Question: Ms. Kyle Mark is employed by BMW Ltd.,a public corporation as a Sales Manager. She is married. Her husband, Neil Mark,66, is unemployed for

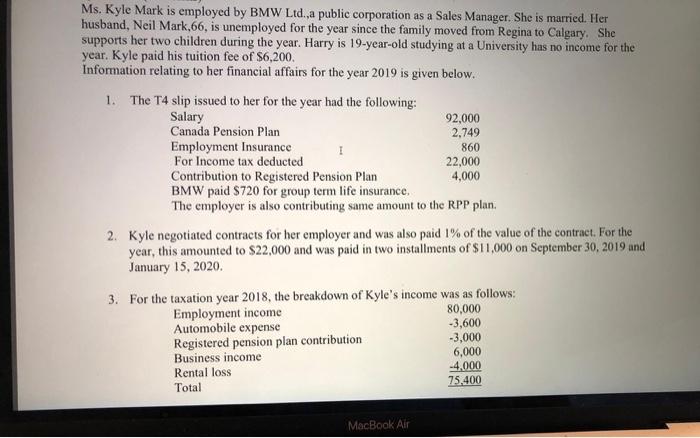

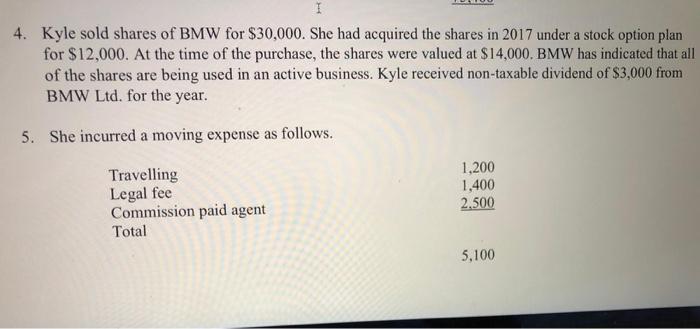

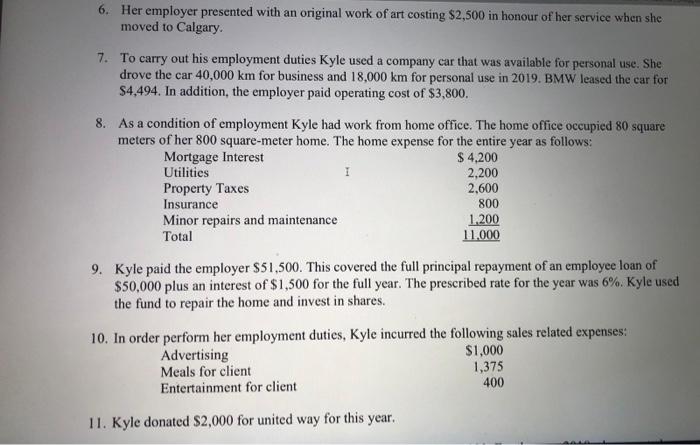

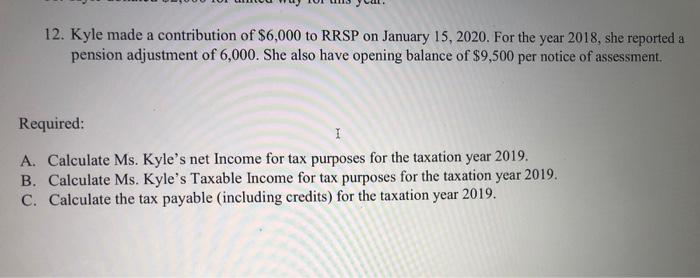

Ms. Kyle Mark is employed by BMW Ltd.,a public corporation as a Sales Manager. She is married. Her husband, Neil Mark,66, is unemployed for the year since the family moved from Regina to Calgary. She supports her two children during the year. Harry is 19-year-old studying at a University has no income for the year. Kyle paid his tuition fee of $6,200. Information relating to her financial affairs for the year 2019 is given below. 1. The T4 slip issued to her for the year had the following: Salary Canada Pension Plan Employment Insurance I For Income tax deducted Contribution to Registered Pension Plan BMW paid $720 for group term life insurance, The employer is also contributing same amount to the RPP plan. 92,000 2,749 860 2. Kyle negotiated contracts for her employer and was also paid 1% of the value of the contract. For the year, this amounted to $22,000 and was paid in two installments of $11,000 on September 30, 2019 and January 15, 2020. Registered pension plan contribution Business income Rental loss Total 22,000 4,000 3. For the taxation year 2018, the breakdown of Kyle's income was as follows: Employment income 80,000 Automobile expense MacBook Air -3,600 -3,000 6,000 -4,000 75.400 I 4. Kyle sold shares of BMW for $30,000. She had acquired the shares in 2017 under a stock option plan for $12,000. At the time of the purchase, the shares were valued at $14,000. BMW has indicated that all of the shares are being used in an active business. Kyle received non-taxable dividend of $3,000 from BMW Ltd. for the year. 5. She incurred a moving expense as follows. Travelling Legal fee Commission paid agent Total 1,200 1,400 2.500 5,100 6. Her employer presented with an original work of art costing $2,500 in honour of her service when she moved to Calgary. 7. To carry out his employment duties Kyle used a company car that was available for personal use. She drove the car 40,000 km for business and 18,000 km for personal use in 2019. BMW leased the car for $4,494. In addition, the employer paid operating cost of $3,800. 8. As a condition of employment Kyle had work from home office. The home office occupied 80 square meters of her 800 square-meter home. The home expense for the entire year as follows: $ 4,200 2,200 2,600 800 Mortgage Interest Utilities Property Taxes Insurance Minor repairs and maintenance Total 1,200 11,000 9. Kyle paid the employer $51,500. This covered the full principal repayment of an employee loan of $50,000 plus an interest of $1,500 for the full year. The prescribed rate for the year was 6%. Kyle used the fund to repair the home and invest in shares. 10. In order perform her employment duties, Kyle incurred the following sales related expenses: Advertising $1,000 1,375 400 Meals for client Entertainment for client 11. Kyle donated $2,000 for united way for this year. 12. Kyle made a contribution of $6,000 to RRSP on January 15, 2020. For the year 2018, she reported a pension adjustment of 6,000. She also have opening balance of $9,500 per notice of assessment. Required: I A. Calculate Ms. Kyle's net Income for tax purposes for the taxation year 2019. B. Calculate Ms. Kyle's Taxable Income for tax purposes for the taxation year 2019. C. Calculate the tax payable (including credits) for the taxation year 2019.

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

A Calculation of Ms Kyles net income for tax purposes for the taxation year 2019 Employment income 9... View full answer

Get step-by-step solutions from verified subject matter experts