Question: Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc. offered hisclosing comments and then disconnected theconference call. The call had been with Costco Wholesalers?

Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc. offered hisclosing comments and then disconnected theconference call. The call had been with Costco Wholesalers? productdevelopment team. Costco wanted BBC tosupply the chain with its wholegrain tanort or flatbread. Bothparties had put their cards on the table?it wastime to make a decision.Today BBC distributes its products in Texas and its 5 neighboringstates. The Costco deal was, however, theproverbial game changer. The firm would need to gear up production,and it did not have long. The unsignedcontract dictated a staged rollout of BBC?s product; the firstshipment of flatbread is to arrive at Costco storesin southern states by January 1, 2023. If the products sell well,then other regions would be added.Unfortunately, if the flatbread sells as predicted the currentproduction line would be unable to meet productionneeds. To thoroughly evaluate the opportunity, BBC has spent$15,000 researching a new production line andthe implications of this deal. The finance department has learnedthat the physical equipment needed totransform the existing bakery line could be purchased for $1.6million. It would cost another $250,000 to shipand install the equipment. In addition, BBC?s staff will need toundergo an intensive training program. Thistraining will cost $10,000.Thus far in year 2022 (Year 0), BBC has sold 12,000 cases offlatbread each month, at an average selling price of$6.50. If the status quo is maintained?slow steady growth?the firmexpects to grow at an 8% annual rate overthe next 4 years. However, sales are expected to changedramatically if BBC agrees to sell through Costco?projections indicate that next year (Year 1) the number of casessold be double those sold in 2022. While unitsales are predicted to shoot upward, Costco has negotiated a lowerprice, and this means that the average caseselling price (average of Costco and existing case price) woulddrop to $5.25. Then, as more Costco locations areadded to the rollout, total annual revenues are projected toincrease 30% (year-over-year) in Years 2 and 3, and10% in Year 4.Today (year 0) total variable and fixed operating costs consumeabout 50% of revenues. It is anticipated that,as a percentage of sales, these costs will increase about onepercentage point per year over the next four years.But, with the Costco deal, the firm anticipates economies of scalethat will reduce total operating costs to about31% of revenues in Year 1, 33% in Years 2 and 3, and 35% in thelast year of the project.The anticipated increase in sales will lead to an increase inworking capital requirements. Prior to beginningproduction of the Costco products, a one-time increase of $100,000in its inventory (flour, shortening, etc.) willbe necessary. This will be partially offset by an increase inaccounts payable of $45,000.The existing bakery line was installed 6 years ago and had anestimated economic life of 10 years. At that time,BBC paid $750,000 to buy the machinery. The machine is depreciatedusing straight-line depreciation. Today, itis believed that the existing equipment can be sold for$400,000.BBC?s chief financial officer has predicted that the new equipmenthas a four-year economic life. It will also bedepreciated using straight-line depreciation. At the time ofreplacement/renovation it is estimated that the firmcould sell the new equipment for about 20 percent of its originalinstalled cost to another wholesale bakery.BBC is in the 21% marginal tax rate, and the riskiness of thisproject warrants that is be assigned a 22% cost ofcapital (AKA, the required rate of return on the project). The firmhas unlimited funds to invest and faces noother constraints in its capital budgeting decisions.

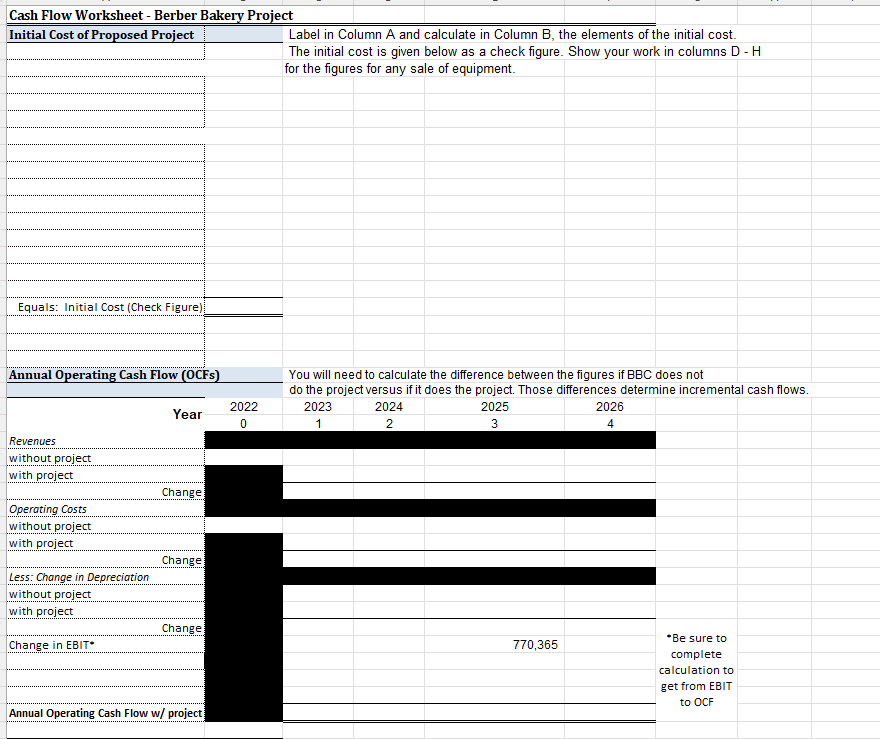

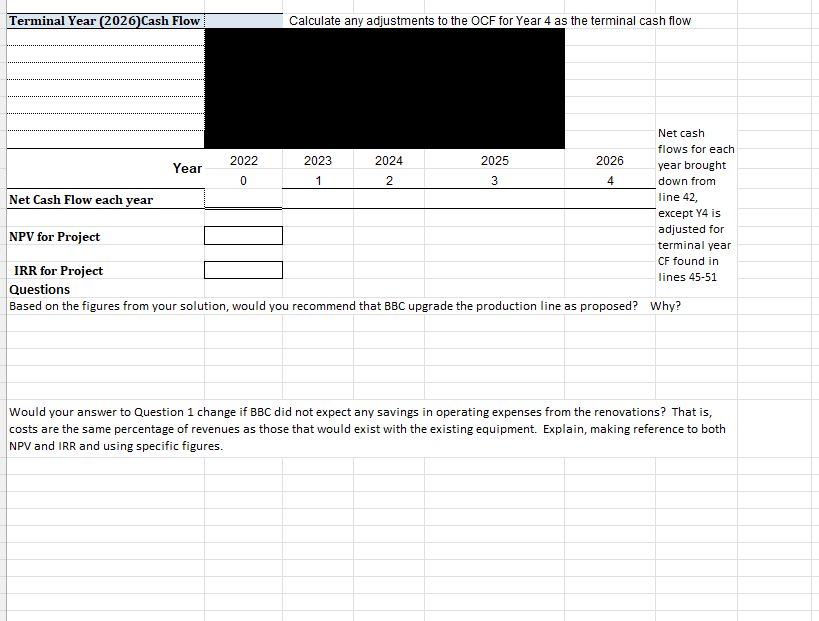

Cash Flow Worksheet - Berber Bakery Project Initial Cost of Proposed Project Equals: Initial Cost (Check Figure) Annual Operating Cash Flow (OCFS) Revenues without project with project Operating Costs without project with project Less: Change in Depreciation without project with project Change in EBIT* Year Change Change Change Annual Operating Cash Flow w/ project 2022 0 Label in Column A and calculate in Column B, the elements of the initial cost. The initial cost is given below as a check figure. Show your work in columns D - H for the figures for any sale of equipment. You will need to calculate the difference between the figures if BBC does not do the project versus if it does the project. Those differences determine incremental cash flows. 2023 1 2024 2 2025 3 770,365 2026 4 *Be sure to complete calculation to get from EBIT to OCF

Step by Step Solution

3.68 Rating (186 Votes )

There are 3 Steps involved in it

Lets work through the Cash Flow Worksheet for the Berber Bakery Project Please note that due to the limitations of this textbased interface Ill provide a simplified representation Ensure to conduct th... View full answer

Get step-by-step solutions from verified subject matter experts