Question: please just answer part C Question 3 DCDC Company is a retailer. The company had the following transactions during the first week of January, 2023:

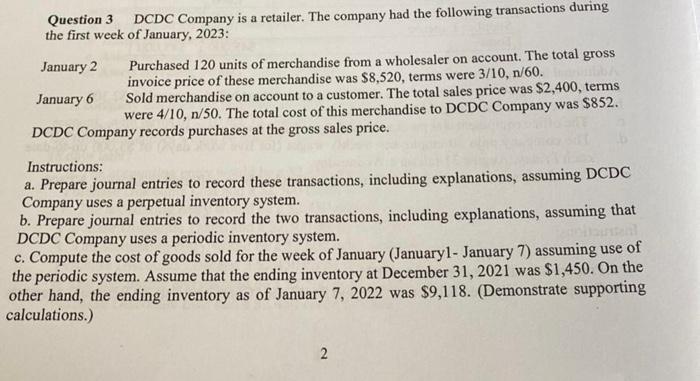

Question 3 DCDC Company is a retailer. The company had the following transactions during the first week of January, 2023: January 2 Purchased 120 units of merchandise from a wholesaler on account. The total gross invoice price of these merchandise was $8,520, terms were 3/10,n/60. January 6 Sold merchandise on account to a customer. The total sales price was $2,400, terms were 4/10,n/50. The total cost of this merchandise to DCDC Company was $852. DCDC Company records purchases at the gross sales price. Instructions: a. Prepare journal entries to record these transactions, including explanations, assuming DCDC Company uses a perpetual inventory system. b. Prepare journal entries to record the two transactions, including explanations, assuming that DCDC Company uses a periodic inventory system. c. Compute the cost of goods sold for the week of January (January1- January 7) assuming use of the periodic system. Assume that the ending inventory at December 31,2021 was $1,450. On the ther hand, the ending inventory as of January 7,2022 was $9,118. (Demonstrate supporting alculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts