Question: please let me know what the correct values are for the red x portions. thank you! The following list includes selected permanent accounts and all

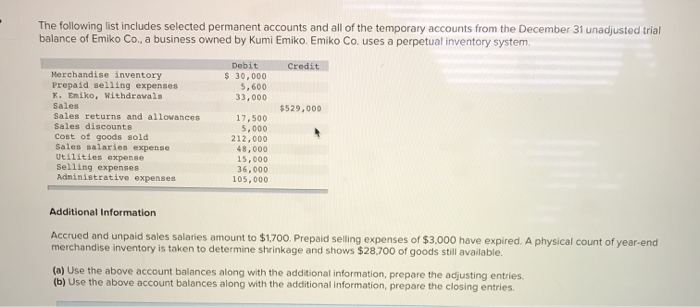

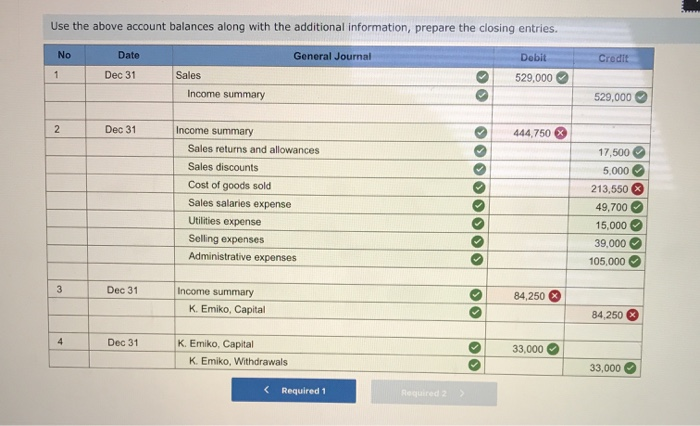

The following list includes selected permanent accounts and all of the temporary accounts from the December 31 unadjusted trial balance of Emiko Co., a business owned by Kumi Emiko. Emiko Co. uses a perpetual inventory system. Credit Debit $ 30,000 5,600 33,000 $529,000 Merchandise inventory Prepaid selling expenses *. Emiko, withdrawals Sales Sales returns and allowances Sales discounts Cost of goods sold Sales salaries expense Utilities expense Selling expenses Administrative expenses 17,500 5,000 212,000 48,000 15,000 36,000 105,000 Additional Information Accrued and unpaid sales salaries amount to $1.700. Prepaid selling expenses of $3,000 have expired. A physical count of year-end merchandise inventory is token to determine shrinkage and shows $28,700 of goods still available. (a) Use the above account balances along with the additional information, prepare the adjusting entries. (b) Use the above account balances along with the additional information, prepare the closing entries Use the above account balances along with the additional information, prepare the closing entries. No General Journal Dobit Credit Date Dec 31 529,000 Sales Income summary 529,000 Dec 31 444.750 X Income summary Sales returns and allowances Sales discounts Cost of goods sold Sales salaries expense Utilities expense Selling expenses Administrative expenses oo 000000000000 17,500 5,000 213,550 49,700 15,000 39.000 105,000 Dec 31 84,250 Income summary K. Emiko, Capital 84.250 Dec 31 K Emiko Capital 33,000 K. Emiko, Withdrawals 33,000

Step by Step Solution

There are 3 Steps involved in it

To solve this problem lets go through the necessary accounting steps Adjusting Entries 1 Accrued Sal... View full answer

Get step-by-step solutions from verified subject matter experts