Question: please just answer b in full solution (i provided a picture of a incase you need the info) b) If we relax the assumption of

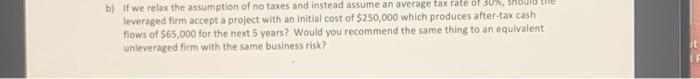

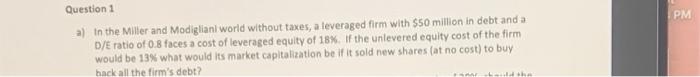

b) If we relax the assumption of no taxes and instead assume an average tax rate of 30%, SH leveraged firm accept a project with an initial cost of $250,000 which produces after-tax cash flows of $65,000 for the next 5 years? Would you recommend the same thing to an equivalent unleveraged firm with the same business risk? PM Question 1 a) in the Miller and Modiglianl world without taxes, a leveraged firm with $50 million in debt and a D/E ratio of 0.8 faces a cost of leveraged equity of 18%. If the unlevered equity cost of the firm would be 13% what would its market capitalization be if it sold new shares (at no cost) to buy hack all the firm's debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts