Question: please long explain. not just solution. 5. Garson Corp, is looking at two possible capital structures. Currently, the firm is an allequity firm with $1.2

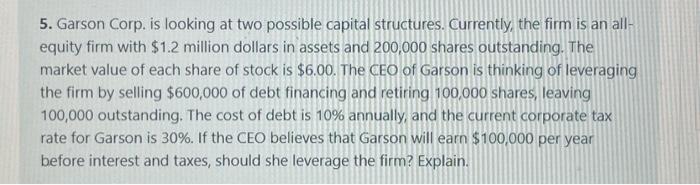

5. Garson Corp, is looking at two possible capital structures. Currently, the firm is an allequity firm with $1.2 million dollars in assets and 200,000 shares outstanding. The market value of each share of stock is $6.00. The CEO of Garson is thinking of leveraging the firm by selling $600,000 of debt financing and retiring 100,000 shares, leaving 100,000 outstanding. The cost of debt is 10% annually, and the current corporate tax rate for Garson is 30%. If the CEO believes that Garson will earn $100,000 per year before interest and taxes, should she leverage the firm? Explain. 5. Garson Corp, is looking at two possible capital structures. Currently, the firm is an allequity firm with $1.2 million dollars in assets and 200,000 shares outstanding. The market value of each share of stock is $6.00. The CEO of Garson is thinking of leveraging the firm by selling $600,000 of debt financing and retiring 100,000 shares, leaving 100,000 outstanding. The cost of debt is 10% annually, and the current corporate tax rate for Garson is 30%. If the CEO believes that Garson will earn $100,000 per year before interest and taxes, should she leverage the firm? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts