Question: Please let me know the answer as soon as possible 10:02 482291 4241 learn.uph.edu CASH FLOW (45%) Presented below are the financial statements of NOAH

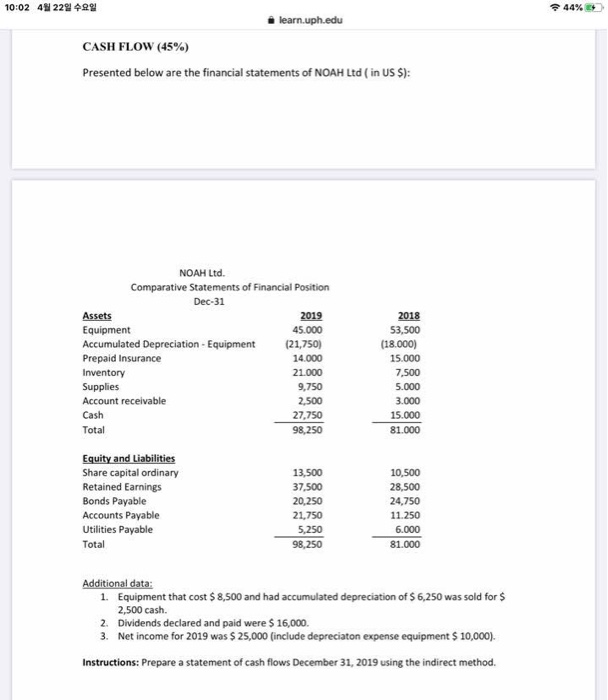

10:02 482291 4241 learn.uph.edu CASH FLOW (45%) Presented below are the financial statements of NOAH Ltd (in US $): NOAH Ltd. Comparative Statements of Financial Position Dec-31 Assets 2019 Equipment 45.000 Accumulated Depreciation - Equipment (21,750) Prepaid Insurance 14.000 Inventory 21.000 Supplies 9,750 Account receivable 2.500 Cash 27,750 Total 98,250 2018 53,500 (18.000) 15.000 7,500 5.000 3.000 15.000 81.000 Equity and Liabilities Share capital ordinary Retained Earnings Bonds Payable Accounts Payable Utilities Payable Total 13,500 37,500 20.250 21,750 5,250 98,250 10,500 28,500 24,750 11.250 6.000 81.000 Additional data 1. Equipment that cost $ 8,500 and had accumulated depreciation of $ 6,250 was sold for $ 2,500 cash. 2. Dividends declared and paid were $ 16,000 3. Net income for 2019 was $ 25,000 (include depreciaton expense equipment $ 10,000). Instructions: Prepare a statement of cash flows December 31, 2019 using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts