Question: Please just answer bottom two yellow boxes. Will upvote! A B D E F G H 44 EXHIBIT: SIMPLEST COMPANY MODEL WITH A DRIFT FORECAST

Please just answer bottom two yellow boxes. Will upvote!

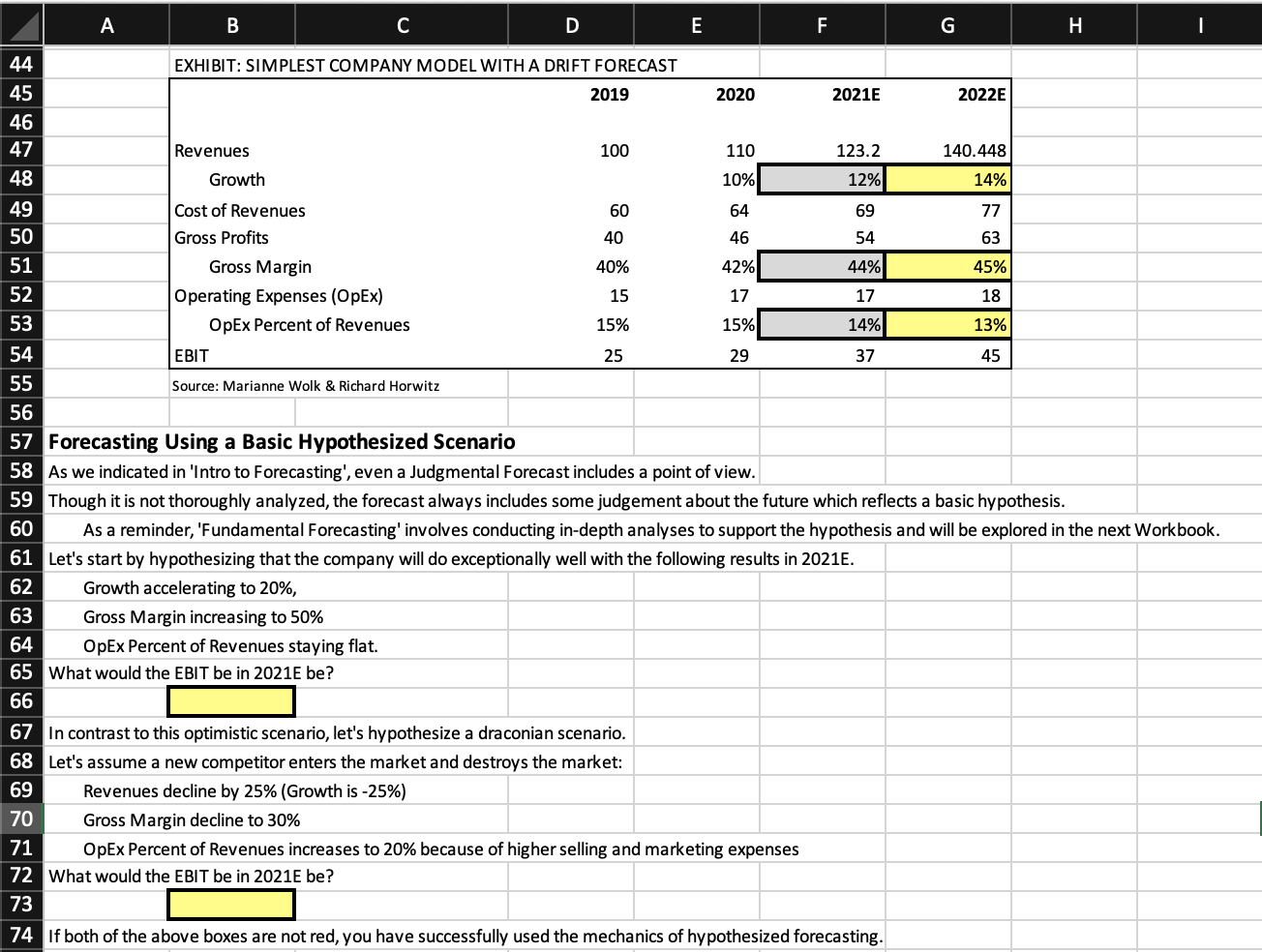

A B D E F G H 44 EXHIBIT: SIMPLEST COMPANY MODEL WITH A DRIFT FORECAST 45 2019 2020 2021E 2022E 46 47 Revenues 100 110 123.2 140.448 48 Growth 10% 12% 14% 49 Cost of Revenues 60 64 69 77 50 Gross Profits 40 46 54 63 51 Gross Margin 40% 42% 44% 45% 52 Operating Expenses (OpEx) 15 17 17 18 53 OpEx Percent of Revenues 15% 15% 14% 13% 54 EBIT 25 29 37 45 55 Source: Marianne Wolk & Richard Horwitz 56 57 Forecasting Using a Basic Hypothesized Scenario 58 As we indicated in 'Intro to Forecasting', even a Judgmental Forecast includes a point of view. 59 Though it is not thoroughly analyzed, the forecast always includes some judgement about the future which reflects a basic hypothesis. 60 As a reminder, 'Fundamental Forecasting' involves conducting in-depth analyses to support the hypothesis and will be explored in the next Workbook. 61 Let's start by hypothesizing that the company will do exceptionally well with the following results in 2021E. 62 Growth accelerating to 20%, 63 Gross Margin increasing to 50% 64 OpEx Percent of Revenues staying flat. 65 What would the EBIT be in 2021E be? 66 67 In contrast to this optimistic scenario, let's hypothesize a draconian scenario. 68 Let's assume a new competitor enters the market and destroys the market: 69 Revenues decline by 25% (Growth is -25%) 70 Gross Margin decline to 30% 71 OpEx Percent of Revenues increases to 20% because of higher selling and marketing expenses 72 What would the EBIT be in 2021E be? 73 74 If both of the above boxes are not red, you have successfully used the mechanics of hypothesized forecasting. A B D E F G H 44 EXHIBIT: SIMPLEST COMPANY MODEL WITH A DRIFT FORECAST 45 2019 2020 2021E 2022E 46 47 Revenues 100 110 123.2 140.448 48 Growth 10% 12% 14% 49 Cost of Revenues 60 64 69 77 50 Gross Profits 40 46 54 63 51 Gross Margin 40% 42% 44% 45% 52 Operating Expenses (OpEx) 15 17 17 18 53 OpEx Percent of Revenues 15% 15% 14% 13% 54 EBIT 25 29 37 45 55 Source: Marianne Wolk & Richard Horwitz 56 57 Forecasting Using a Basic Hypothesized Scenario 58 As we indicated in 'Intro to Forecasting', even a Judgmental Forecast includes a point of view. 59 Though it is not thoroughly analyzed, the forecast always includes some judgement about the future which reflects a basic hypothesis. 60 As a reminder, 'Fundamental Forecasting' involves conducting in-depth analyses to support the hypothesis and will be explored in the next Workbook. 61 Let's start by hypothesizing that the company will do exceptionally well with the following results in 2021E. 62 Growth accelerating to 20%, 63 Gross Margin increasing to 50% 64 OpEx Percent of Revenues staying flat. 65 What would the EBIT be in 2021E be? 66 67 In contrast to this optimistic scenario, let's hypothesize a draconian scenario. 68 Let's assume a new competitor enters the market and destroys the market: 69 Revenues decline by 25% (Growth is -25%) 70 Gross Margin decline to 30% 71 OpEx Percent of Revenues increases to 20% because of higher selling and marketing expenses 72 What would the EBIT be in 2021E be? 73 74 If both of the above boxes are not red, you have successfully used the mechanics of hypothesized forecasting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts