Question: please lable and answer all questions. 8. Conclusions about capital budgeting The decision process Before making capital budgeting decisions, finance professionals often generate, review, analyze,

please lable and answer all questions.

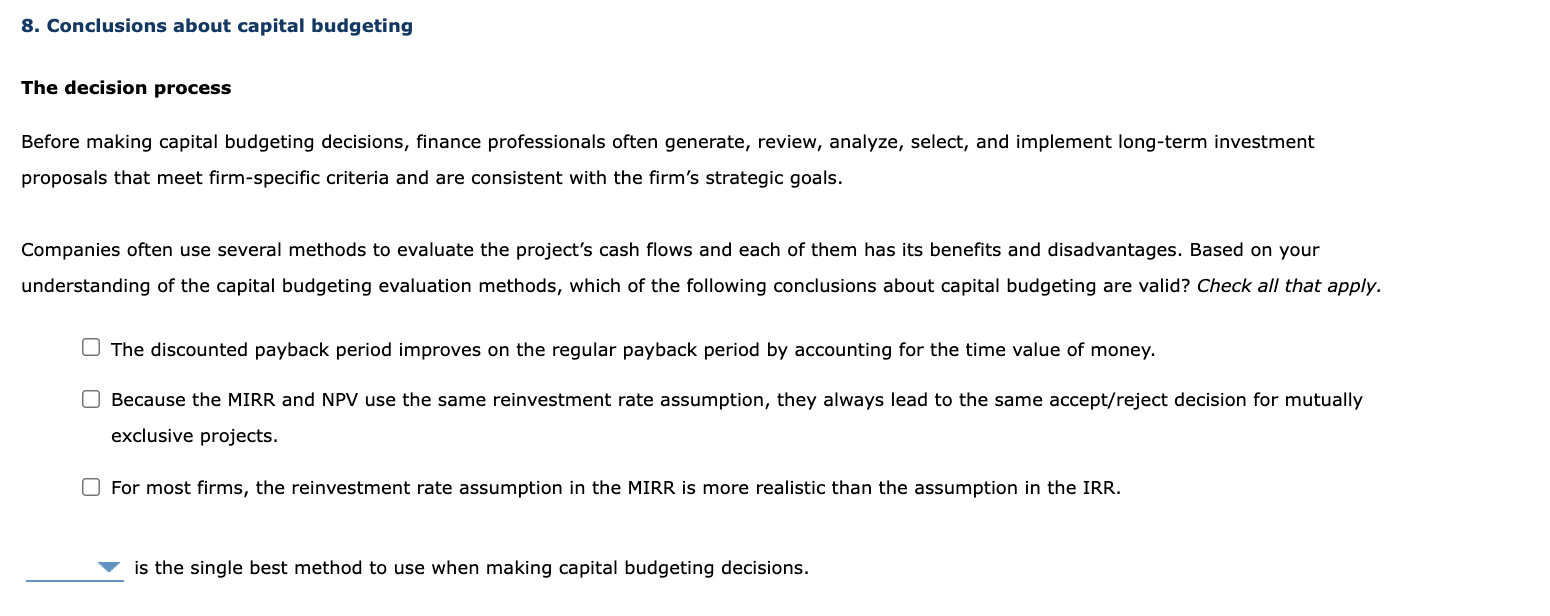

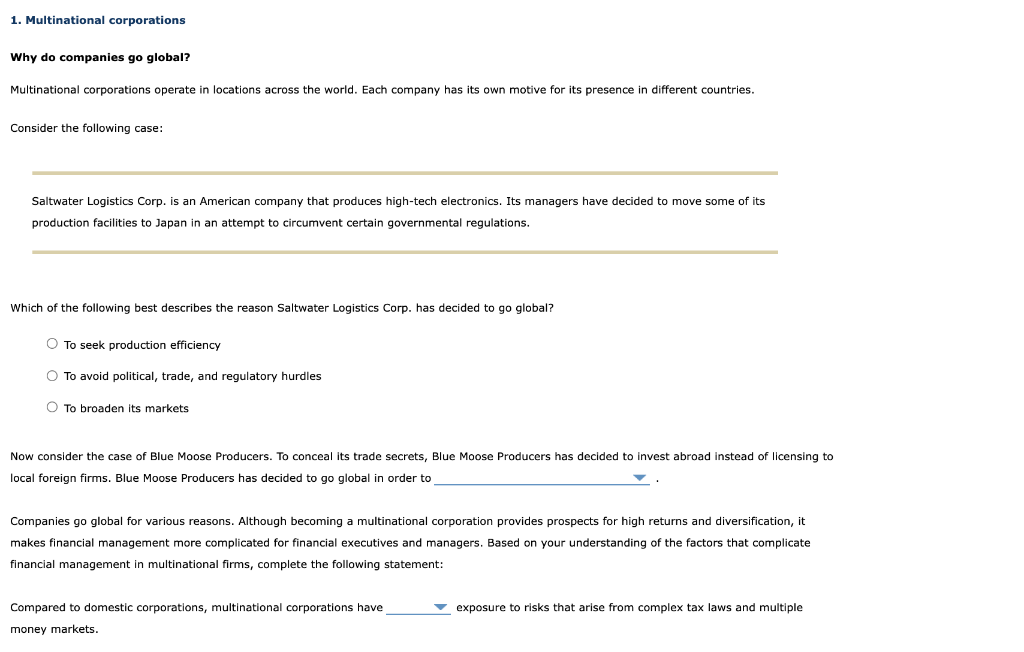

8. Conclusions about capital budgeting The decision process Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply. The discounted payback period improves on the regular payback period by accounting for the time value of money. Because the MIRR and NPV use the same reinvestment rate assumption, they always lead to the same accept/reject decision for mutually exclusive projects. For most firms, the reinvestment rate assumption in the MIRR is more realistic than the assumption in the IRR. is the single best method to use when making capital budgeting decisions. 1. Multinational corporations Why do companies go global? Multinational corporations operate in locations across the world. Each company has its own motive for its presence in different countries. Consider the following case: Saltwater Logistics Corp. is an American company that produces high-tech electronics. Its managers have decided to move some of its production facilities to Japan in an attempt to circumvent certain governmental regulations. Which of the following best describes the reason Saltwater Logistics Corp. has decided to go global? O To seek production efficiency To avoid political, trade, and regulatory hurdles To broaden its markets Now consider the case of Blue Moose Producers. To conceal its trade secrets, Blue Moose Producers has decided to invest abroad instead of licensing to local foreign firms. Blue Moose Producers has decided to go global in order to Companies go global for various reasons. Although becoming a multinational corporation provides prospects for high returns and diversification, it makes financial management more complicated for financial executives and managers. Based on your understanding of the factors that complicate financial management in multinational firms, complete the following statement: exposure to risks that arise from complex tax laws and multiple Compared to domestic corporations, multinational corporations have money markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts