Question: please kindly answer all please. just answer True or False no explanation. thanks in advance sir. 25. Disaggregating ROA into its component parts highlights that

please kindly answer all please. just answer True or False no explanation. thanks in advance sir.

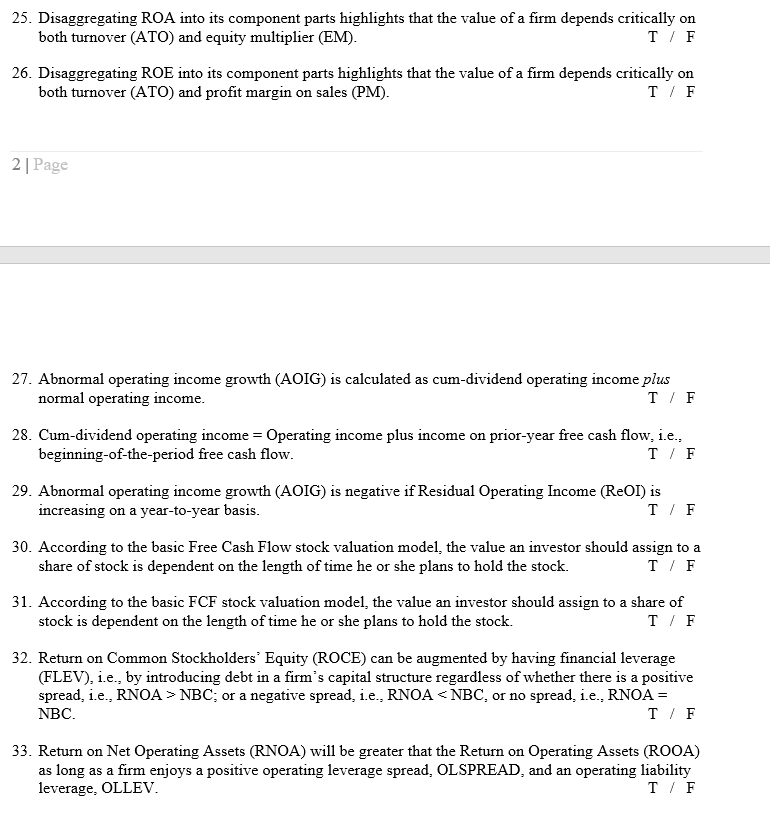

25. Disaggregating ROA into its component parts highlights that the value of a firm depends critically on both turnover (ATO) and equity multiplier (EM). T/F 26. Disaggregating ROE into its component parts highlights that the value of a firm depends critically on both turnover (ATO) and profit margin on sales (PM). T/F 2 Page 27. Abnormal operating income growth (AOIG) is calculated as cum-dividend operating income plus normal operating income. T / F 28. Cum-dividend operating income = Operating income plus income on prior-year free cash flow, i.e., beginning-of-the-period free cash flow. TIF 29. Abnormal operating income growth (AOIG) is negative if Residual Operating Income (ReOI) is increasing on a year-to-year basis. T/F 30. According to the basic Free Cash Flow stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. TIF 31. According to the basic FCF stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. T/F 32. Return on Common Stockholders' Equity (ROCE) can be augmented by having financial leverage (FLEV), i.e., by introducing debt in a firm's capital structure regardless of whether there is a positive spread, i.e., RNOA > NBC; or a negative spread, i.e., RNOA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts