Question: please keep in mind that there is 9 years remaining not 6 please try again! if correct i will like!! Problem 18-26 Make-Whole Call Premium

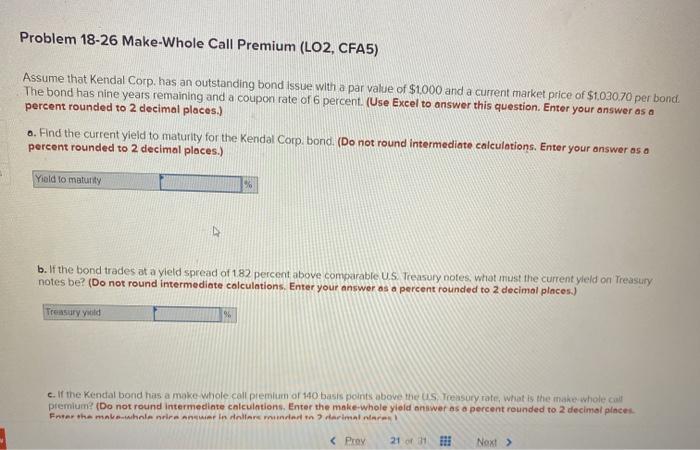

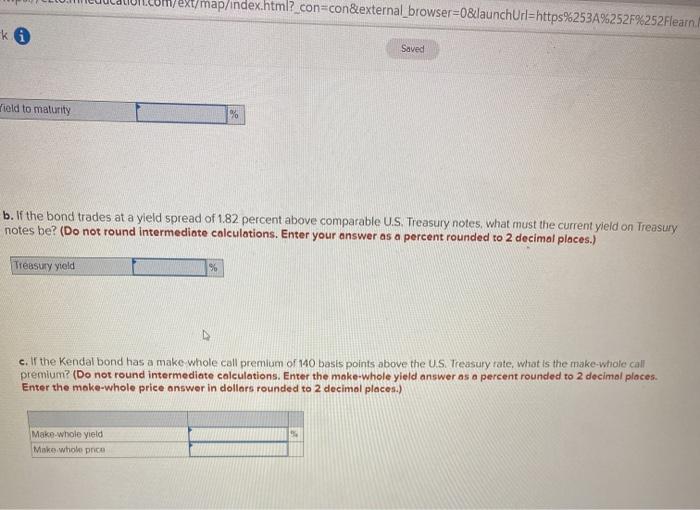

Problem 18-26 Make-Whole Call Premium (LO2, CFA5) Assume that Kendal Corp. has an outstanding bond issue with a par value of $1000 and a current market price of $1,030.70 per bond. The bond has nine years remaining and a coupon rate of 6 percent. (Use Excel to answer this question. Enter your answer as a percent rounded to 2 decimal places.) o. Find the current yield to maturity for the Kendal Corp, bond. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Yield to maturity b. If the bond trades at a yleld spread of 182 percent above comparable US Treasury notes, what is the current yield on Treasury notes be? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Treasury old c. If the Kendal bond has a make whole call premium of 140 basis points above the US Treasury rate, what is the make whole premium? (Do not round Intermediate calculations. Enter the make-whole yield answer as o percent rounded to 2 decimal places Fnter the male nire anche in altre munca in Harimalni Text/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flearn ki Saved Fiold to maturity % b. If the bond trades at a yield spread of 1.82 percent above comparable US Treasury notes, what must the current yield on Treasury notes be? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Treasury yield % c. If the Kendal bond has a make whole call premium of 140 basis points above the US Treasury rate, what is the make-whole call premium? (Do not round intermediate calculations. Enter the make-whole yield answer as a percent rounded to 2 decimal places. Enter the make-whole price answer in dollars rounded to 2 decimal places.) Make whole yield Mike whole price Problem 18-26 Make-Whole Call Premium (LO2, CFA5) Assume that Kendal Corp. has an outstanding bond issue with a par value of $1000 and a current market price of $1,030.70 per bond. The bond has nine years remaining and a coupon rate of 6 percent. (Use Excel to answer this question. Enter your answer as a percent rounded to 2 decimal places.) o. Find the current yield to maturity for the Kendal Corp, bond. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Yield to maturity b. If the bond trades at a yleld spread of 182 percent above comparable US Treasury notes, what is the current yield on Treasury notes be? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Treasury old c. If the Kendal bond has a make whole call premium of 140 basis points above the US Treasury rate, what is the make whole premium? (Do not round Intermediate calculations. Enter the make-whole yield answer as o percent rounded to 2 decimal places Fnter the male nire anche in altre munca in Harimalni Text/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flearn ki Saved Fiold to maturity % b. If the bond trades at a yield spread of 1.82 percent above comparable US Treasury notes, what must the current yield on Treasury notes be? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Treasury yield % c. If the Kendal bond has a make whole call premium of 140 basis points above the US Treasury rate, what is the make-whole call premium? (Do not round intermediate calculations. Enter the make-whole yield answer as a percent rounded to 2 decimal places. Enter the make-whole price answer in dollars rounded to 2 decimal places.) Make whole yield Mike whole price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts