Question: Please just do part 3. Thanks! Intro The current exchange rate between the dollar and the Swiss franc is $1.11 per franc. Interest rates are

Please just do part 3. Thanks!

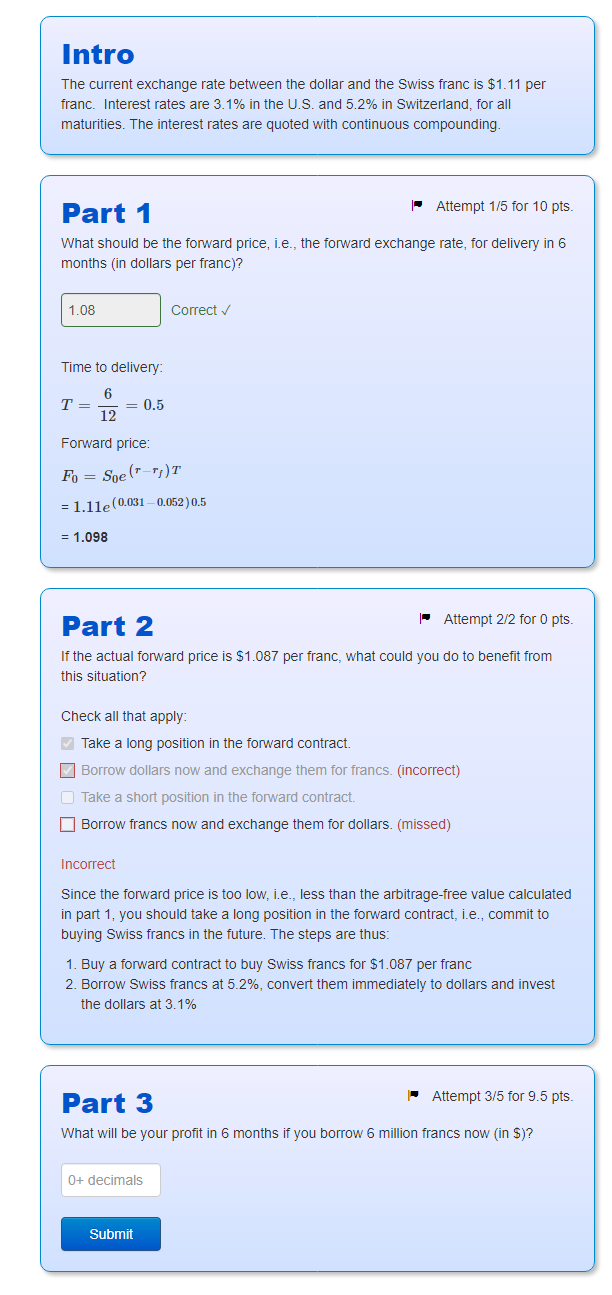

Intro The current exchange rate between the dollar and the Swiss franc is $1.11 per franc. Interest rates are 3.1% in the U.S. and 5.2% in Switzerland, for all maturities. The interest rates are quoted with continuous compounding. Part 1 Attempt 1/5 for 10 pts. What should be the forward price, i.e., the forward exchange rate, for delivery in 6 months (in dollars per franc)? Correct Time to delivery: T=126=0.5 Forward price: F0=S0e(rrf)T=1.11e(0.0310.052)0.5=1.098 Part 2 Attempt 2/2 for 0 pts. If the actual forward price is $1.087 per franc, what could you do to benefit from this situation? Check all that apply: Take a long position in the forward contract. Borrow dollars now and exchange them for francs. (incorrect) Take a short position in the forward contract. Borrow francs now and exchange them for dollars. (missed) Incorrect Since the forward price is too low, i.e., less than the arbitrage-free value calculated in part 1, you should take a long position in the forward contract, i.e., commit to buying Swiss francs in the future. The steps are thus: 1. Buy a forward contract to buy Swiss francs for $1.087 per franc 2. Borrow Swiss francs at 5.2%, convert them immediately to dollars and invest the dollars at 3.1% Part 3 - Attempt 3/5 for 9.5 pts. What will be your profit in 6 months if you borrow 6 million francs now (in \$)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts