Question: Please kindly show step by step solution. U . J 0 Turbo Inc. acquired 60% of Sugarland Co on January 1, 2018 At the time

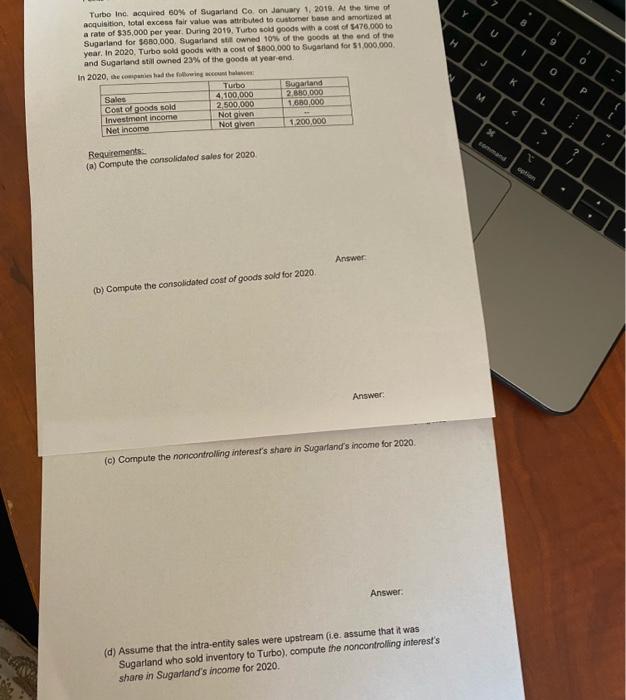

U . J 0 Turbo Inc. acquired 60% of Sugarland Co on January 1, 2018 At the time of acquisition total excess fair value was attributed to customer base and amorized a rate of $35,000 per year. During 2010. Turbo sold goods with a cost of $476,000 to Sugarland for 5680.000. Sugarland still owned 10% of the goods at the end of the year. In 2020. Turbo sold goods with a cost of $600,000 to Sugarland for $1.000.000 and Sugarland still owned 23% of the goods at year and in 2020, the companies had the following concen Turbo Sugarland Sales 4.100,000 2 B30 000 Cost of goods sold 2.500.000 1,680,000 Investment income Not given Net Income Not given 1 200.000 0 M V A 3 cand Requirements: (a) Compute the consolidated sales for 2020 option Answer (b) Compute the consolidated cost of goods sold for 2020 Answer: (c) Compute the non controlling interest's share in Sugarfand's income for 2020 Answer: (d) Assume that the intra-entity sales were upstream (.e. assume that it was Sugarland who sold inventory to Turbo), compute the noncontrolling interest's share in Sugarland's income for 2020, U . J 0 Turbo Inc. acquired 60% of Sugarland Co on January 1, 2018 At the time of acquisition total excess fair value was attributed to customer base and amorized a rate of $35,000 per year. During 2010. Turbo sold goods with a cost of $476,000 to Sugarland for 5680.000. Sugarland still owned 10% of the goods at the end of the year. In 2020. Turbo sold goods with a cost of $600,000 to Sugarland for $1.000.000 and Sugarland still owned 23% of the goods at year and in 2020, the companies had the following concen Turbo Sugarland Sales 4.100,000 2 B30 000 Cost of goods sold 2.500.000 1,680,000 Investment income Not given Net Income Not given 1 200.000 0 M V A 3 cand Requirements: (a) Compute the consolidated sales for 2020 option Answer (b) Compute the consolidated cost of goods sold for 2020 Answer: (c) Compute the non controlling interest's share in Sugarfand's income for 2020 Answer: (d) Assume that the intra-entity sales were upstream (.e. assume that it was Sugarland who sold inventory to Turbo), compute the noncontrolling interest's share in Sugarland's income for 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts