Question: Please kindly help me with this question. It is highly important to use only excel PLEASE. Also, the cell reference or formula is very important

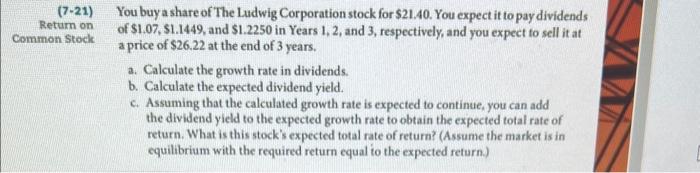

21) You buy a share of The Ludwig Corporation stock for $21.40. You expect it to pay dividends of \$1.07, \$1.1449, and $1.2250 in Years 1,2, and 3, respectively, and you expect to sell it at a price of $26.22 at the end of 3 years. a. Calculate the growth rate in dividends. b. Calculate the expected dividend yield. c. Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to obtain the expected total rate of return. What is this stock's expected total rate of return? (Assume the market is in equilibrium with the required return equal to the expected return.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts