Question: please label everything for ex: Req 1a , Req 1B , req 2 , Req 3. Division's direct material cost by $1.50 per unit. In

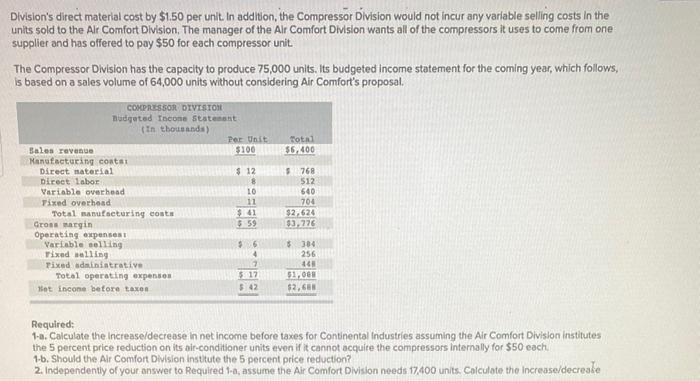

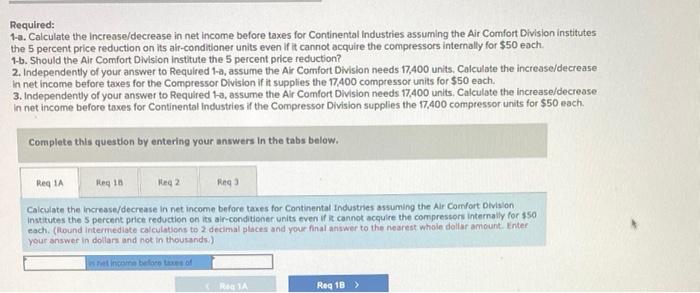

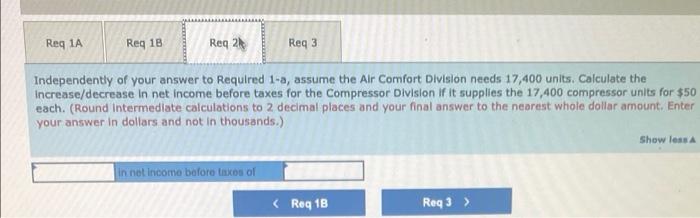

Division's direct material cost by $1.50 per unit. In addition, the Compressor Division would not incur any variable selling costs in the units sold to the Alr Comfort Division. The manager of the Alr Comfort Division wants all of the compressors it uses to come from one supplier and has offered to pay $50 for each compressor unit The Compressor Division has the capacity to produce 75,000 units. Its budgeted income statement for the coming year, which follows, is based on a sales volume of 64,000 units without considering Air Comfort's proposal. Total $6.400 COMPRESSOR DIVISION mudgeted Income Statement in thousands) Per Unit Bales revenge $100 Manufacturing costs Direct material $ 12 Direct labor 8 Variable overhead 10 Tixed overhead 11 Total manufacturing costs $141 Gross margin Operating expenses Variable selling 56 Tixed Balling Fixed administrative 7 Total operating expenses 517 Hot income before taxes 5.42 5768 512 640 704 $2.624 $3.774 559 $ 384 256 14 51,068 $2,68 Required: 1-a. Calculate the increase/decrease in net income before taxes for Continental Industries assuming the Air Comfort Division Institutes the 5 percent price reduction on its air-conditioner units even if it cannot acquire the compressors internally for $50 each 1-6. Should the Air Comfort Division Institute the 5 percent price reduction? 2. Independently of your answer to Required 1-o, assume the Air Comfort Division needs 17,400 units. Calculate the increase/decreate Required: 1-a. Calculate the increase/decrease in net income before taxes for Continental Industries assuming the Air Comfort Division institutes the 5 percent price reduction on its air-conditioner units even if it cannot acquire the compressors internally for $50 each 1-b. Should the Air Comfort Division Institute the 5 percent price reduction? 2. Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the increase/decrease in net income before taxes for the Compressor Division if it supplies the 17,400 compressor units for $50 each 3. Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the increase/decrease In net income before taxes for Continental Industries if the Compressor Division supplies the 17,400 compressor units for $50 each Complete this question by entering your answers in the tabs below. Req1A Heq 10 Reg 2 Req Calculate the increase/decrease in net income before taxes for Continental Industries assuming the Alr Comfort Division Institutes the percent price reduction on its air-conditioner units even if it cannot acquire the compressors internally for $50 cach. (tound intermediate calculations to 2 decimal places and your final answer to the nearest whole dollar amount, Enter your answer in dollars and not in thousands) income before taxes of RA Reg 18 > Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Req 3 Should the Air Comfort Division Institute the 5 percent price reduction? Yes ONO Reg 1A Reg 18 Reg 2 Reg 3 Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the Increase/decrease in net income before taxes for the Compressor Division If it supplies the 17,400 compressor units for $50 each. (Round Intermediate calculations to 2 decimal places and your final answer to the nearest whole dollar amount. Enter your answer in dollars and not in thousands.) Show less In net income before in cos of Complete this question by entering your answers in the tabs below. Req1A Req 18 Reg 2 Rua 3 Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the Increase/decrease in net income before taxes for Continental Industries if the Compressor Division supplies the 17,400 compressor units for $50 ench. (Round Intermediate calculations to 2 decimal places and your final answer to the nearest whole dollar amount. Enter your answer in dollars and not in thousands.) Show less in not income before taxes of Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Req 3 Should the Air Comfort Division Institute the 5 percent price reduction? Yes ONO Reg 1A Reg 18 Reg 2 Reg 3 Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the Increase/decrease in net income before taxes for the Compressor Division If it supplies the 17,400 compressor units for $50 each. (Round Intermediate calculations to 2 decimal places and your final answer to the nearest whole dollar amount. Enter your answer in dollars and not in thousands.) Show less In net income before in cos of Complete this question by entering your answers in the tabs below. Req1A Req 18 Reg 2 Rua 3 Independently of your answer to Required 1-a, assume the Air Comfort Division needs 17,400 units. Calculate the Increase/decrease in net income before taxes for Continental Industries if the Compressor Division supplies the 17,400 compressor units for $50 ench. (Round Intermediate calculations to 2 decimal places and your final answer to the nearest whole dollar amount. Enter your answer in dollars and not in thousands.) Show less in not income before taxes of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts