Question: please kindly answer all mcq please. just answer A,B,C or D, thanks in advance sir. 2. Which of the following statements is NOT CORRECT? a.

please kindly answer all mcq please. just answer A,B,C or D, thanks in advance sir.

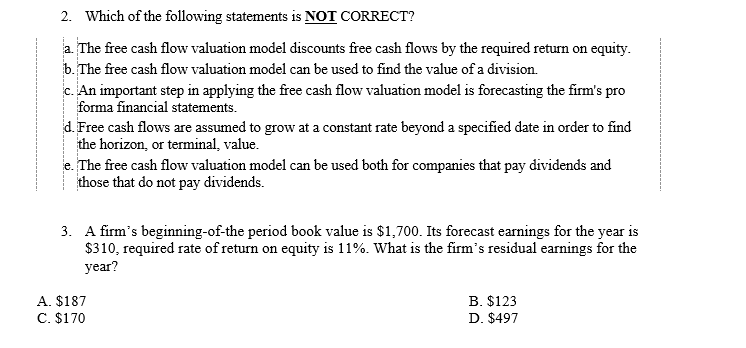

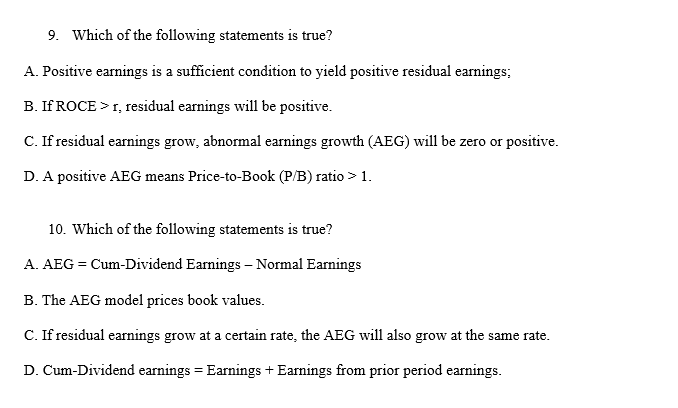

2. Which of the following statements is NOT CORRECT? a. The free cash flow valuation model discounts free cash flows by the required return on equity. b. The free cash flow valuation model can be used to find the value of a division. c. An important step in applying the free cash flow valuation model is forecasting the firm's pro forma financial statements. d. Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value. e. The free cash flow valuation model can be used both for companies that pay dividends and those that do not pay dividends. A firm's beginning-of-the period book value is $1,700. Its forecast earnings for the year is $310, required rate of return on equity is 11%. What is the firm's residual earnings for the year? A. $187 C. $170 B. $123 D. $497 9. Which of the following statements is true? A. Positive earnings is a sufficient condition to yield positive residual earnings: B. If ROCE > 1, residual earnings will be positive. C. If residual earnings grow, abnormal earnings growth (AEG) will be zero or positive. D. A positive AEG means Price-to-Book (P/B) ratio > 1. 10. Which of the following statements is true? A. AEG = Cum-Dividend Earnings - Normal Earnings B. The AEG model prices book values. C. If residual earnings grow at a certain rate, the AEG will also grow at the same rate. D. Cum-Dividend earnings = Earnings + Earnings from prior period earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts