Question: Please let me check the answer for this worksheet. (No need explanation) Complete the worsheet one section at a time, beginning with the Adjustments columns.

Please let me check the answer for this worksheet. (No need explanation)

Please let me check the answer for this worksheet. (No need explanation)

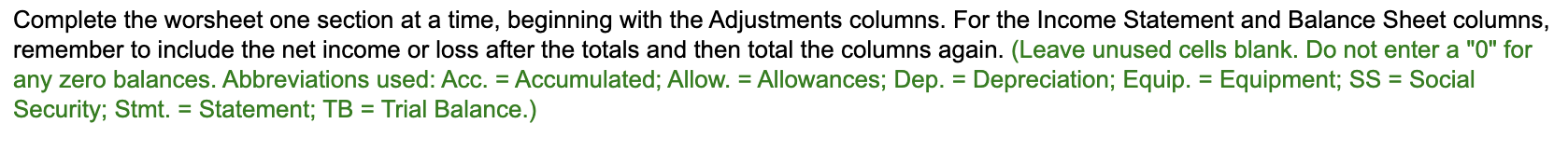

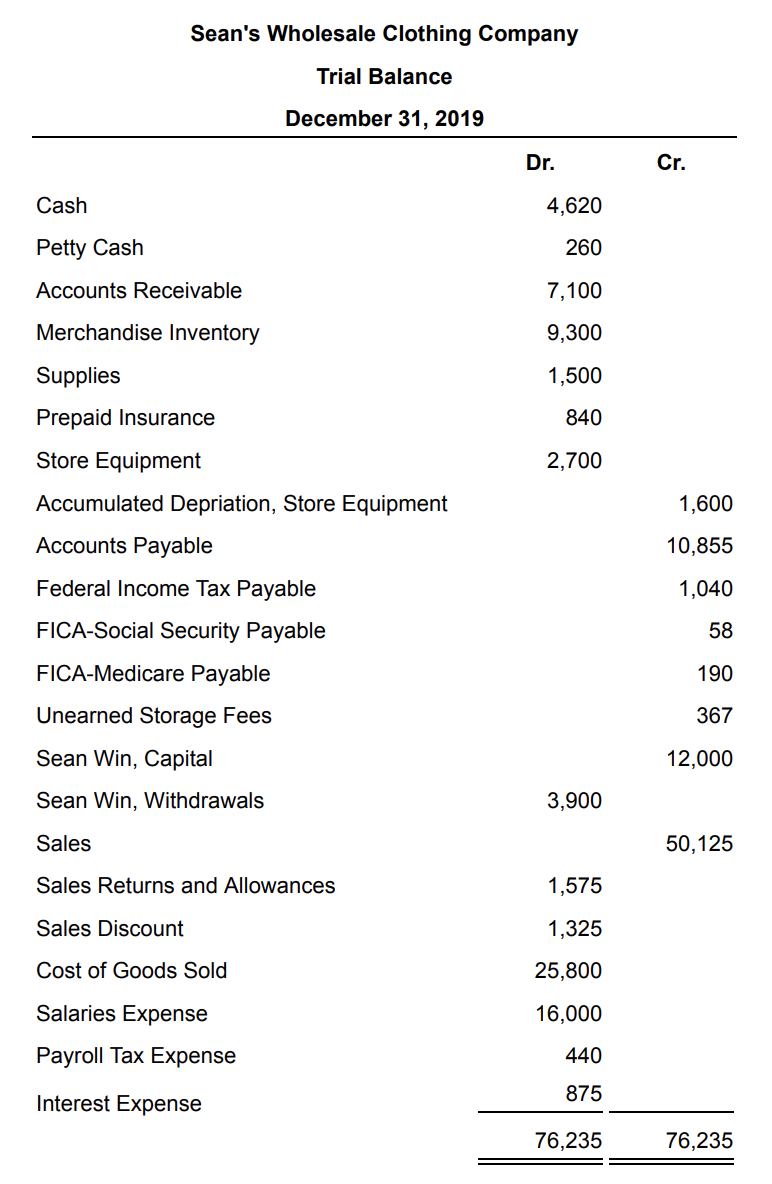

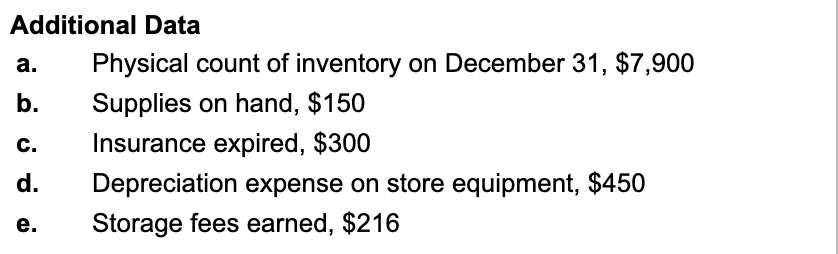

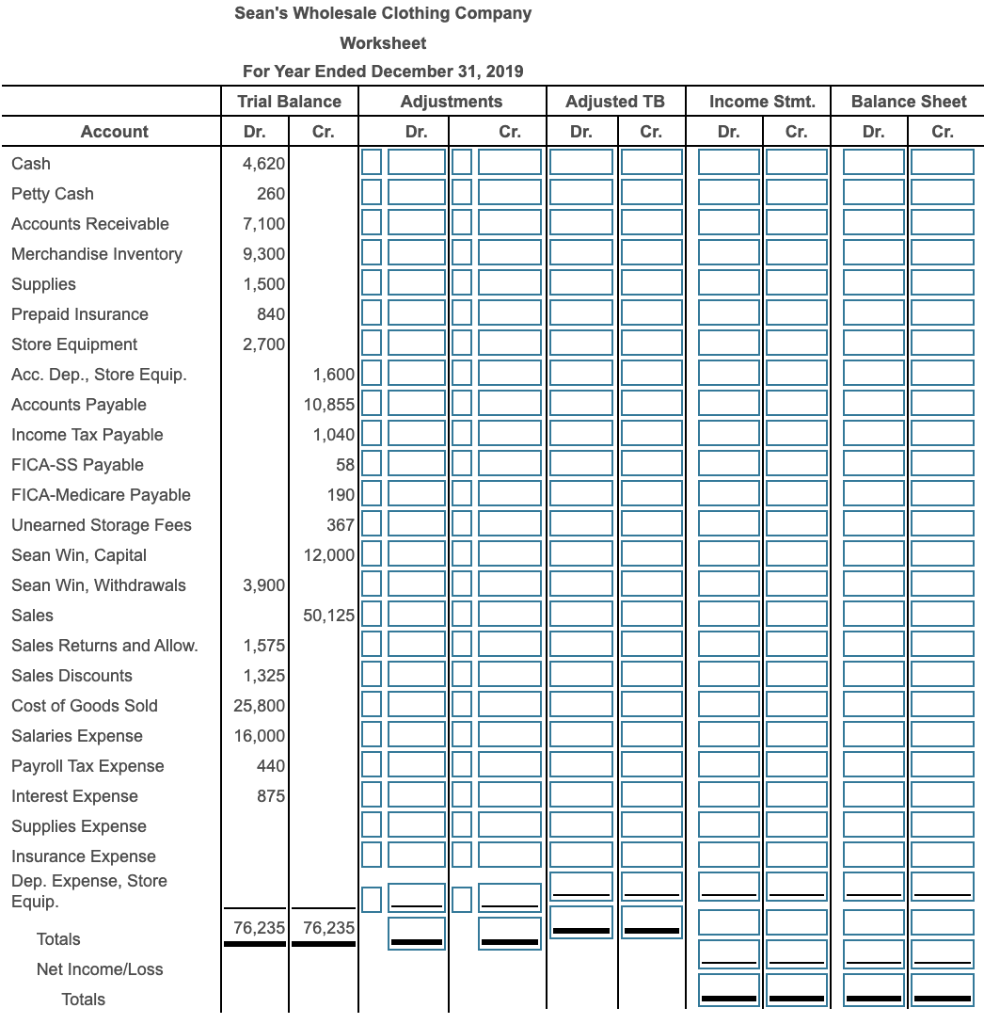

Complete the worsheet one section at a time, beginning with the Adjustments columns. For the Income Statement and Balance Sheet columns, remember to include the net income or loss after the totals and then total the columns again. (Leave unused cells blank. Do not enter a "O" for any zero balances. Abbreviations used: Acc. = Accumulated; Allow. = Allowances; Dep. = Depreciation; Equip. = Equipment; SS = Social Security; Stmt. = Statement; TB = Trial Balance.) Sean's Wholesale Clothing Company Trial Balance December 31, 2019 Dr. Cr. Cash 4,620 Petty Cash 260 Accounts Receivable 7,100 Merchandise Inventory 9,300 Supplies 1,500 Prepaid Insurance 840 Store Equipment 2,700 Accumulated Depriation, Store Equipment Accounts Payable 1,600 10,855 Federal Income Tax Payable 1,040 FICA-Social Security Payable 58 FICA-Medicare Payable 190 Unearned Storage Fees 367 12,000 Sean Win, Capital Sean Win, Withdrawals 3,900 Sales 50,125 1,575 1,325 Sales Returns and Allowances Sales Discount Cost of Goods Sold Salaries Expense Payroll Tax Expense 25,800 16,000 440 875 Interest Expense 76,235 76,235 Additional Data Physical count of inventory on December 31, $7,900 b. Supplies on hand, $150 c. Insurance expired, $300 Depreciation expense on store equipment, $450 Storage fees earned, $216 DO Adjusted TB Dr. Cr. Income Stmt. Dr. Cr. Balance Sheet Dr. Cr. Account Sean's Wholesale Clothing Company Worksheet For Year Ended December 31, 2019 Trial Balance Adjustments Dr. Cr. Dr. Cr. 4,620 260 7,100 9,300 1,500 840 2,700 1,600 10,855 1,040 Cash Petty Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Store Equipment Acc. Dep., Store Equip. Accounts Payable Income Tax Payable FICA-SS Payable FICA-Medicare Payable Unearned Storage Fees Sean Win, Capital Sean Win, Withdrawals Sales Sales Returns and Allow. Sales Discounts Cost of Goods Sold Salaries Expense Payroll Tax Expense Interest Expense Supplies Expense Insurance Expense Dep. Expense, Store Equip. 12,000 3,900 50,125 1,575 1,325 25,800 16,000 440 875 76,235 76,235 Totals Net Income/Loss Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts