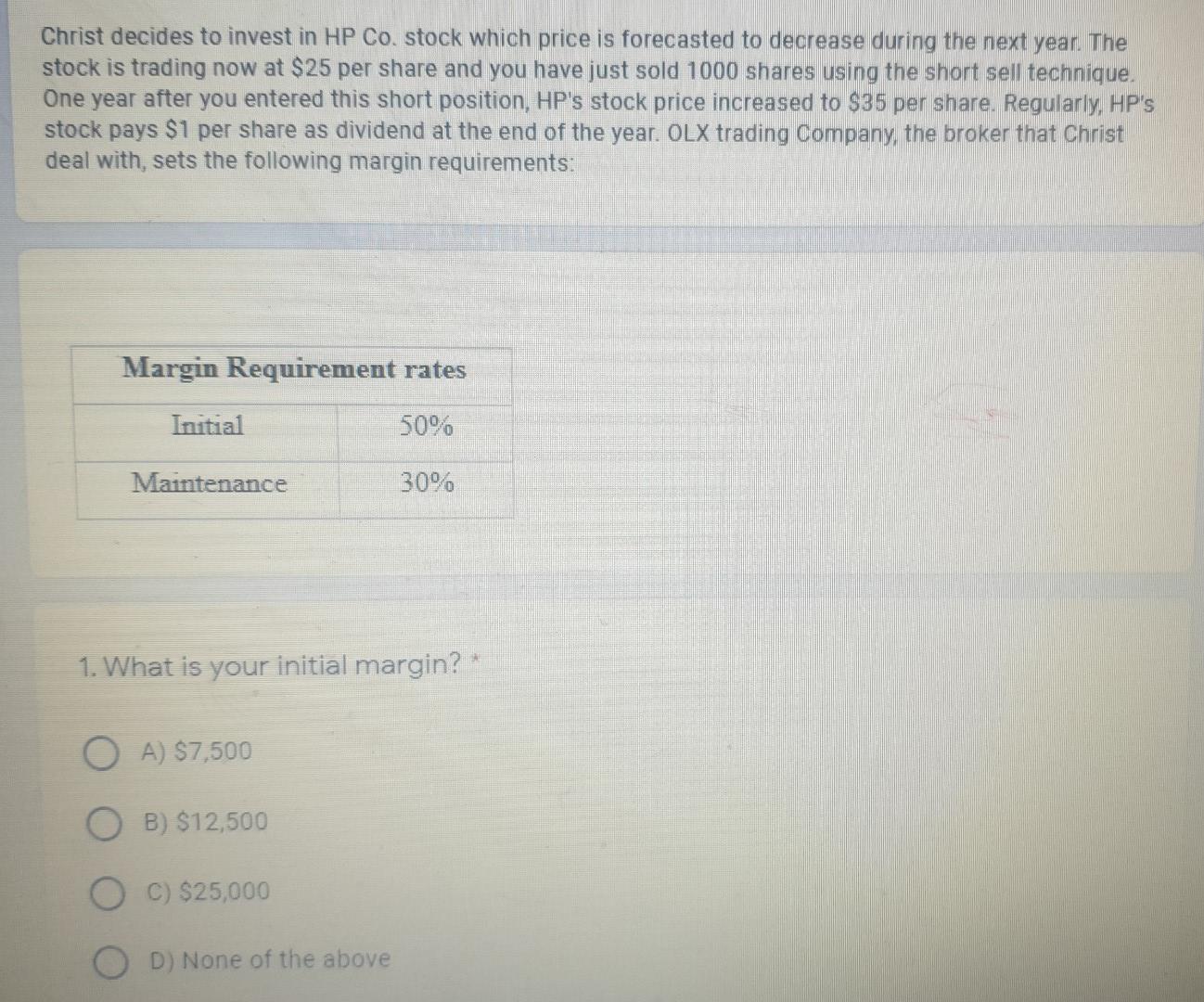

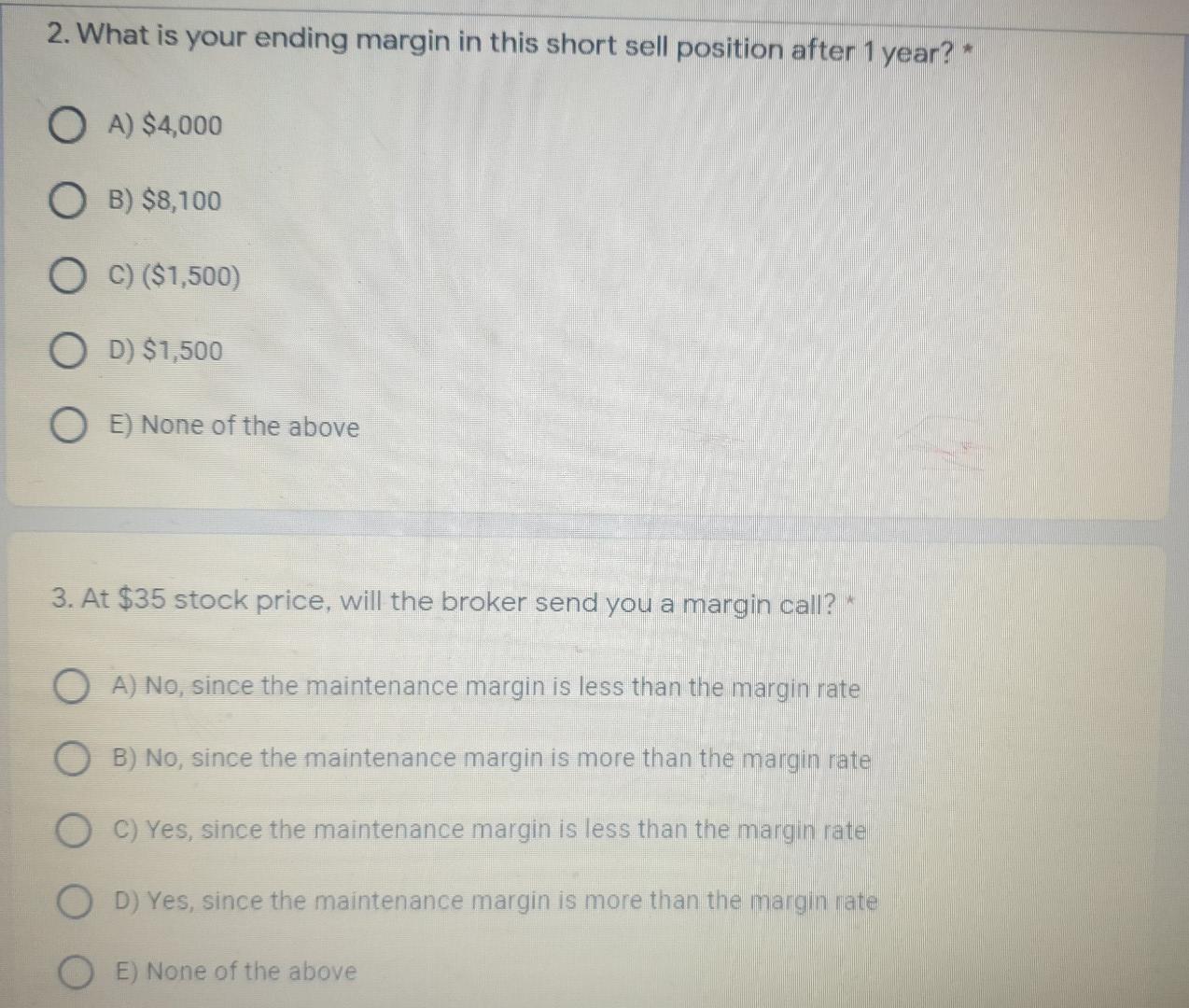

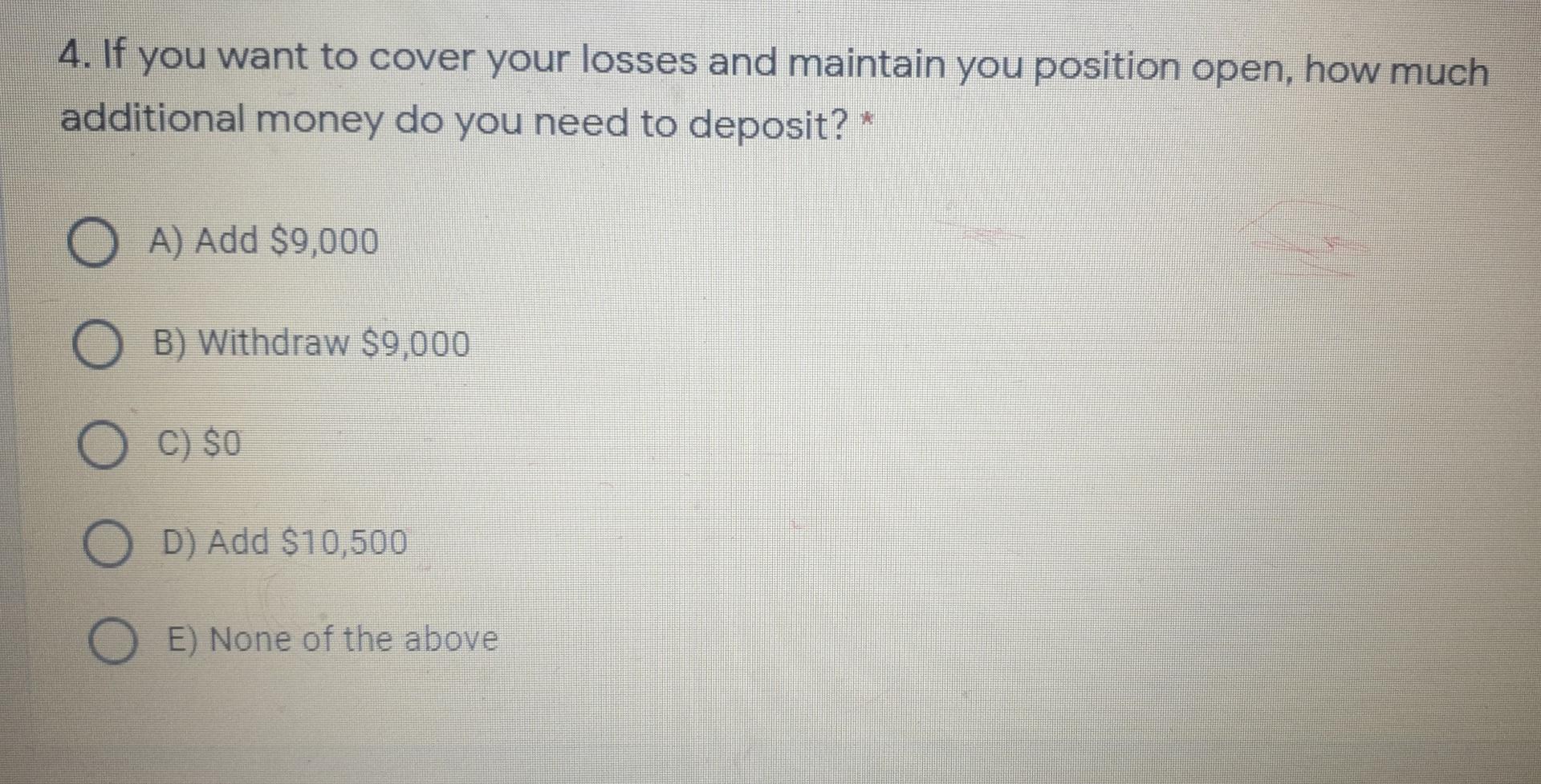

Christ decides to invest in HP Co. stock which price is forecasted to decrease during the next year. The stock is trading now at $25 per share and you have just sold 1000 shares using the short sell technique. One year after you entered this short position, HP's stock price increased to $35 per share. Regularly, HP's stock pays $1 per share as dividend at the end of the year. OLX trading Company, the broker that Christ deal with, sets the following margin requirements: Margin Requirement rates Initial 50% Maintenance 30% 1. What is your initial margin? * O A) $7,500 B) $12,500 C) $25,000 OD) None of the above 2. What is your ending margin in this short sell position after 1 year?* O A) $4,000 OB) $8,100 OC) ($1,500) OD) $1,500 OE) None of the above 3. At $35 stock price, will the broker send you a margin call? IN OA) No, since the maintenance margin is less than the margin rate B) No, since the maintenance margin is more than the margin rate C) Yes, since the maintenance margin is less than the margin rate OD) Yes, since the maintenance margin is more than the margin rate E) None of the above 4. If you want to cover your losses and maintain you position open, how much additional money do you need to deposit? O A) Add $9,000 B) Withdraw $9,000 O C) $0 D) Add $10,500 O E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts