Question: please just do Part b!!!!! please show all work i cant get rates at end of year . Palermo Incorporated purchased 80 percent of the

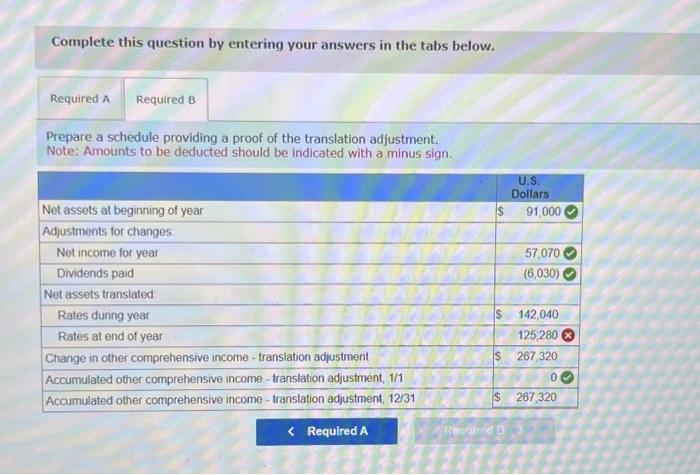

Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company. located in Australia, on January 1 . 20X3. The purchase price in Australian dollars (A\$) was AS200,000, and A\$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 yeat period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. Salina Ranching's inal balance on December 31, 20X3, in Australian dollars is as follows: Additional Information: 1. Salina Ranching uses average cost for cost of goods sold Inventory increased by A $20.000 during the year Purchases were mode uniformly during 203. The ending inventory was acquired ot the overage exchange rate for the yoar 2. Plant and equipment were acquired as follows Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory increasod by A\$20,000 during the year. Purchases were made uniformly during 203. The ending inventory was acquired at the average exchange rate for the year 2. Plant and equipment were acquired as follows 3. Plant and equipment are depreciated using the straight-line method and a 10 -year life with no residual value. 4. The payable to Palermo is in Australian dollars. Palermo's books show a receivable from Salina Ranching of $6,480. paid on April 1 and October 1 6. The dividends were declared and paid on April 1 7. Exchange rates were as follows: Required: a. Prepare a schedule translating the December 31,203, thal balance of Salina Ranching from Austrolian dollars to US dollars b. Prepate a schedule proyiding a proof of the translation adjustment Complete this question by entering your answers in the tabs below. Prepare a schedule providing a proof of the translation adjustment. Note: Amounts to be deducted should be indicated with a minus sign. Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company. located in Australia, on January 1 . 20X3. The purchase price in Australian dollars (A\$) was AS200,000, and A\$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 yeat period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. Salina Ranching's inal balance on December 31, 20X3, in Australian dollars is as follows: Additional Information: 1. Salina Ranching uses average cost for cost of goods sold Inventory increased by A $20.000 during the year Purchases were mode uniformly during 203. The ending inventory was acquired ot the overage exchange rate for the yoar 2. Plant and equipment were acquired as follows Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory increasod by A\$20,000 during the year. Purchases were made uniformly during 203. The ending inventory was acquired at the average exchange rate for the year 2. Plant and equipment were acquired as follows 3. Plant and equipment are depreciated using the straight-line method and a 10 -year life with no residual value. 4. The payable to Palermo is in Australian dollars. Palermo's books show a receivable from Salina Ranching of $6,480. paid on April 1 and October 1 6. The dividends were declared and paid on April 1 7. Exchange rates were as follows: Required: a. Prepare a schedule translating the December 31,203, thal balance of Salina Ranching from Austrolian dollars to US dollars b. Prepate a schedule proyiding a proof of the translation adjustment Complete this question by entering your answers in the tabs below. Prepare a schedule providing a proof of the translation adjustment. Note: Amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts