Question: Please let me know if my below entries are correct. I am having a hard time calculating the payment for the present value annuity and

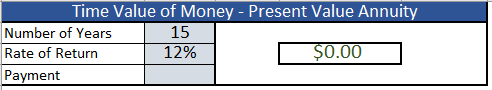

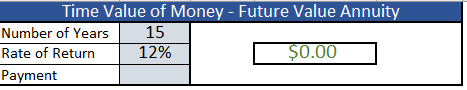

Please let me know if my below entries are correct. I am having a hard time calculating the payment for the present value annuity and future value annuity.

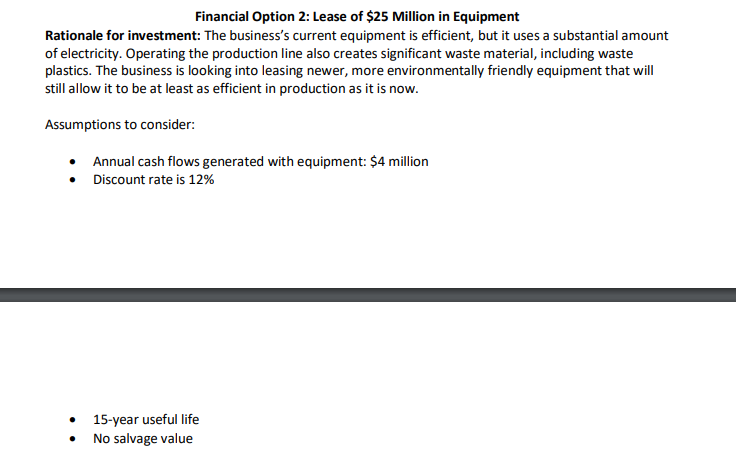

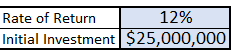

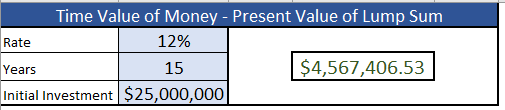

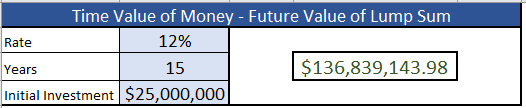

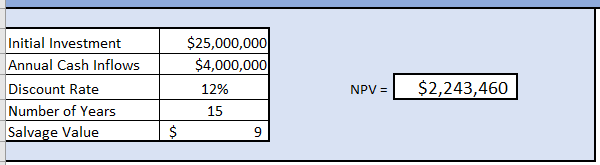

Financial Option 2: Lease of $25 Million in Equipment Rationale for investment: The business's current equipment is efficient, but it uses a substantial amount of electricity. Operating the production line also creates significant waste material, including waste plastics. The business is looking into leasing newer, more environmentally friendly equipment that will still allow it to be at least as efficient in production as it is now. Assumptions to consider: Annual cash flows generated with equipment: $4 million Discount rate is 12% 15-year useful life No salvage value Rate of Return 12% Initial Investment $25,000,000 Time Value of Money - Present Value Annuity Number of Years 15 Rate of Return 12% $0.00 Payment Time Value of Money - Future Value Annuity Number of Years 15 Rate of Return 12% $0.00 Payment Rate Time Value of Money - Present Value of Lump Sum 12% 15 $4,567,406.53 Initial Investment $25,000,000 Years Rate Time Value of Money - Future Value of Lump Sum 12% Years 15 $136,839,143.98 Initial Investment $25,000,000 Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value $25,000,000 $4,000,000 12% 15 NPV = $2,243,460 $ 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts