Question: Please just answer exercise 6. Thank you. Will give thumbs up. exercise 5 6 Let C; be as in Exercise 5 and let Pt be

Please just answer exercise 6. Thank you. Will give thumbs up.

exercise 5

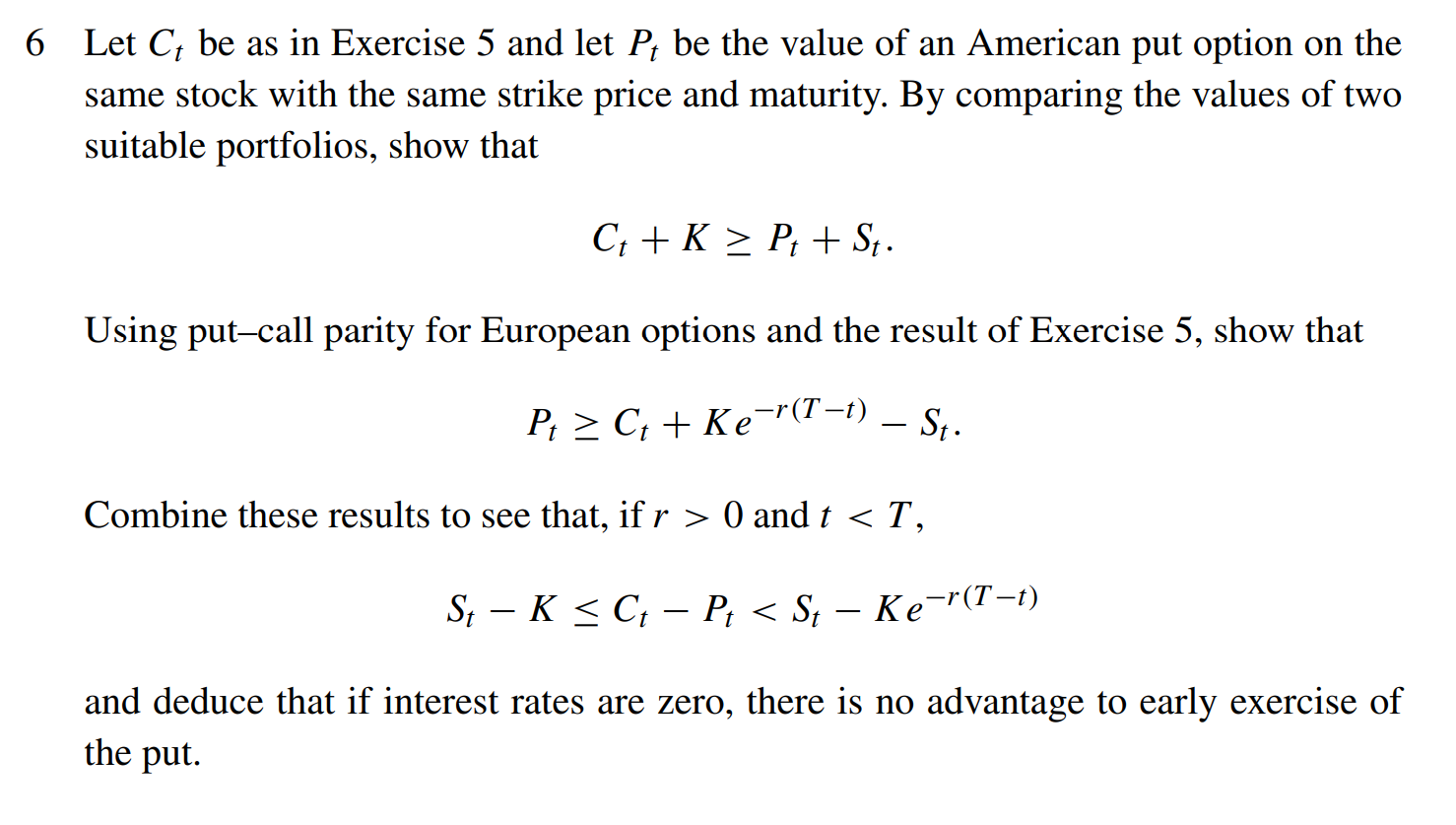

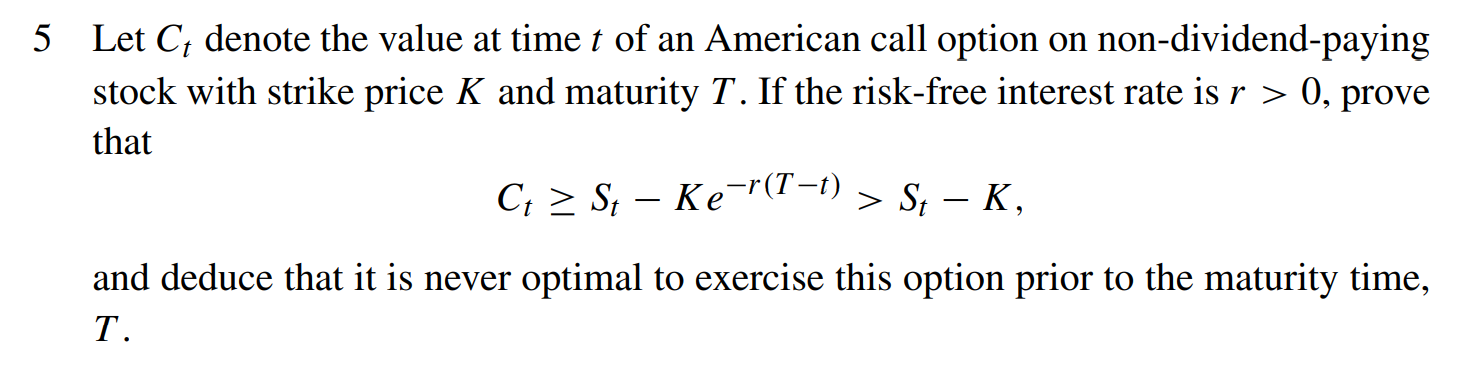

6 Let C; be as in Exercise 5 and let Pt be the value of an American put option on the same stock with the same strike price and maturity. By comparing the values of two suitable portfolios, show that Ct + K > Pt + St. Using put-call parity for European options and the result of Exercise 5, show that P>+ Ke-r(T-1) S. Combine these results to see that, if r > 0) and t 0, prove that C > S, - Ke-r(T-1) > S, - K, and deduce that it is never optimal to exercise this option prior to the maturity time, T. 6 Let C; be as in Exercise 5 and let Pt be the value of an American put option on the same stock with the same strike price and maturity. By comparing the values of two suitable portfolios, show that Ct + K > Pt + St. Using put-call parity for European options and the result of Exercise 5, show that P>+ Ke-r(T-1) S. Combine these results to see that, if r > 0) and t 0, prove that C > S, - Ke-r(T-1) > S, - K, and deduce that it is never optimal to exercise this option prior to the maturity time, T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts