Question: please just do #2 question Question 2 - Accounting for Receivables and Bad Debt [25 minutes; 28 points] The December 31, 2012 statement of financial

![Bad Debt [25 minutes; 28 points] The December 31, 2012 statement of](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66928dc6c8ec8_58266928dc66890e.jpg) please just do #2 question

please just do #2 question

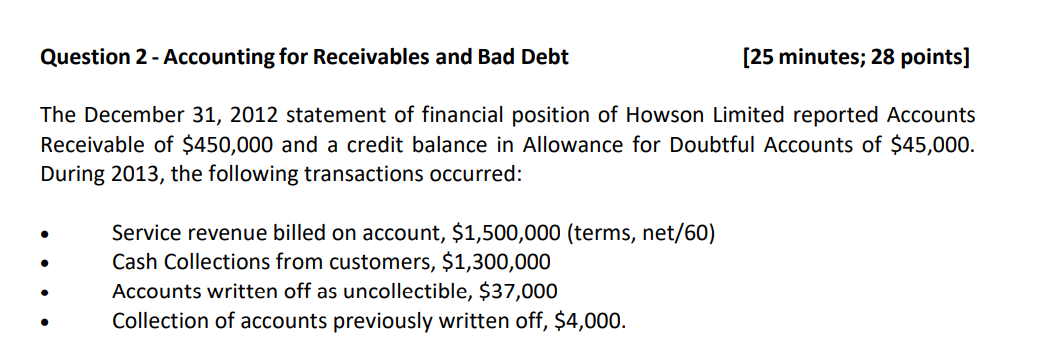

Question 2 - Accounting for Receivables and Bad Debt [25 minutes; 28 points] The December 31, 2012 statement of financial position of Howson Limited reported Accounts Receivable of $450,000 and a credit balance in Allowance for Doubtful Accounts of $45,000. During 2013, the following transactions occurred: Service revenue billed on account, $1,500,000 (terms, net/60) Cash Collections from customers, $1,300,000 Accounts written off as uncollectible, $37,000 Collection of accounts previously written off, $4,000. 1. Record all the 2013 transactions in journal entry form. [5 points] 2. The company uses the percentage of credit sales method to estimate bad debts expense. Assume bad debt rate is 2.5%. Show the adjusting journal entry at December 31, 2013. [3 points] 3. Prepare a partial Comparative Statement of Financial Position as at December 31, 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts