Question: Please list all written formula steps, NOT in excel. Thank-You! Calculate the company's weighted average cost of capital (WACC) using all of the information below

Please list all written formula steps, NOT in excel. Thank-You!

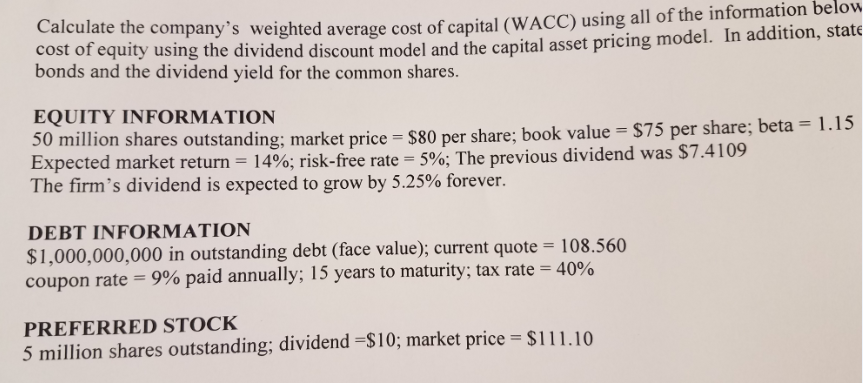

Calculate the company's weighted average cost of capital (WACC) using all of the information below cost of equity using the dividend discount model and the capital asset pricing model. In addition, state bonds and the dividend yield for the common shares. 50 million shares outstanding; market price = $80 per share; book value = $75 per share, beta = 1.15 Expected market return = 14%; risk-free rate = 5%; The previous dividend was $7.4109 The firm's dividend is expected to grow by 5.25% forever. $1,000,000,000 in outstanding debt (face value); current quote = 108.560 coupon rate = 9% paid annually; 15 years to maturity; tax rate = 40% 5 million shares outstanding; dividend = $10; market price = $111.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts