Question: Please label each answer, Thank you Task 2 - Ratio Analysis, Bank Reconciliation and Receivables 40 MARKS Luke Jones, owner of LJ Corporation approached Topeka

Please label each answer, Thank you

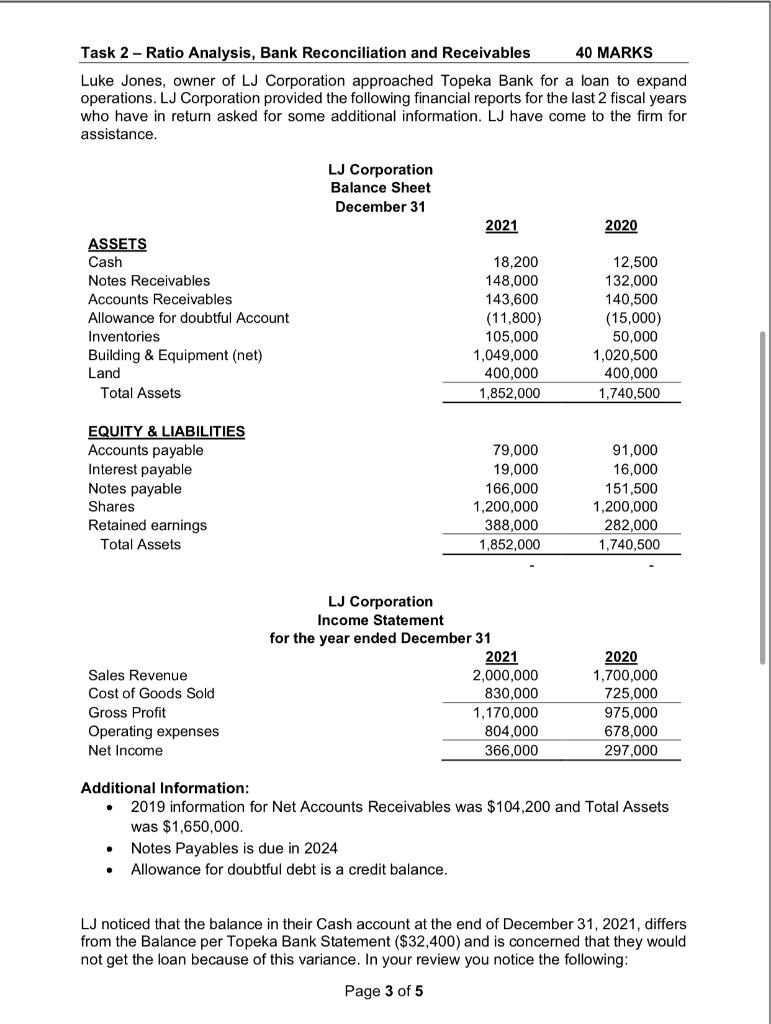

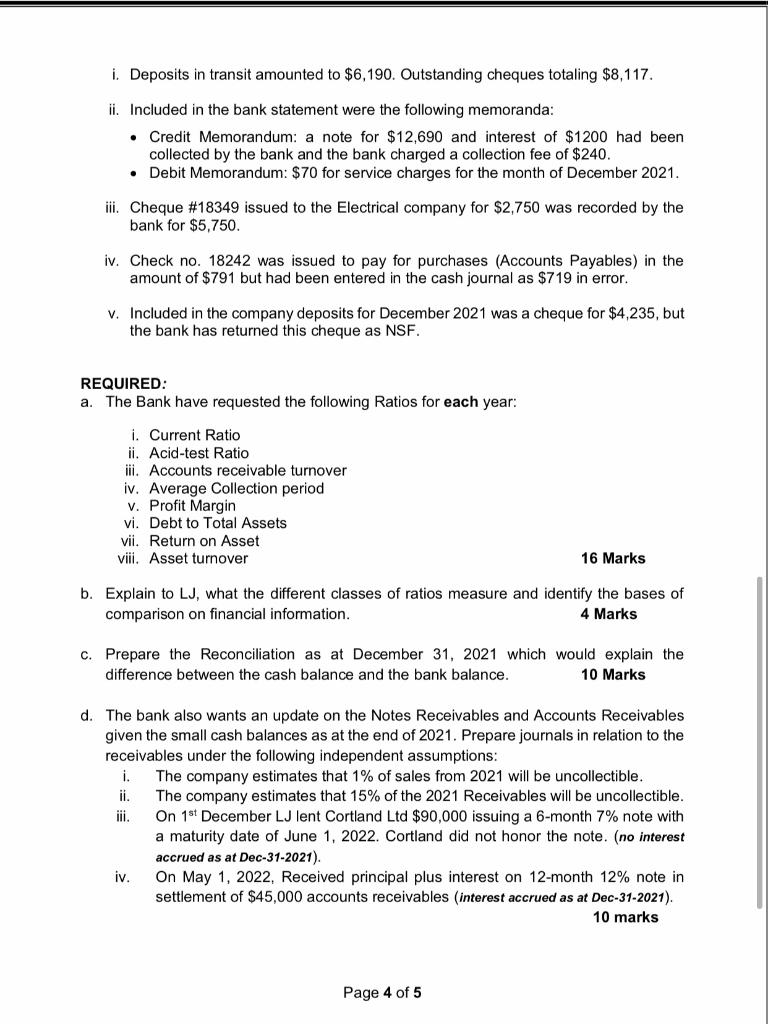

Task 2 - Ratio Analysis, Bank Reconciliation and Receivables 40 MARKS Luke Jones, owner of LJ Corporation approached Topeka Bank for a loan to expand operations. LJ Corporation provided the following financial reports for the last 2 fiscal years who have in return asked for some additional information. LJ have come to the firm for assistance. LJ Corporation Balance Sheet December 31 2021 2020 ASSETS Cash Notes Receivables Accounts Receivables Allowance for doubtful Account Inventories Building & Equipment (net) Land Total Assets 18,200 148,000 143,600 (11,800) 105,000 1,049,000 400,000 1,852,000 12,500 132,000 140,500 (15,000) 50,000 1,020,500 400,000 1,740,500 EQUITY & LIABILITIES Accounts payable Interest payable Notes payable Shares Retained earnings Total Assets 79,000 19,000 166,000 1,200,000 388,000 1,852,000 91,000 16,000 151,500 1,200,000 282,000 1,740,500 Sales Revenue Cost of Goods Sold Gross Profit Operating expenses Net Income LJ Corporation Income Statement for the year ended December 31 2021 2,000,000 830,000 1,170,000 804,000 366,000 2020 1,700,000 725,000 975,000 678,000 297,000 . Additional Information: 2019 information for Net Accounts Receivables was $104,200 and Total Assets was $1,650,000 Notes Payables is due in 2024 Allowance for doubtful debt is a credit balance. . . LJ noticed that the balance in their Cash account at the end of December 31, 2021, differs from the Balance per Topeka Bank Statement ($32,400) and is concerned that they would not get the loan because of this variance. In your review you notice the following: Page 3 of 5 i. Deposits in transit amounted to $6,190. Outstanding cheques totaling $8,117. ii. Included in the bank statement were the following memoranda: Credit Memorandum: a note for $12,690 and interest of $1200 had been collected by the bank and the bank charged a collection fee of $240. Debit Memorandum: $70 for service charges for the month of December 2021. . iii. Cheque #18349 issued to the Electrical company for $2,750 was recorded by the bank for $5,750. iv. Check no. 18242 was issued to pay for purchases (Accounts Payables) in the amount of $791 but had been entered in the cash journal as $719 in error. v. Included in the company deposits for December 2021 was a cheque for $4,235, but the bank has returned this cheque as NSF. REQUIRED: a. The Bank have requested the following Ratios for each year: i. Current Ratio ii. Acid-test Ratio iii. Accounts receivable turnover iv. Average Collection period V. Profit Margin vi. Debt to Total Assets vii. Return on Asset viii. Asset turnover 16 Marks b. Explain to LJ, what the different classes of ratios measure and identify the bases of comparison on financial information. 4 Marks c. Prepare the Reconciliation as at December 31, 2021 which would explain the difference between the cash balance and the bank balance. 10 Marks d. The bank also wants an update on the Notes Receivables and Accounts Receivables given the small cash balances as at the end of 2021. Prepare journals in relation to the receivables under the following independent assumptions: i. The company estimates that 1% of sales from 2021 will be uncollectible. ii. The company estimates that 15% of the 2021 Receivables will be uncollectible. iii. On 1st December LJ lent Cortland Ltd $90,000 issuing a 6-month 7% note with a maturity date of June 1, 2022. Cortland did not honor the note. (no interest accrued as at Dec-31-2021). iv. On May 1, 2022, Received principal plus interest on 12-month 12% note in settlement of $45,000 accounts receivables interest accrued as at Dec-31-2021). 10 marks Page 4 of 5 Task 2 - Ratio Analysis, Bank Reconciliation and Receivables 40 MARKS Luke Jones, owner of LJ Corporation approached Topeka Bank for a loan to expand operations. LJ Corporation provided the following financial reports for the last 2 fiscal years who have in return asked for some additional information. LJ have come to the firm for assistance. LJ Corporation Balance Sheet December 31 2021 2020 ASSETS Cash Notes Receivables Accounts Receivables Allowance for doubtful Account Inventories Building & Equipment (net) Land Total Assets 18,200 148,000 143,600 (11,800) 105,000 1,049,000 400,000 1,852,000 12,500 132,000 140,500 (15,000) 50,000 1,020,500 400,000 1,740,500 EQUITY & LIABILITIES Accounts payable Interest payable Notes payable Shares Retained earnings Total Assets 79,000 19,000 166,000 1,200,000 388,000 1,852,000 91,000 16,000 151,500 1,200,000 282,000 1,740,500 Sales Revenue Cost of Goods Sold Gross Profit Operating expenses Net Income LJ Corporation Income Statement for the year ended December 31 2021 2,000,000 830,000 1,170,000 804,000 366,000 2020 1,700,000 725,000 975,000 678,000 297,000 . Additional Information: 2019 information for Net Accounts Receivables was $104,200 and Total Assets was $1,650,000 Notes Payables is due in 2024 Allowance for doubtful debt is a credit balance. . . LJ noticed that the balance in their Cash account at the end of December 31, 2021, differs from the Balance per Topeka Bank Statement ($32,400) and is concerned that they would not get the loan because of this variance. In your review you notice the following: Page 3 of 5 i. Deposits in transit amounted to $6,190. Outstanding cheques totaling $8,117. ii. Included in the bank statement were the following memoranda: Credit Memorandum: a note for $12,690 and interest of $1200 had been collected by the bank and the bank charged a collection fee of $240. Debit Memorandum: $70 for service charges for the month of December 2021. . iii. Cheque #18349 issued to the Electrical company for $2,750 was recorded by the bank for $5,750. iv. Check no. 18242 was issued to pay for purchases (Accounts Payables) in the amount of $791 but had been entered in the cash journal as $719 in error. v. Included in the company deposits for December 2021 was a cheque for $4,235, but the bank has returned this cheque as NSF. REQUIRED: a. The Bank have requested the following Ratios for each year: i. Current Ratio ii. Acid-test Ratio iii. Accounts receivable turnover iv. Average Collection period V. Profit Margin vi. Debt to Total Assets vii. Return on Asset viii. Asset turnover 16 Marks b. Explain to LJ, what the different classes of ratios measure and identify the bases of comparison on financial information. 4 Marks c. Prepare the Reconciliation as at December 31, 2021 which would explain the difference between the cash balance and the bank balance. 10 Marks d. The bank also wants an update on the Notes Receivables and Accounts Receivables given the small cash balances as at the end of 2021. Prepare journals in relation to the receivables under the following independent assumptions: i. The company estimates that 1% of sales from 2021 will be uncollectible. ii. The company estimates that 15% of the 2021 Receivables will be uncollectible. iii. On 1st December LJ lent Cortland Ltd $90,000 issuing a 6-month 7% note with a maturity date of June 1, 2022. Cortland did not honor the note. (no interest accrued as at Dec-31-2021). iv. On May 1, 2022, Received principal plus interest on 12-month 12% note in settlement of $45,000 accounts receivables interest accrued as at Dec-31-2021). 10 marks Page 4 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts