Question: please just answer true or false all 25 question A partnership agreement governs all rights and responsibilities between the partners with respect to business affairs.

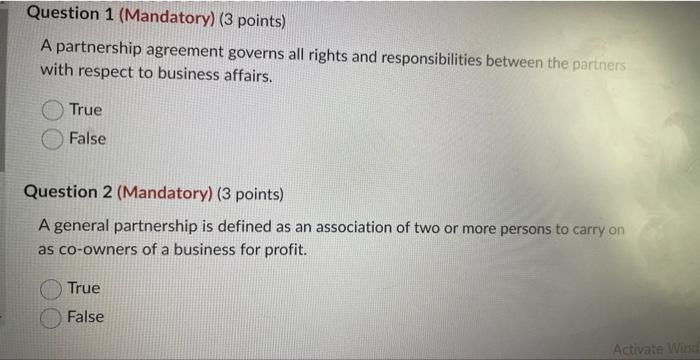

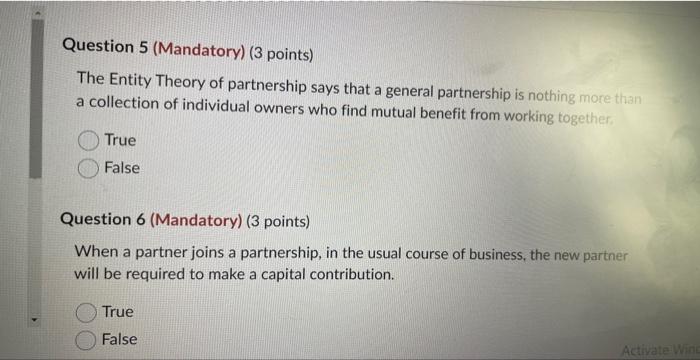

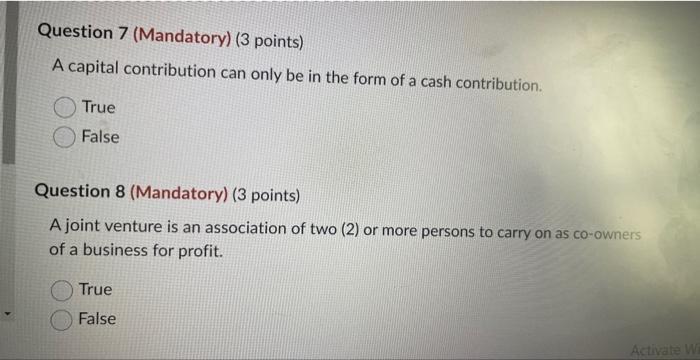

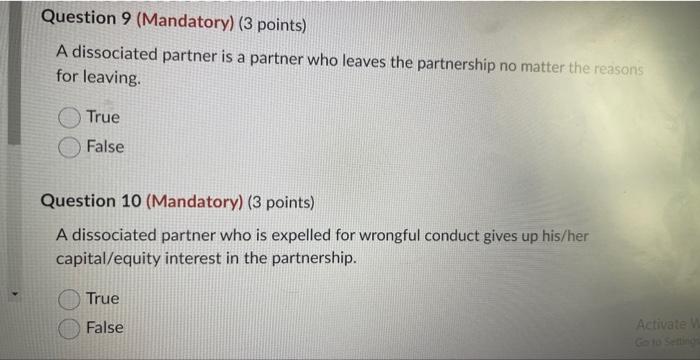

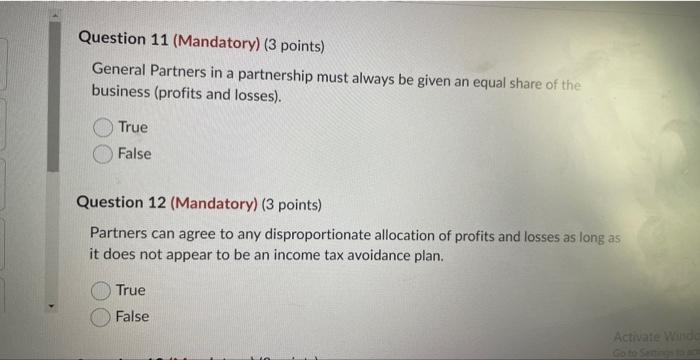

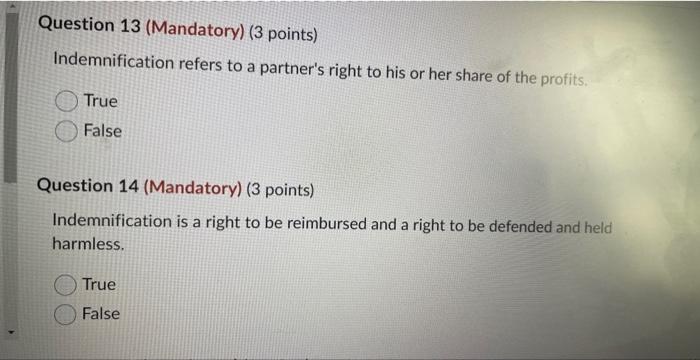

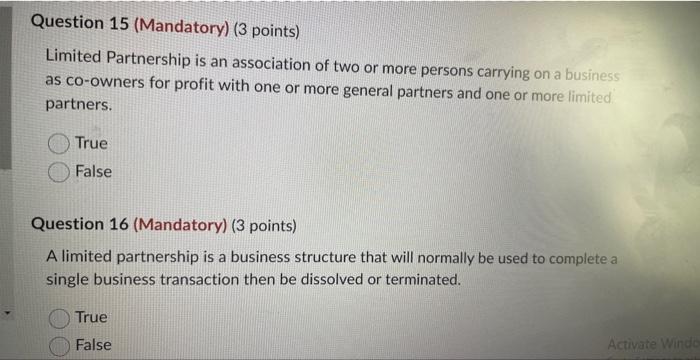

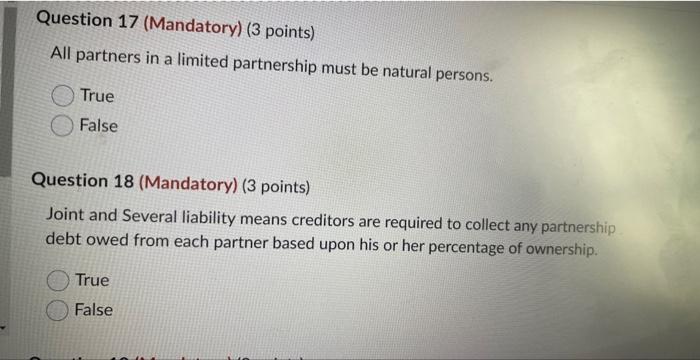

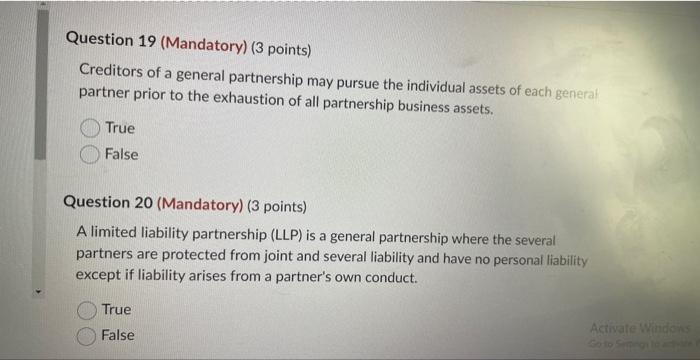

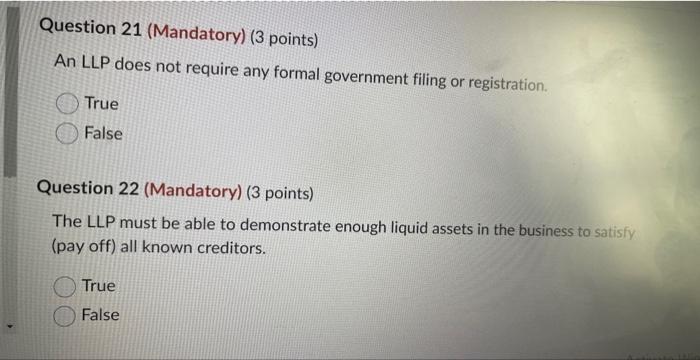

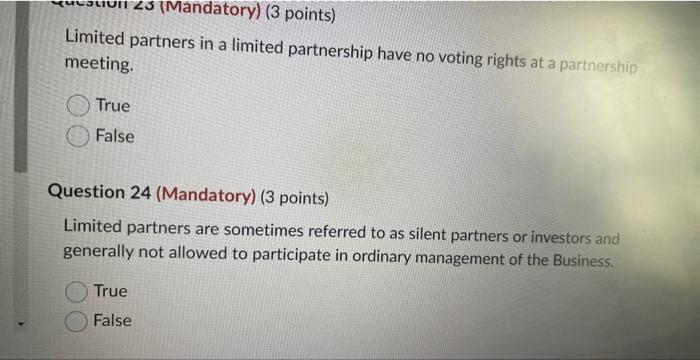

A partnership agreement governs all rights and responsibilities between the partners with respect to business affairs. True False Question 2 (Mandatory) ( 3 points) A general partnership is defined as an association of two or more persons to carry on as co-owners of a business for profit. True False Two or more persons as co-owners of a general partnership must be natural persons, True False Question 4 (Mandatory) (3 points) The aggregate theory of partnership says that a general partnership is nothing more than a collection of individual owners who find mutual benefit from working together. True False Question 5 (Mandatory) ( 3 points) The Entity Theory of partnership says that a general partnership is nothing more than a collection of individual owners who find mutual benefit from working togetherf. True False Question 6 (Mandatory) ( 3 points) When a partner joins a partnership, in the usual course of business, the new partner will be required to make a capital contribution. True False A capital contribution can only be in the form of a cash contribution. True False Question 8 (Mandatory) (3 points) A joint venture is an association of two (2) or more persons to carry on as co-owners of a business for profit. True False A dissociated partner is a partner who leaves the partnership no matter the reasons for leaving. True False Question 10 (Mandatory) (3 points) A dissociated partner who is expelled for wrongful conduct gives up his/her capital/equity interest in the partnership. True False General Partners in a partnership must always be given an equal share of the business (profits and losses). True False Question 12 (Mandatory) (3 points) Partners can agree to any disproportionate allocation of profits and losses as long as it does not appear to be an income tax avoidance plan. True False Indemnification refers to a partner's right to his or her share of the profits. True False Question 14 (Mandatory) (3 points) Indemnification is a right to be reimbursed and a right to be defended and held harmless. True False Limited Partnership is an association of two or more persons carrying on a business as co-owners for profit with one or more general partners and one or more limited partners. True False Question 16 (Mandatory) (3 points) A limited partnership is a business structure that will normally be used to complete a single business transaction then be dissolved or terminated. True False All partners in a limited partnership must be natural persons. True False Question 18 (Mandatory) (3 points) Joint and Several liability means creditors are required to collect any partnership debt owed from each partner based upon his or her percentage of ownership. True False Creditors of a general partnership may pursue the individual assets of each general partner prior to the exhaustion of all partnership business assets. True False Question 20 (Mandatory) (3 points) A limited liability partnership (LLP) is a general partnership where the several partners are protected from joint and several liability and have no personal liability except if liability arises from a partner's own conduct. True False An LLP does not require any formal government filing or registration. True False Question 22 (Mandatory) ( 3 points) The LLP must be able to demonstrate enough liquid assets in the business to satisfy (pay off) all known creditors. True False Limited partners in a limited partnership have no voting rights at a partnership meeting. True False Question 24 (Mandatory) (3 points) Limited partners are sometimes referred to as silent partners or investors and generally not allowed to participate in ordinary management of the Business. True False True False Question 25 (Mandatory) ( 3 points) In a limited partnership it is the general partners who are responsible management. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts