Question: please just answer question e, f, g, h, i -5. Use the information below to answer question 5: Commercial Banks Assets Liabilities Reserves 400 Deposits

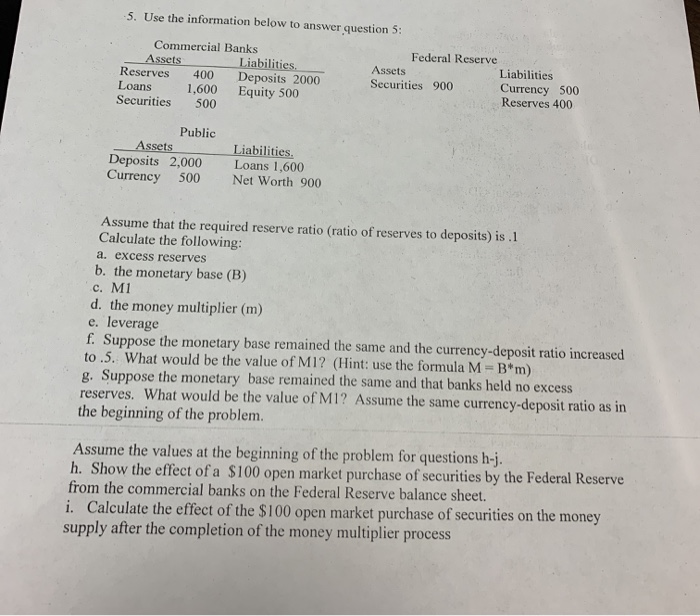

-5. Use the information below to answer question 5: Commercial Banks Assets Liabilities Reserves 400 Deposits 2000 Loans 1,600 Equity 500 Securities 500 Federal Reserve Assets Liabilities Securities 900 Currency 500 Reserves 400 Public Assets Deposits 2,000 Currency 500 Liabilities. Loans 1,600 Net Worth 900 Assume that the required reserve ratio (ratio of reserves to deposits) is.1 Calculate the following: a. excess reserves b. the monetary base (B) c. Mi d. the money multiplier (m) e. leverage f. Suppose the monetary base remained the same and the currency-deposit ratio increased to .5. What would be the value of Mi? (Hint: use the formula M-B*m) g. Suppose the monetary base remained the same and that banks held no excess reserves. What would be the value of Mi? Assume the same currency-deposit ratio as in the beginning of the problem. Assume the values at the beginning of the problem for questions h-j. h. Show the effect of a $100 open market purchase of securities by the Federal Reserve from the commercial banks on the Federal Reserve balance sheet. i. Calculate the effect of the $100 open market purchase of securities on the money supply after the completion of the money multiplier process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts