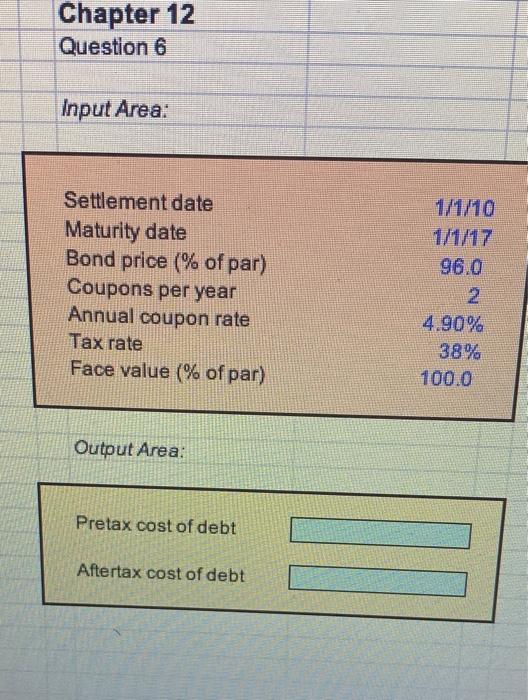

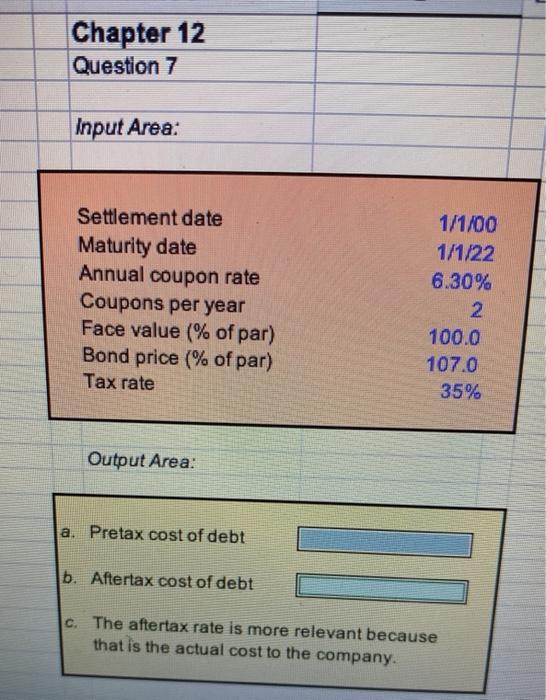

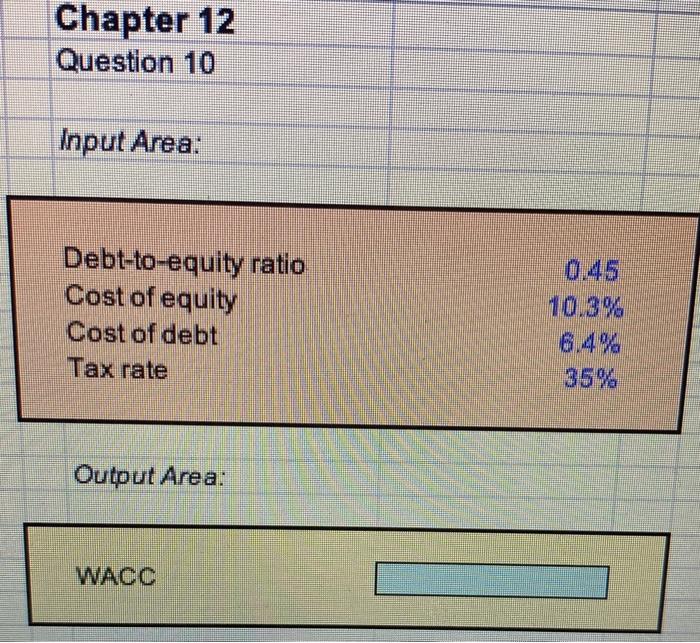

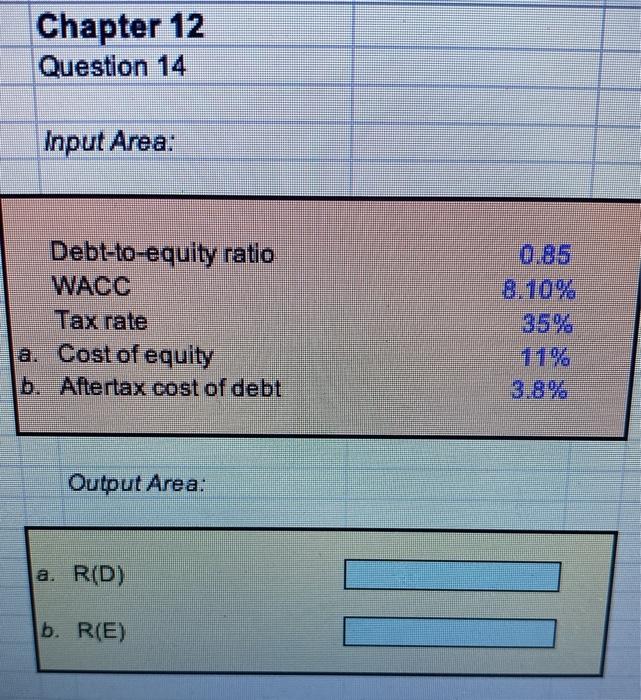

Question: Please lable all answer in a way thats clear!! I ran out of questions. Please answer as many questions as possible. Chapter 12 Question 6

Chapter 12 Question 6 Input Area: 1/1/10 Settlement date Maturity date Bond price (% of par) Coupons per year Annual coupon rate Tax rate Face value (% of par) 96.0 2 4.90% 38% 100.0 Output Area: Pretax cost of debt Aftertax cost of debt Chapter 12 Question 7 Input Area: Settlement date Maturity date Annual coupon rate Coupons per year Face value (% of par) Bond price (% of par) Tax rate 1/1/00 1/1/22 6.30% 2 100.0 107.0 35% Output Area: a. Pretax cost of debt b. Aftertax cost of debt c. The aftertax rate is more relevant because that is the actual cost to the company. Chapter 12 Question 10 Input Area: Debt-to-equity ratio Cost of equity Cost of debt Tax rate 10.3% Output Area: WACC Chapter 12 Question 14 Input Area: Debt-to-equity ratio WACC Tax rate a. Cost of equity b. Aftertax cost of debt Output Area: a. R(D) b. R(E)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts