Question: PLEASE JUST ANSWER 6 & 7 4 & 5 IS NOT NEEDED !!!!! QUESTION 4 Firmi XYZ issues a constant amount of preferred dididends at

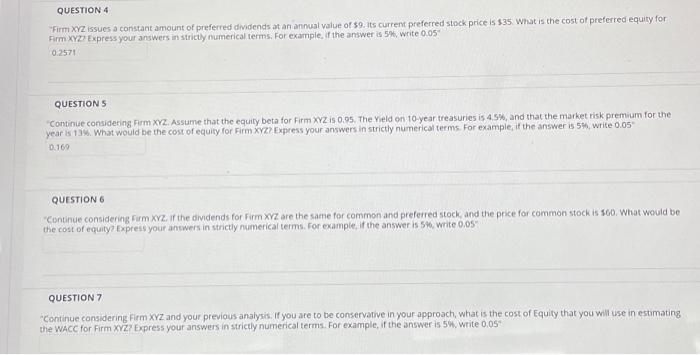

QUESTION 4 Firmi XYZ issues a constant amount of preferred dididends at an annual value of $9 alts current preferred stock.price is 135 . What is the cost of preferred equity for Firm:XYLl Express your answers in strictly numerical rerms, For example, if the answer is 5%, write 0.05 QUESTION "Continue considering Firm XYZ. Assume that the equity beta for Firm XYZ is 0.05 . The Yield on 10-year treasuries is 4.5%, and that the market risk premium for the vear is 13. What would be the cost of equity for Firm XyZ? Express your answers in strictly numerical terms. For example, if the answer is 5m, write 0.05 . QUESTION 6 "Continue considering Furm Xrz. If the dividends for firm XVZ are the same for common and preferred stock, and the price for common stock is 360 . What would be the cost of equity? Express your answers in strictly numerical terms. For example, if the answer is 5 .6. write 0.05 . QUESTION 7 Continue considering Firm XYZ and your previous analysis. If you are to be conservative in your approach, what is the cost of Equity that you whil use in estimating the WACc for Firm xyR? Express your answers in stricty numerical terms. For example, if the answer-is 54 . write 0.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts