Question: please kindly answer only B & C Question One: ROCE decomposition using reformulated financial statements Leonie, Inc. had the following summary financial data for the

please kindly answer only B & C

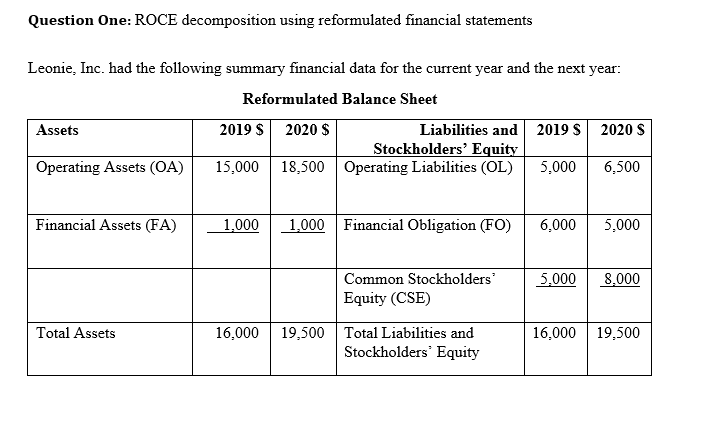

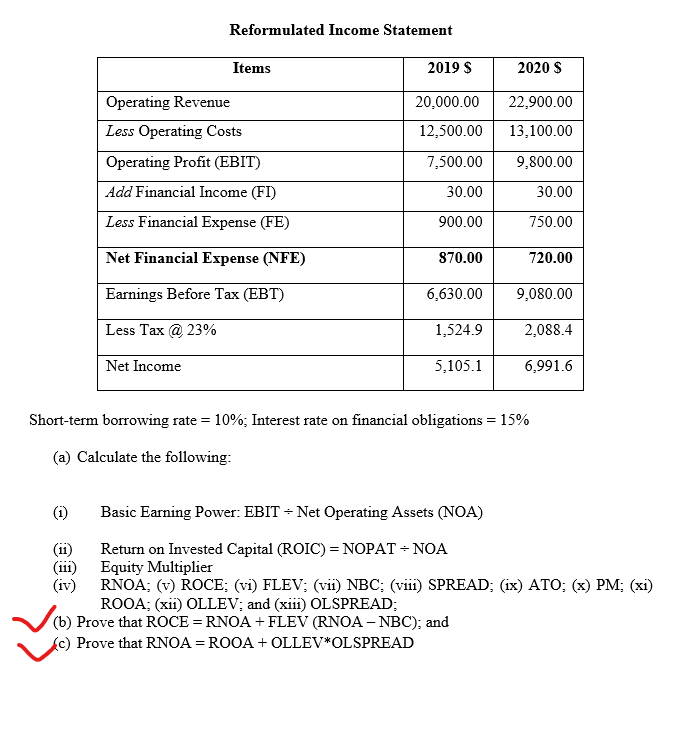

Question One: ROCE decomposition using reformulated financial statements Leonie, Inc. had the following summary financial data for the current year and the next year: Reformulated Balance Sheet Assets 2019 $ 2020 $ Liabilities and 2019 S 2020 S Stockholders' Equity Operating Assets (OA) 15,000 18,500 Operating Liabilities (OL) 5,000 6,500 Financial Assets (FA) 1,000 1,000 Financial Obligation (FO) 6,000 5,000 5.000 8.000 Common Stockholders' Equity (CSE) 16,000 19,500 Total Liabilities and Stockholders' Equity Total Assets 16,000 19,500 Reformulated Income Statement Items 2019 $ 2020 S 20,000.00 22,900.00 Operating Revenue Less Operating Costs Operating Profit (EBIT) 13,100.00 12,500.00 7,500.00 9,800.00 Add Financial Income (FI) 30.00 30.00 Less Financial Expense (FE) 900.00 750.00 Net Financial Expense (NFE) 870.00 720.00 Earnings Before Tax (EBT) 6,630.00 9,080.00 Less Tax @ 23% 1,524.9 2,088.4 Net Income 5,105.1 6,991.6 Short-term borrowing rate = 10%; Interest rate on financial obligations = 15% (a) Calculate the following: (1) Basic Earning Power: EBIT = Net Operating Assets (NOA) (ii) Return on Invested Capital (ROIC) = NOPAT = NOA (111) Equity Multiplier (iv) RNOA; (v) ROCE; (vi) FLEV; (vii) NBC: (viii) SPREAD; (ix) ATO; (x) PM; (xi) ROOA; (xii) OLLEV; and (x111) OL SPREAD: (b) Prove that ROCE = RNOA + FLEV (RNOA - NBC), and (c) Prove that RNOA =ROOA + OLLEV*OL SPREAD Question One: ROCE decomposition using reformulated financial statements Leonie, Inc. had the following summary financial data for the current year and the next year: Reformulated Balance Sheet Assets 2019 $ 2020 $ Liabilities and 2019 S 2020 S Stockholders' Equity Operating Assets (OA) 15,000 18,500 Operating Liabilities (OL) 5,000 6,500 Financial Assets (FA) 1,000 1,000 Financial Obligation (FO) 6,000 5,000 5.000 8.000 Common Stockholders' Equity (CSE) 16,000 19,500 Total Liabilities and Stockholders' Equity Total Assets 16,000 19,500 Reformulated Income Statement Items 2019 $ 2020 S 20,000.00 22,900.00 Operating Revenue Less Operating Costs Operating Profit (EBIT) 13,100.00 12,500.00 7,500.00 9,800.00 Add Financial Income (FI) 30.00 30.00 Less Financial Expense (FE) 900.00 750.00 Net Financial Expense (NFE) 870.00 720.00 Earnings Before Tax (EBT) 6,630.00 9,080.00 Less Tax @ 23% 1,524.9 2,088.4 Net Income 5,105.1 6,991.6 Short-term borrowing rate = 10%; Interest rate on financial obligations = 15% (a) Calculate the following: (1) Basic Earning Power: EBIT = Net Operating Assets (NOA) (ii) Return on Invested Capital (ROIC) = NOPAT = NOA (111) Equity Multiplier (iv) RNOA; (v) ROCE; (vi) FLEV; (vii) NBC: (viii) SPREAD; (ix) ATO; (x) PM; (xi) ROOA; (xii) OLLEV; and (x111) OL SPREAD: (b) Prove that ROCE = RNOA + FLEV (RNOA - NBC), and (c) Prove that RNOA =ROOA + OLLEV*OL SPREAD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts