Question: Please leave the final answer unrounded MACRS, or the Modified Accelerated Cost Recovery System is the current tax depreciation system in the US. It assigns

Please leave the final answer unrounded

Please leave the final answer unrounded

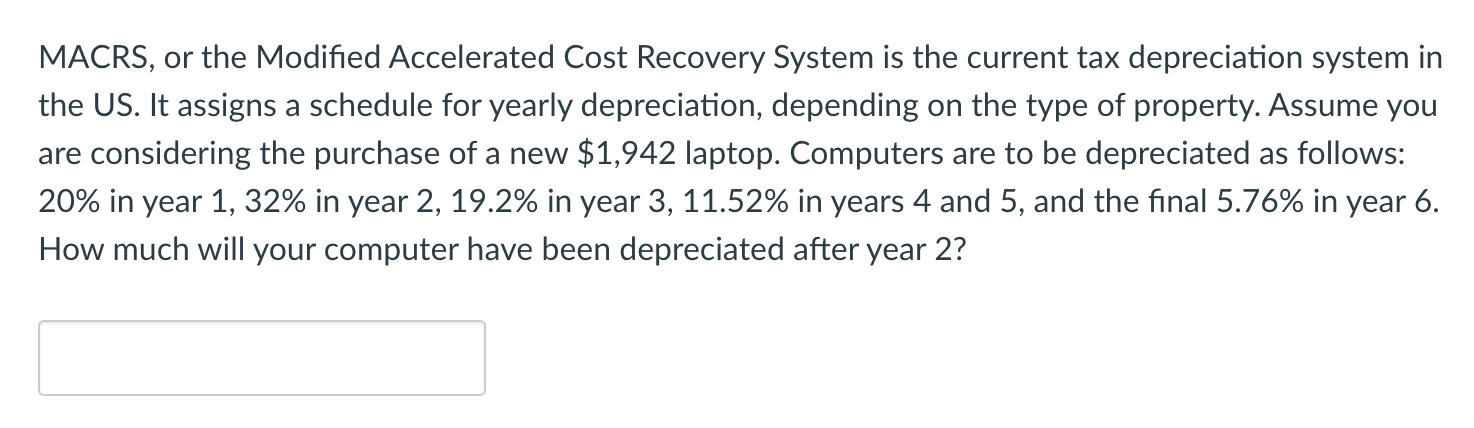

MACRS, or the Modified Accelerated Cost Recovery System is the current tax depreciation system in the US. It assigns a schedule for yearly depreciation, depending on the type of property. Assume you are considering the purchase of a new $1,942 laptop. Computers are to be depreciated as follows: 20% in year 1, 32% in year 2, 19.2% in year 3, 11.52% in years 4 and 5, and the final 5.76% in year 6. How much will your computer have been depreciated after year 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock