Question: Please look at all images. Will thumbs up if correct. As of December 31, Cookie Creations' year-end, the following adjusting entry data are provided. 1.

Please look at all images. Will thumbs up if correct.

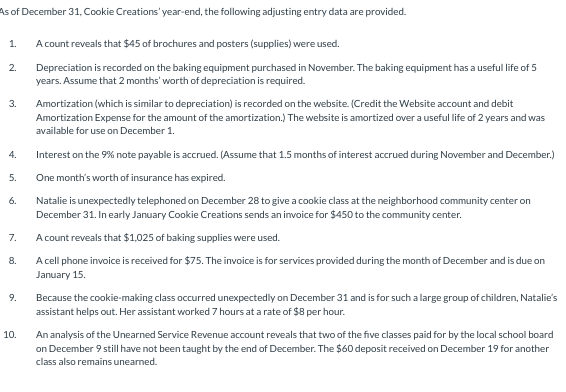

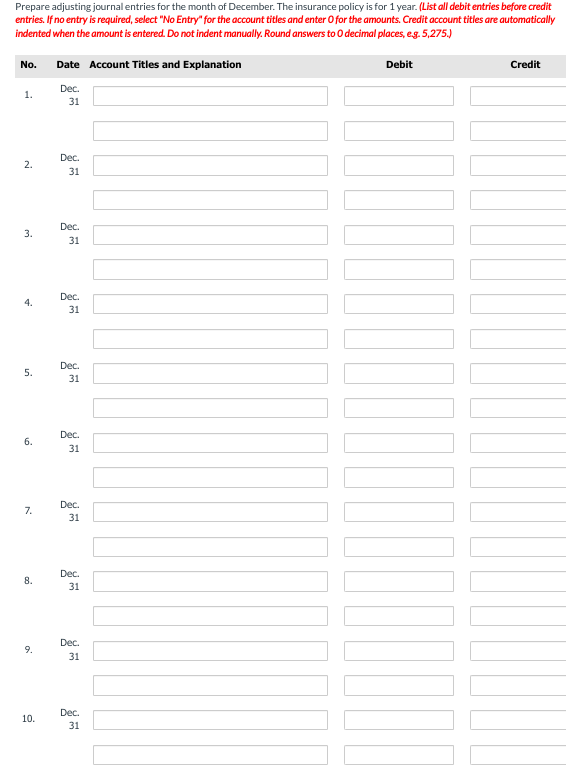

As of December 31, Cookie Creations' year-end, the following adjusting entry data are provided. 1. A count reveals that $45 of brochures and posters (supplies) were used. 2. Depreciation is recorded on the baking equipment purchased in November. The baking equipment has a useful life of 5 years. Assume that 2 months' worth of depreciation is required. 3. Amortization (which is similar to depreciation) is recorded on the website. (Credit the Website account and debit Amortization Expense for the amount of the amortization.) The website is amortized over a useful life of 2 years and was available for use on December 1. 4. Interest on the 9% note payable is accrued. (Assume that 1.5 months of interest accrued during November and December.) 5. One month's worth of insurance has expired. 6. Natalie is unexpectedly telephoned on December 28 to give a cookie class at the neighborhood community center on December 31. In early January Cookie Creations sends an invoice for $450 to the community center. 7. A count reveals that $1,025 of baking supplies were used. 8. A cell phone invoice is received for $75. The invoice is for services provided during the month of December and is due on January 15. 9. Because the cookie-making class occurred unexpectedly on December 31 and is for such a large group of children, Natalie's assistant helps out. Her assistant worked 7 hours at a rate of $8 per hour. 10. An analysis of the Unearned Service Revenue account reveals that two of the five classes paid for by the local school board on December 9 still have not been taught by the end of December. The $60 deposit received on December 19 for another class also remains unearned. Prepare adjusting journal entries for the month of December. The insurance policy is for 1 year. (List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts