Question: please let me knw the answers with same statment Mean Beans, a local coffee shop, has the following assets on January 1, 2023. Mean Beans

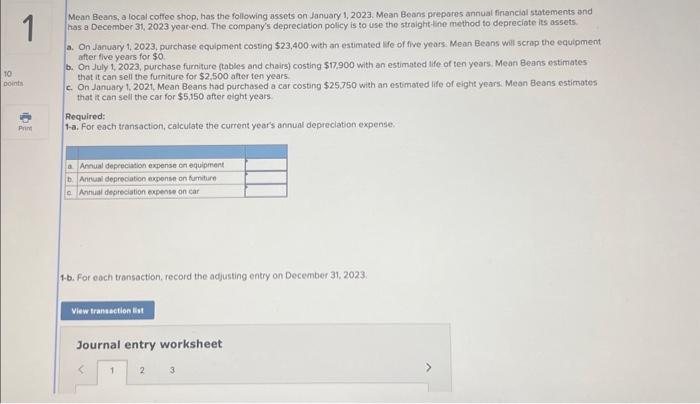

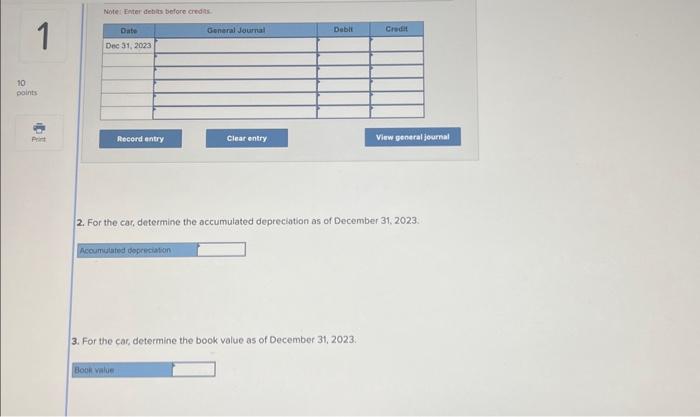

Mean Beans, a local coffee shop, has the following assets on January 1, 2023. Mean Beans prepares annual firancial statements and has a December 31, 2023 yoar-end. The company's depreclation policy is to use the straighif-the method to depreciate its assets. a. On January 1, 2023, purchase equipment costing 523,400 with an estimated Me of five years. Mean Beans will scrap the equipment after flive years for $0 b. On July 1, 2023, purchase furniture (tables and chairs) costing $17,900 with an estimated life of ten years. Mean Beans estimates thot it can sell the furniture for $2.500 aher ten years c. On January 1, 2021, Mean Beans had purchased a car costing $25,750 with an estimated life of eight years. Mean Beans ostimotes that it can seil the car for $5,150 after oight years Required: 1-a. For each transaction, calculate the current years annual depreclation expense. 1.b. For each transaction, record the adjusting entry on December 31, 2023: Journal entry worksheet Notei Futer dehats beloro aredas. 2. For the car, determine the accumulated depreciotion as of December 31, 2023. 3. For the car, determine the book value as of December 31,2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts