Question: PLEASE LABEL AND ANSWER ALL QUESTIONS CORRECTLY WITH THE CORRESPONDING QUESTION Problem 14-07 Dosley Cndowment Fund, ahich supports the activites of the Dosley Charitable Thust,

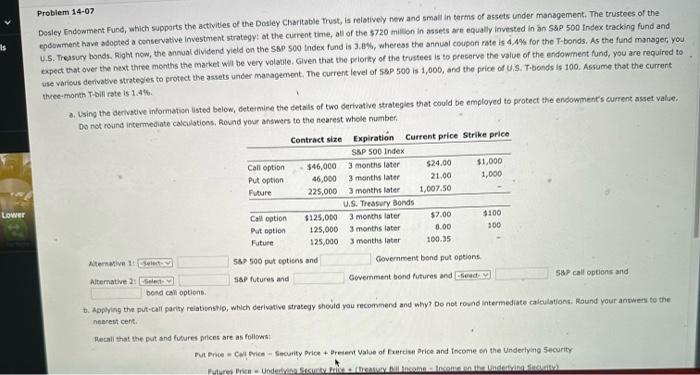

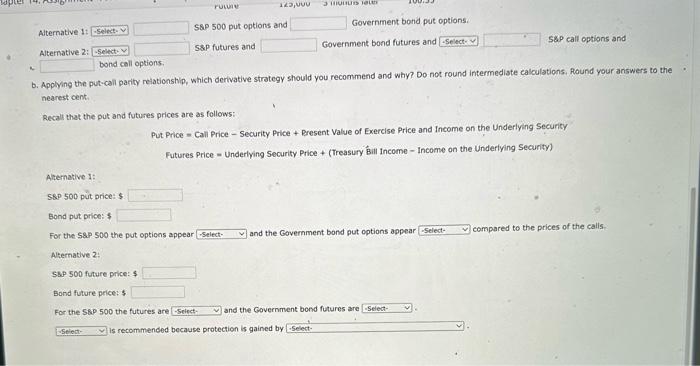

Problem 14-07 Dosley Cndowment Fund, ahich supports the activites of the Dosley Charitable Thust, is relatively new and small in terms of assets under mansgement. The trustees of the endowment havh adopted a conservative investment strategy: at the current time, all of the 5720 milion in assets are equally invested in an Sap 500 index tracking fund and U.S. Treasury bonds. Right now, the annual dividend yield on the SBP 500 tndex fund is 3.8\%, wheress the annual coupon rate is 4.4% for the T-bonds. As the fund manager you expect that over the next three menths the market wil be very volatile. Given that the priorky of the trustees is to presorve the value of the endowment fund, you are required to wie varieus derivative strateges to protect the assets under management. The current level of 58P500 is 1,000, and the price of U.S. T.bonds is 100. Assume that the current theee-month T-bifi rate is 1.4\%. a. Using the derivative information listed below, determine the detais of two derivative strategies that could be employed to protect the endowment's current asset value. Do not round intemrediate calculaticos. Round your answers to the nearest whole number. b. Appling the put-call parity reiationstip, which derivative strategy should you recommend and why? Do not rownd intermediate calculations. Round your antwers to the nesest cent. Decali that the evt and futures prices are as foliows Dut Froce = CevI Frice - Security Price + Breient Value of Frertive Brice and fncome th the Undertyang Security Alternative It S8P 500 put options and Government bond put options. Alternative 2: S\&P futures and Government bond futures and 589 call options and b. Applying the put-call parity reiationship, which derivative strategy should you recommend and why? Do not round intermediste ealculations, Round your answers to the nearest cent. Recall that the put and futures prices are as follows: Put Price = Call Price - Security Price + Bresent Value of Exercise Price and Income on the Underlying Security Futures Price = Underlying Security Price + (Treasury Bill income - Income on the Underlying Security) Alternative 1: Ssp 500 put price: $ Bond put price: $ For the 58p500 the put optigns appear and the Government bond put options appear compared to the prices of the calis Alternative 2: S\$P 500 future price: $ Bond future price: 5 For the S8P 500 the futures are and the Covernment bond futures are is recommended because protection is gained by! Problem 14-07 Dosley Cndowment Fund, ahich supports the activites of the Dosley Charitable Thust, is relatively new and small in terms of assets under mansgement. The trustees of the endowment havh adopted a conservative investment strategy: at the current time, all of the 5720 milion in assets are equally invested in an Sap 500 index tracking fund and U.S. Treasury bonds. Right now, the annual dividend yield on the SBP 500 tndex fund is 3.8\%, wheress the annual coupon rate is 4.4% for the T-bonds. As the fund manager you expect that over the next three menths the market wil be very volatile. Given that the priorky of the trustees is to presorve the value of the endowment fund, you are required to wie varieus derivative strateges to protect the assets under management. The current level of 58P500 is 1,000, and the price of U.S. T.bonds is 100. Assume that the current theee-month T-bifi rate is 1.4\%. a. Using the derivative information listed below, determine the detais of two derivative strategies that could be employed to protect the endowment's current asset value. Do not round intemrediate calculaticos. Round your answers to the nearest whole number. b. Appling the put-call parity reiationstip, which derivative strategy should you recommend and why? Do not rownd intermediate calculations. Round your antwers to the nesest cent. Decali that the evt and futures prices are as foliows Dut Froce = CevI Frice - Security Price + Breient Value of Frertive Brice and fncome th the Undertyang Security Alternative It S8P 500 put options and Government bond put options. Alternative 2: S\&P futures and Government bond futures and 589 call options and b. Applying the put-call parity reiationship, which derivative strategy should you recommend and why? Do not round intermediste ealculations, Round your answers to the nearest cent. Recall that the put and futures prices are as follows: Put Price = Call Price - Security Price + Bresent Value of Exercise Price and Income on the Underlying Security Futures Price = Underlying Security Price + (Treasury Bill income - Income on the Underlying Security) Alternative 1: Ssp 500 put price: $ Bond put price: $ For the 58p500 the put optigns appear and the Government bond put options appear compared to the prices of the calis Alternative 2: S\$P 500 future price: $ Bond future price: 5 For the S8P 500 the futures are and the Covernment bond futures are is recommended because protection is gained by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts