Question: Please just explain why the correct answers are well correct if its just math please just show what math you used to get that answer

Please just explain why the correct answers are well correct if its just math please just show what math you used to get that answer that will suffice.

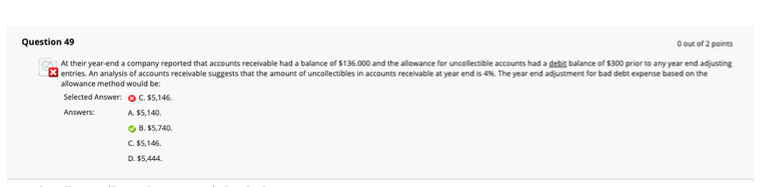

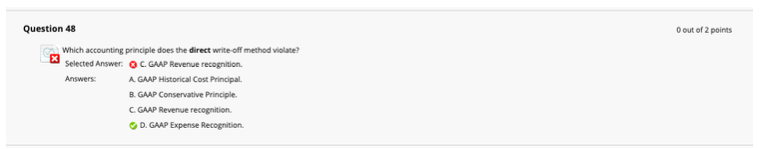

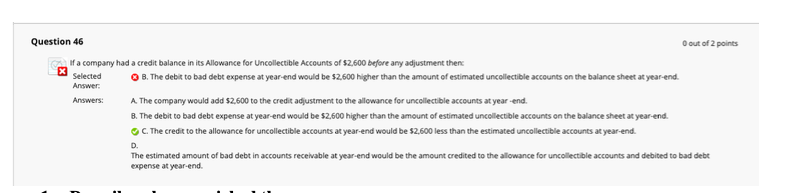

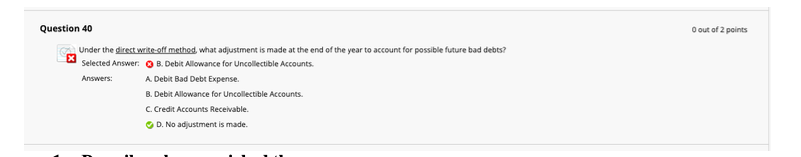

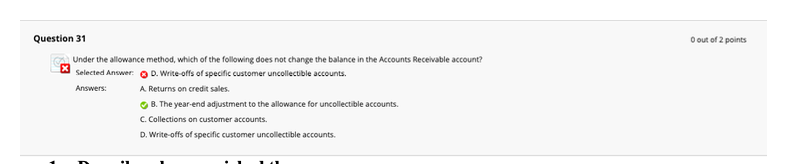

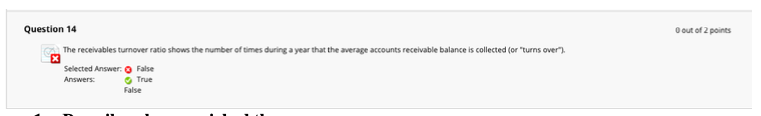

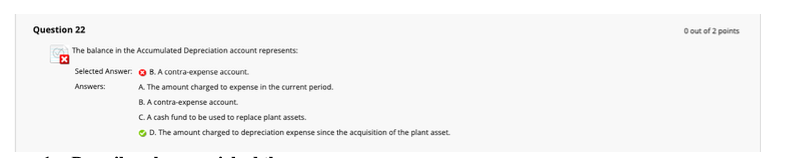

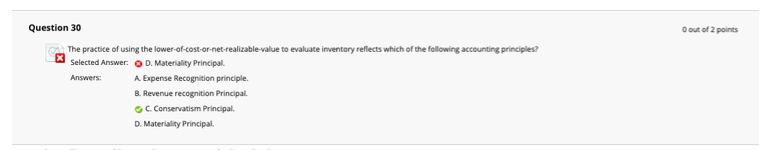

Question 49 O out of 2 points At their year-end a company reported that accounts receivable had a balance of $136.000 and the allowance for uncollectible accounts had a debisbalance of 5300 prior to any year end adjusting x entries. An analysis of accounts receivable suggests that the amount of uncollectibles in accounts receivable at year end is 4%. The year end adjustment for bad debt expense based on the allowance method would be: Selected Answer: C. 55,146. Answers: A $5,140 B.$5,740 C. $5,146. D. $5,444 Question 48 O out of 2 points Which accounting principle does the direct write-off method violate? Selected Answer: C. GAAP Revenue recognition Answers: A GAAP Historical Cost Principal. B. GAAP Conservative Principle. C. GAAP Revenue recognition D. GAAP Expense Recognition Question 46 O out of 2 points A of a company had a credit balance in its Allowance for Uncollectible Accounts of $2,600 before any adjustment there Selected B. The debt to bad debt expense at year-end would be 52.600 higher than the amount of estimated uncollectible accounts on the balance sheet at year-end. Answer: Answers: A. The company would add $2,600 to the credit adjustment to the allowance for uncollectible accounts at year-end. B. The debit to bad debt expense at year-end would be $2,600 higher than the amount of estimated uncollectible accounts on the balance sheet at year-end. C. The credit to the allowance for uncollectible accounts at year-end would be $2,600 less than the estimated uncollectible accounts at year-end. The estimated amount of bad debt in accounts receivable at year-end would be the amount credited to the allowance for uncollectible accounts and debited to bad debt expense at year-end. Question 40 O out of 2 points Under the direct write-off method, what adjustment is made at the end of the year to account for possible future bad debts? Selected Answer. B. Debit Allowance for Uncollectible Accounts. Answers: A. Debit Bad Debt Expense. B. Debit Allowance for Uncollectible Accounts C. Credit Accounts Receivable. D. No adjustment is made. Question 31 O out of 2 points A Under the allowance method, which of the following does not change the balance in the Accounts Receivable account? Selected Answer D. Write offs of specific customer uncollectible accounts. Answers: A Returns on credit sales. B. The year-end adjustment to the allowance for uncollectible accounts. C. Collections on customer accounts. D. Write-offs of specific customer uncollectible accounts. Question 14 O out of 2 points The receivables turnover ratio shows the number of times during a year that the average accounts receivable balance is collected (or "turns over Selected Answer: Answers False True False Question 22 O out of 2 points The balance in the Accumulated Depreciation account represents: Selected Answer. Answers: B. A contra-expense account. A. The amount charged to expense in the current period. B. A contra expense account. C. A cash fund to be used to replace plant assets. D. The amount charged to depreciation expense since the acquisition of the plant asset. Dout of 2 points Question 30 The practice of using the lower-of-cost-or-net-realizable-value to evaluate inventory reflects which of the following accounting principles X Selected Answer: D. Materiality Principal Answers: A Expense Recognition principle. B. Revenue recognition Principal. C. Conservatism Principal D. Materiality Principal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts