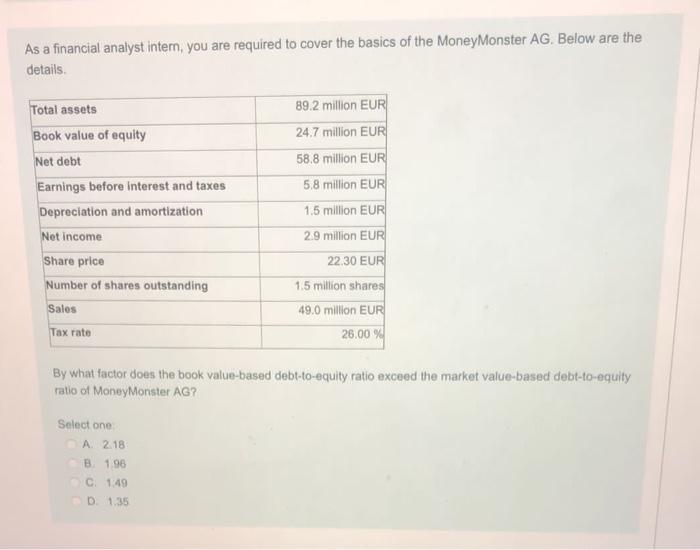

Question: PLEASE JUST CORRECT ANSWER As a financial analyst intem, you are required to cover the basics of the MoneyMonster AG. Below are the details 89.2

As a financial analyst intem, you are required to cover the basics of the MoneyMonster AG. Below are the details 89.2 million EUR 24.7 million EUR 58.8 million EUR Total assets Book value of equity Net debt Earnings before interest and taxes Depreciation and amortization Net income 5.8 million EUR 1.5 million EUR 2.9 million EUR 22.30 EUR Share price Number of shares outstanding Salos 1.5 million shares 49.0 million EUR 26.00% Tax rate By what factor does the book value-based debt-to-equity ratio exceed the market value-based debt-to-equity ratio of Money Monster AG? Select one A 2.18 B1.96 C 1:49 D1.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts